Brokers will pay a collective £22.9m towards the more than £1bn FSCS levy in 2021-22, more than seven times the £3m total mortgage advisers contributed during the current financial year.

The initial estimate of £1.04bn to cover the FSCS for the coming financial year is almost 50 per cent higher than the final £700m tally for 2020-21.

The shocking rise is driven largely by pension advice failings, self-invested personal pension (SIPP) operators, general insurance claims and firm failures as a result of the Covid-19 pandemic.

It has drawn frustration and anger across the industry, particularly from those sectors not responsible for the surge.

The regulator is predicting an increase of claims against home finance intermediaries but the sector will still remain one of the smallest contributors to the FSCS’s workload and expenses.

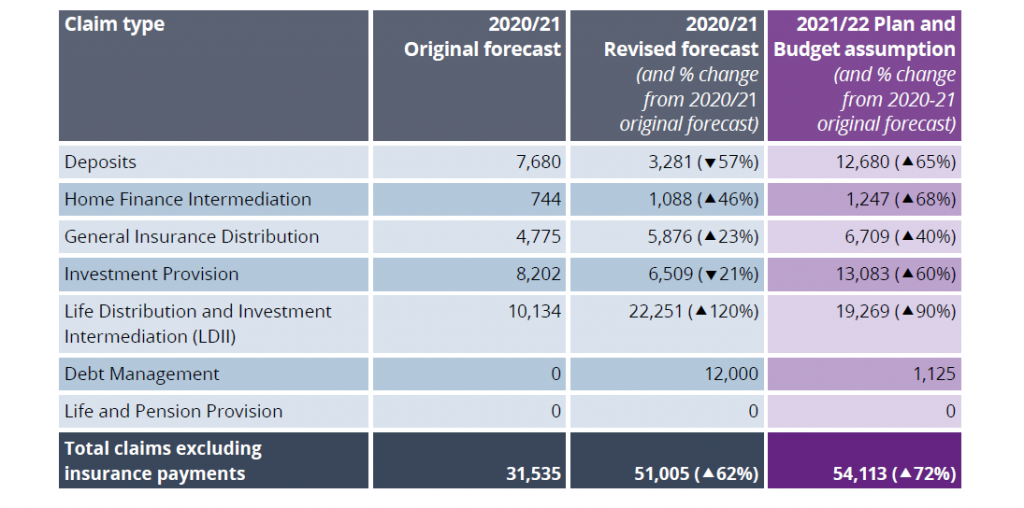

Complaints received are predicted to rise to 1,247, up from around 1,088 for the current financial year – just two per cent of the actual claims anticipated. (See FSCS graph below)

The £22.9m fee for mortgage advisers for 2021-22 is made up of £5.8m to cover its own sector and £17.1m for the wider industry failings.

Mortgage providers will also see an increase in contributions, rising from £1.1m to £8.6m, with £6.4m of that to fund the wider industry.

Association of Mortgage Intermediaries (AMI) chief executive Robert Sinclair (pictured) said the need to raise in excess of £1bn to make compensation claims was “a new low in the story of financial regulation in the UK”.

He said: “The dire discovery that the investment and pensions sector has been blind to widespread fraud and poor advice needs direct action by the industry.

“Asking mortgage brokers to pay more for bad pensions and investment advice than they are levied by the Financial Conduct Authority (FCA) for their own regulation is nothing short of a disgrace. The announcement of a Treasury Taskforce is too little and too late.

“On behalf of ordinary advisers who will have to find this money at a time when doing their job could not be harder, AMI requests that the review of future regulatory framework is expanded to look at how we develop a new approach that gives proper scrutiny of how firms are able to operate within the UK regulatory framework.”

Pensions and insurance failings

Announcing the details, the FSCS acknowledged the Life Distribution and Investment Intermediation (LDII) and Investment Provision classes were expected to breach their class funding limits for the second year in a row.

As a result, the retail pool will be triggered for a total of £252m.

It explained the four key factors behind the massive rise in claims costs:

- We are expecting an increase in failures throughout 2021-22 due to the widespread economic impacts of Covid-19. However, the situation is continually changing and the potential impact, both in terms of the number of firms failing, and their timing, is something we will continue to monitor carefully.

- We are anticipating an ongoing rise in complex pension advice claims. The compensation cost for the LDII class is forecast to be £361m, which is a similar level to the latest 2020-21 forecast. The main cost (71 per cent) of this class is estimated to be in respect of advice claims, where we expect the recent trend of processing more complex and expensive claims to continue.

- We expect further failures of SIPP operators. Claims in relation to SIPP operators are forecast to account for £336m of the Investment Provision’s anticipated £345m compensation costs. The compensation cost for this class is a significant (89 per cent) increase on 2020-21, mainly due to expectations that firms in this sector may fail.

- We expect an increase in pay-outs for the General Insurance Provision class. The costs of are expected to increase by 46 per cent to £233m due to continuing costs arising from current failures, such as East West Insurance Company Ltd. We also expect additional failures in this class, in line with trends we see year-on-year.

Silver lining

In one small positive, the FSCS revised the forecasted 2020-21 supplementary levy announced in November down from £92m to £78m. This saw the mortgage adviser contribution falling from £2m to £1.5m.

FSCS chief executive Caroline Rainbird said: “Although we are prepared for a difficult and uncertain year ahead, we look forward to working with the industry and the FCA on our recommendations.

“Much more must be done as regulation alone cannot be expected to solve the complex problem of the rising levy. We need multiple interventions and fundamental shifts across the sector.

“I am a strong believer in tackling the root causes of the increased compensation costs and distress caused by failures, rather than the symptoms of the problem.

“We are ready to contribute by providing insights, an independent view on the issues and recommendations that could transform the financial services market.

“It is only by taking these steps in an integrated and coordinated way that we can improve outcomes for consumers and, in turn, reduce the burden of the levy on the industry.”