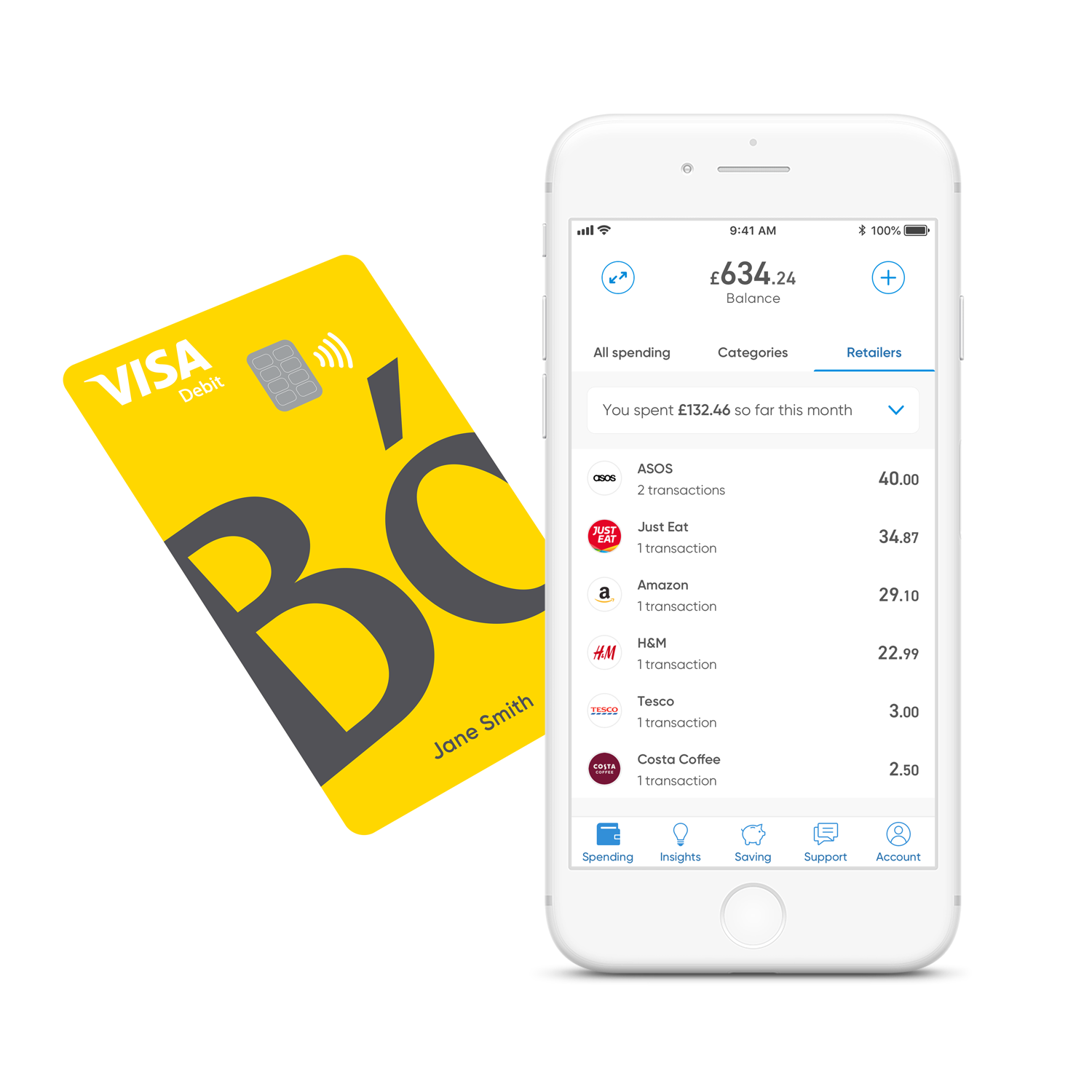

Bó comes with a bright yellow Visa card and a mobile app, which is available in the App Store and Google Play.

You can open a Bó account if you’re 18 and over and live and work in the UK.

There are no fees for overseas spending or for cash withdrawals in the UK or worldwide.

The team behind Bó said it’s an account to help people manage their everyday spending.

They suggest leaving your bills and direct debits in your existing current account and adding your day-to-day money to your Bó account to help you budget.

The app allows you to see everything you buy listed by retailer category and location. You can also create a spending budget, set savings goals and put money in a virtual ‘piggy bank’.

Up to £85,000 of your money is protected by the Financial Services Compensation Scheme but if you have accounts with both Bó and NatWest, the maximum you’d be able to claim across all accounts is £85,000.

Mark Bailie, chief executive of Bó, said: “We are launching Bó to help people build the habits and routines that will allow them do money better day-by-day and week after week so they can fund their lives and lifestyles in a more sustainable way.

“As we’re part of NatWest, people can rely on Bó to keep their money safe. But as a digital bank, built entirely on a separate cloud-based technology, Bó is also able to harness new technology and develop rapidly in line with our customers’ needs and expectations.”