The BoE also increased the total quantitative easing (QE) target by £150bn to £875bn – beating market expectations which initially forecast £100bn.

This mainly consisted of £150bn worth of government bond purchases, whereas corporate bonds purchases remained at £20bn.

The MPC noted that the stimulus was to “support the economy” during the second national lockdown.

Despite continued media speculation, there was no mention of negative rates in the minutes, which indicated that the BoE is focussing on asset purchases for the near term.

The MPC’s tone was dovish, indicating an estimated contraction of the economy by close to three per cent in Q4 2020 due to the second lockdown, lowering 2020’s overall GDP growth to -11 per cent, a downward revision to August’s projections.

Economy and unemployment

Household spending was expected to increase at the start of next year, however the MPC acknowledged that the Brexit transition at the end of December would impact the economy as businesses adjust new arrangements.

The MPC also highlighted there would be a 7.25 per cent annual rise in GDP in 2021, revised down from the nine per cent increase anticipated in the August report.

However, the MPC upgraded its 2022 growth projection to 6.25 from 3.5 per cent.

The MPC now expects UK GDP to return to its pre-Covid levels in early 2022 rather than late next year.

Despite the extension of the furlough scheme, the latest Office for National Statistics (ONS) unemployment figures show unemployment has hit a four-year high at 4.8 per cent – but the MPC noted this will peak to 7.75 per cent by summer next year.

The MPC indicated that monetary policy will remain accommodative for some time, with no policy tightening expected until inflation returns sustainably to the two per cent target.

Recent ONS data indicates that inflation increased to 0.7 per cent in September 2020, up from 0.5 per cent in August 2020. The MPC expects inflation to rise to two per cent in two years’ time.

Negative rates forecast

With the fear of a second COVID wave and the risks of a no-deal Brexit, the market is expecting the BoE to cut interest rates below zero next year, for the first time ever.

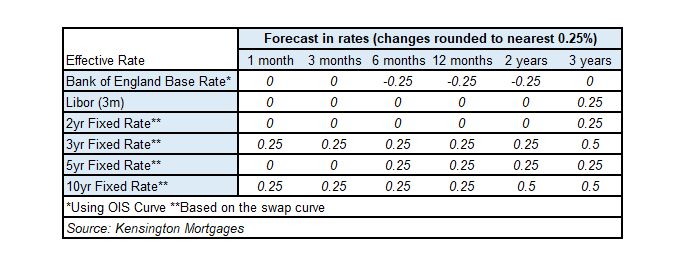

The market expects the BoE base rate will fall to negative 25bps in the next six months and remain stagnant for the next two years, returning to zero in three years.

Forecasts for the three-month London Inter-bank Offered Rate (Libor) and two-year rates will fall to zero for the next two years and then increase to 25 bps in three years’ time.

Three-year rates remain at 25bps for the next year and are expected to increase to 50 bps in three years, and five-year rates to remain at zero for six months, then increase to 25bps.

Ten-year rates are likely to remain at 25bps for the next twelve months and then increase to 50bps in the two years.

All this follows on from the announcement of a first viable Covid-19 vaccine earlier this week.

Slower return means more stimulus

We believe at this stage, given that UK growth is likely to take longer to return to its pre-pandemic levels, that the likelihood of further stimulus of the BoE is currently on the horizon.

The MPC is still considering the operational implications of negative rates for financial institutions, and the avoidance of negative rates in the MPC minutes hints out that asset purchases will be the MPC primary tool for stimulus, for now.

The MPC added that it is “ready to take whatever action was necessary”.

UK ABS Primary securitisation markets continued to be very quiet this quarter and it is likely that transactions scheduled to access the market before the year-end will be postponed to early next year, on the back of the current economic backdrop.