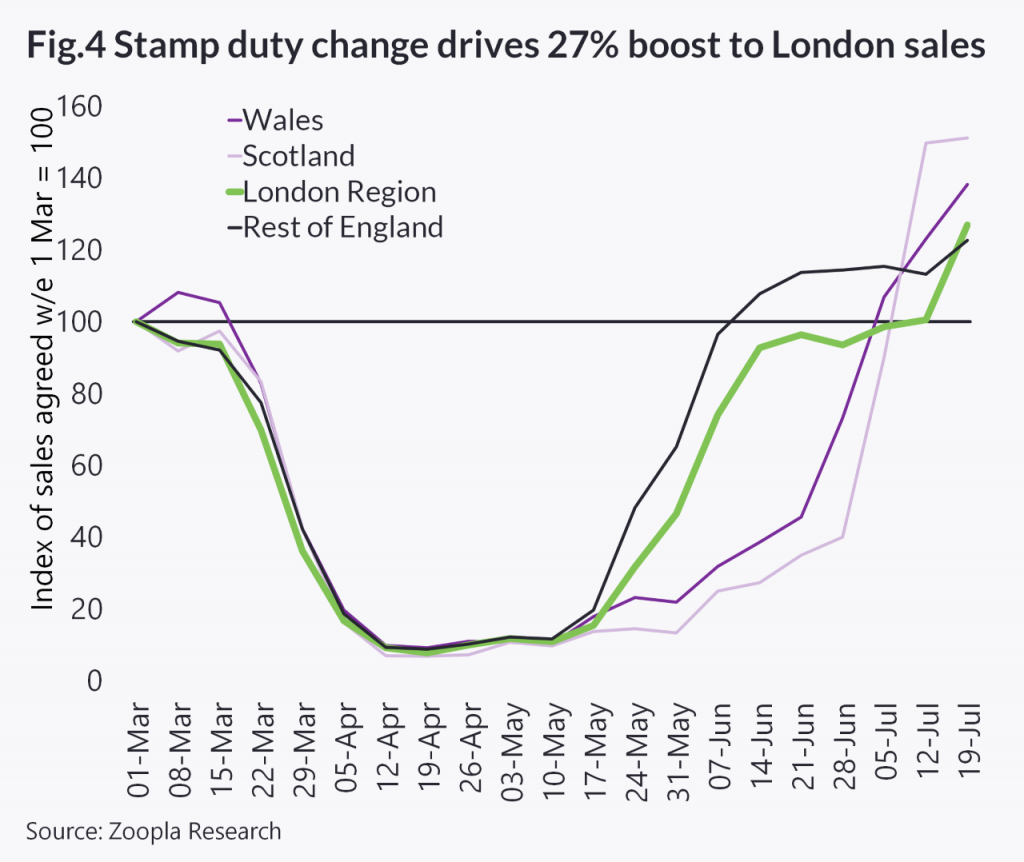

The property site predicted stamp duty relief will support demand in higher value markets across southern England, but the affect will likely fade as we head into 2021.

New home sales overall are running 28 per cent above pre-lockdown levels as pent-up demand converts into transactions.

This has helped translate into house price growth jumping by 2.7 per cent year-on-year – the highest level of annual growth for almost two years.

It come as new sales and supply since the start of the year is lagging 20 per cent behind compared to 2019, the property site said.

In contrast, demand for housing has rebounded more strongly with demand from buyers over the last month double that of the same period in 2019.

On a cumulative basis, since January 2020, demand is running 25 per cent higher than the same period in 2019 despite the market closure.

The site said it is clear there is a widening gap between supply and demand, which is set to support house prices over the second half of 2020.

Sheffield, Liverpool, Manchester and Nottingham are seeing the greatest increase in prices with demand up most in 2020 compared to 2019.

Demand for city living not fading

The data shows demand for city living is holding firm, despite speculation about the long-term demand for urban homes.

London ranks fifth for growth in demand since the start of 2020 with a modest shift away from the centre, towards the suburbs and commuter belt.

The lockdown has changed the priorities of today’s buyers who want a garden and are planning to commute less, Zoopla said.

This means consumers will look where this type of housing is available and meets their budget, which for many is outside inner London.

Richard Donnell, research and insight director at Zoopla, said: “Covid and the lockdown have shifted the dynamics of supply and demand across the housing market…

“For those operating in the market, and others looking in, the latest forecasts for increased unemployment and a sharp economic contraction over the next 12-18 months certainly seem at odds with current levels of sales market activity.

“We expect rising unemployment to weigh on market activity over the final quarter of 2020 and into the first half of 2021.

“The impact on pricing looks set to be pushed into 2021 as a result of sizable government support for the economy.

“Further support cannot be ruled out while forbearance by lenders, and the availability of the mortgage payment deferrals, which can start up until the end of October for three to six months, is likely to limit the scale of downside for house prices.

“Much depends on how businesses respond to the outlook and their decisions on staffing levels and the knock-on impact for unemployment.”