The products will be available on 19 April and includes two deals, but will only be available direct to begin with.

The bank did not confirm when the range would be available through brokers, but said it would be in due course.

There is a two-year fix with a rate of 3.9 per cent and a five-year fix set at 4.04 per cent. Both products have no fees and there are no details on maximum loan sizes yet.

Employed and self-employed borrowers will be eligible with the mortgages open to first-time buyers and home movers.

Miguel Sard, managing director of home buying and ownership at NatWest said: “We welcome the government’s new mortgage guarantee scheme to give further support to those with smaller deposits.

“For those customers, particular younger or first-time buyers, saving up for a big deposit can often be difficult, and we know people in these groups are some of the hardest hit by the effects of the pandemic.”

He added: “A government-backed scheme will help segments of the market for whom home ownership has felt far out of reach in recent months.”

Rate reductions and ERC changes

The bank has also reduced rates by up to 0.15 per cent on its residential range.

Two-year fixed residential products have had rates cuts up to five basis points (bps) including the 70 per cent LTV offering with a £1,495 fee. This has been reduced to 1.28 per cent from 1.33 per cent.

The fee-free two-year fixed product at 90 per cent LTV has been reduced from 3.43 per cent to 3.38 per cent.

The Help to Buy range received the largest reductions, including the five-year fixes at both 70 and 75 per cent LTV both reduced by 15 bps to 1.93 per cent.

The two-year fixes for Help to Buy at 70 and 75 per cent LTV have been cut by 10 bps to 1.78 per cent and £250 cashback has been added.

ERC overhaul

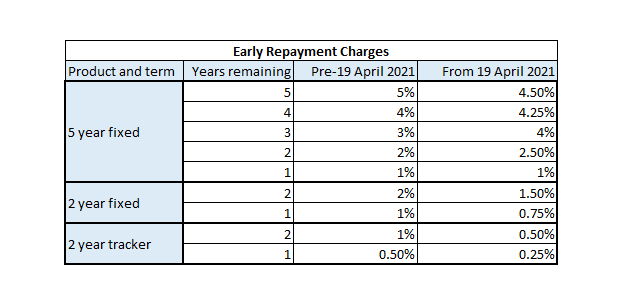

The bank has also updated its early repayment charges (ERCs) system and charges will no longer decline by one percentage point each consecutive year.

From 19 April, ERCs for a five-year fixed will begin at 4.5 per cent, previously five per cent.

The charge will then drop by 25 bps until the fourth year of the fixed period, where it falls from four per cent to 2.5 per cent. The ERC will then drop to one per cent in the final year of the fixed rate period.

ERCs for two-year fixes will start at 1.5 per cent then drop to 0.75 per cent and two-year trackers will begin at 0.5 per cent then go down to 0.25 per cent.