The External Wall Fire Review process will help people buy and sell homes and re-mortgage in buildings above 18 metres and was brought together by The Royal Institution of Chartered Surveyors (RICS), The Building Societies Association (BSA), and UK Finance.

Since the Grenfell Tower disaster the issue of fire safety in high rise buildings has come to the forefront with the government issuing new regulations.

This has led to surveyors giving £0 valuations to properties and leaving potentially thousands at people at risk of becoming mortgage prisoners in these buildings which are at risk of being non-compliant.

However, the new process should help to solve this situation.

The process will require a fire safety assessment to be conducted by a suitably qualified and competent professional delivering assurance for lenders, valuers, residents, buyers and sellers.

The review has been developed through extensive consultation with a wide range of stakeholders including fire engineers, lenders, valuers, and other cross industry representatives.

Only one assessment will be needed for each building and this will be valid for five years.

How it works

This process is based around a standard form originally proposed by Fiona Haggett at Barclays which has been refined by the working group.

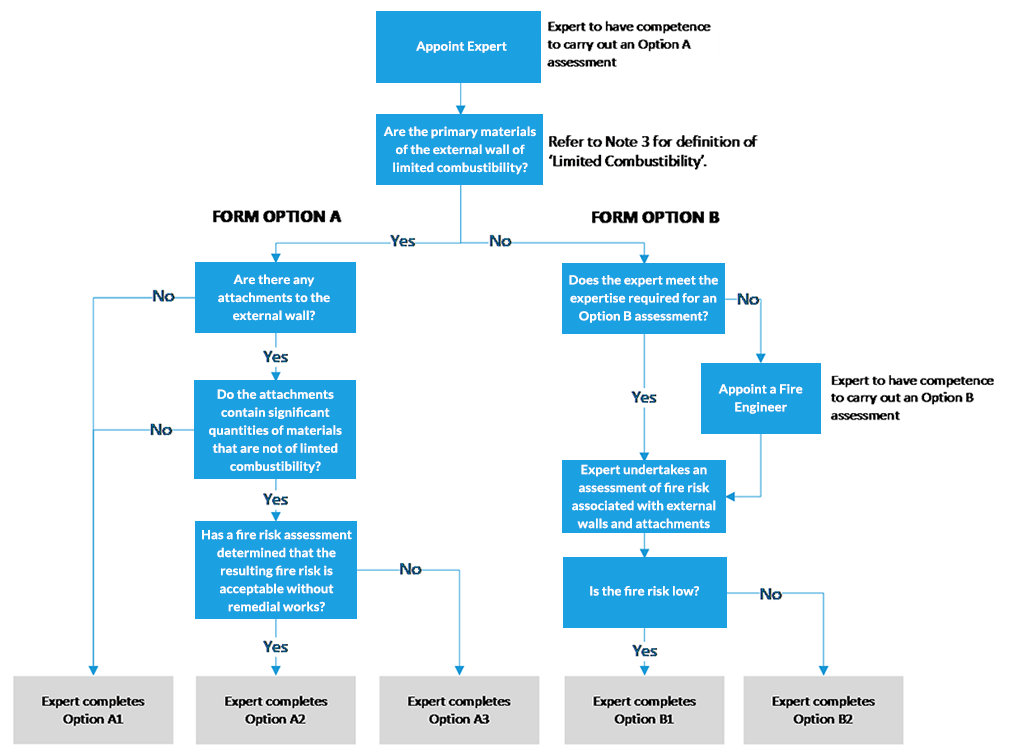

The process is as follows:

- Valuer instructed by lender

- Valuer checks whether building has External Wall System (EWS) certificate

- If yes – valuer acts depending on certificate content

- If no – the following process starts:

Building owners are responsible

UK Finance confirmed to Mortgage Solutions that building owners should be the ones to organise and pay for the initial review and to then distribute the results as required.

“A building owner, as the responsible party, should be able to confirm what materials are on the building,” UK Finance said.

“This process and form is a set way for them to confirm to valuers acting on behalf of mortgage lenders that an external wall system has been assessed by a suitable expert. The consumer should ask their building owner or their representative to ensure the assessment is carried out.

“Building owners and managing agents have been involved in the development of this process and form and have indicated that they are willing to do this.”

The trade body added that the cost will vary according to the commercial contract with the expert filling in the form. The building owner or their representative is responsible for instructing that expert and will bear the cost of doing so, which may be passed on to leaseholders within the building.

Surveyors and lenders cannot control whether a building owner passes on the costs.

However, the government has indicated that it does not expect individual homeowners to face bills for the remediation of buildings found to be a fire risk.

In a worst-case scenario where building owners are not willing to cooperate with the process, homeowner’s will need to pressure the building owner or their representative to have the building assessed.

UK Finance also noted that borrowers may wish to report the issue to their local authority, which has powers under the Housing Act 2004 to take enforcement action against building owners over serious hazards.

Ease market issues

BSA policy manager Charlie Blagbrough, said: “This new industry process is the result of substantial consultation across the housing industry and government.

“It takes into account the range of external wall materials that are in use on apartment buildings and will now be used industry-wide. Ensuring the safety and security of those selling, purchasing and living in high-rise homes remains paramount.

“However, we expect that this new process will instil confidence to enable surveyors to value, lenders to lend, and ultimately keep the high-rise property market flowing.”

RICS tangible assets valuation director John Baguley, noted that RICS had also worked with the Ministry of Housing Communities and Local Government (MHCLG).

He added that the standardised approach between valuers and lenders will ease current issues in the high-rise property market.

“To unclog areas of the market, a qualified and experienced fire safety expert will be appointed by the building owner to provide a report on the building’s cladding, and associated wall system, as an additional part of the valuation process,” he said.

“This will ensure safety, and will also ultimately allow the high rise property market to function properly.”

UK Finance policy manager Matthew Jupp added: “The independent valuation has a key role to play in the home-buying process, helping to deliver assurance to all parties involved that a property is both safe and secure.

“The External Wall Fire Review is an industry-wide initiative that will further support the buying and selling of homes in this section of the market.”