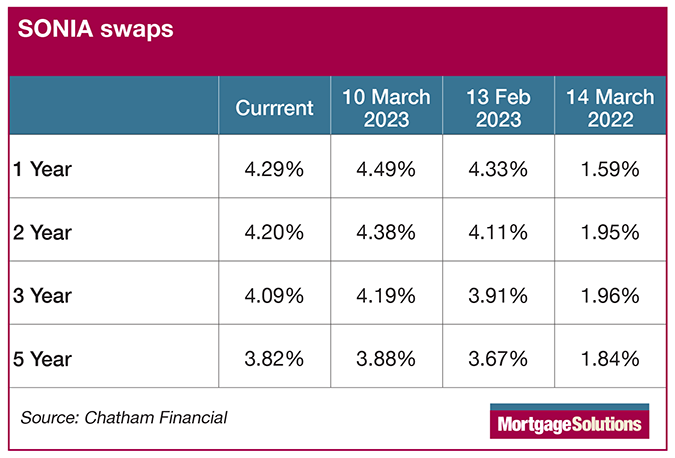

According to Chatham Financial, two-year Sonia swap rates stand at 4.12 per cent, down from 4.38 per cent at close on Thursday.

Five-year Sonia swaps are now at 3.73 per cent, which is down from 3.88 per cent at close on Thursday.

The rates were correct as of midday 14 March.

Industry figures attributed the fall to the collapse of Silicon Valley Bank and Signature Bank, the former of which collapsed last week. HSBC stepped into buy its UK branch yesterday.

Swap rates are when two parties swap interest rates, and dictate the price lenders pay to financial institutions to acquire fixed rate funding for a set period of time. This is then used to price mortgage products so lenders can ensure a profit margin.

Swap rates have become more volatile over the past year and on the increase since the start of 2022. This was due to increased volatility driven by factors including base rate increases, the war in Ukraine, rising inflation and the falling value of sterling.

This culminated in the mini Budget last year when sterling fell to a record low as proposed tax cuts that were due to be financed by debt spooked investors to sell-off the pound. The Bank of England was expected to increase base rates significantly to stabilise the economy.

Swap rates had started to stabilise, with some lenders offering sub-four per cent mortgages and many lenders cutting their rates at the start of the year. However, some have started to increase them as swap rates have started to tick up slightly.

Alex Maddox, capital markets and digital director at Kensington Mortgages, explained: “The collapse of Silicon Valley Bank has caused exceptionally high volatility in markets, and rates in the UK dramatically fell last Friday and at the start of this week; however, this is a global rather than UK phenomenon.

“The large rate movements seen were on the back of increasing concern around the deleveraging of a few US banks and overall worries about the wider banking sector, where we have started to see fears that increasing rates are eroding balance sheets across the financial industry, therefore tempering the market expectations for future increases in central bank rates.

He continued: “The UK rate curve has shifted dramatically with the two-year swap rate moving from 4.6 per cent to sub-four per cent between Friday and Monday and currently trading around 4.25 per cent. As a result, markets now expect the Bank of England to increase its base rate in 2023 by only plus 30 basis points versus the plus 70 basis ponts expectation last Friday; the plus 50 basis points bank rate hike that was priced in for March is now highly unlikely.”

“The overall decrease in the UK rate curve is great news for mortgage borrowers, who should see some cheaper deals from lenders given their cost of funding has significantly decreased from last week. Ongoing volatility and uncertainty are probably here to stay until some level of confidence returns to the markets, meaning that it is uncertain whether central banks will increase rates much further. The question is whether swap rates will continue to decrease or settle at these new levels. The good news is that we will likely see more sub-four per cent fixed rate mortgage deals in the near-term.”

Swap rate falls could benefit mortgage customers

Rhys Schofield, managing director at Peak mortgages and Protection, said that the fall in swap rates could be “good news for mortgage customers”.

“Over the past week or two, we’ve seen mortgage rates creep up as it was felt the UK economy is doing better than expected, meaning that it was more likely the Bank of England would hike rates.

“Now that it looks like perhaps they won’t have the room to do that, I’d expect to see the upward pressure on mortgage rates ease off a bit,” he explained.

David Conway, director at Clayhall Financial Services, agreed and said that the fall in swap rates could “prolong the sub-four per cent market rates and maybe even trigger a reduction in the base rate sooner than expected”.

Justin Moy, managing director at EHF Mortgages, added that the collapse could “bring forward reductions in the base rate”.

“This won’t be immediate by any means, but the peak may come sooner than expected. The overnight swap rates showed a significant decline in light of Silicon Valley Bank’s collapse, enough for everyone to take notice, especially when the recent trend has been upward for a few weeks.

“Is this just a bounce for a few days, or have the markets had a little nudge in the ribs? Let’s see what happens for the remainder of the week. It could be significant,” he noted.

Recovery of swap rates could be sooner rather than later

Gareth Davies, director at South Coast Mortgage Services, said that he “wouldn’t bank on it [swap rates] staying that way”.

“So many factors can change the trend at the drop of a hat. It’ll now be interesting to see if the base rate remains the same this month. A rate hike is no longer a nailed-on certainty,” he added.

Scott Taylor-Barr, financial adviser at Carl Summers Financial Services, said that financial markets “tend to react badly to surprises and have a tendency to over-react, too”.

“The collapse of Silicon Valley Bank in itself is not a major issue for UK markets as a whole, but the fear of a repeat of 2008/2009 is what’s setting the background music to all this. Is SVB a one-off, or the first domino to fall?,” he noted.

Taylor-Barr said that the “good news” for the UK was that its banking sector was in a “more robust place” so the fear of UK banking collapses was “far less than it is in the US”.

“Chances are that markets will stabilise in the coming days and swaps return to around their pre-SVB levels. But as the saying goes, when the US sneezes the UK catches a cold,” he said.

Graham Cox, director at SelfEmployedMortgageHub.com, added: “Silicon Valley Bank going bust is likely to have focused the minds of the world’s central bankers on the dangers of pushing interest rates too high, too fast.

“The markets certainly seem to think so, with swap rates falling in the immediate aftermath. That’s good news for mortgage rates, as the recent increases may now be reversed over the coming weeks.”

He added that “fear about major bank exposure to bond price falls is continuing to drive market sentiment” and this could mean that an “emergency brake is applied to interest rate hikes”.