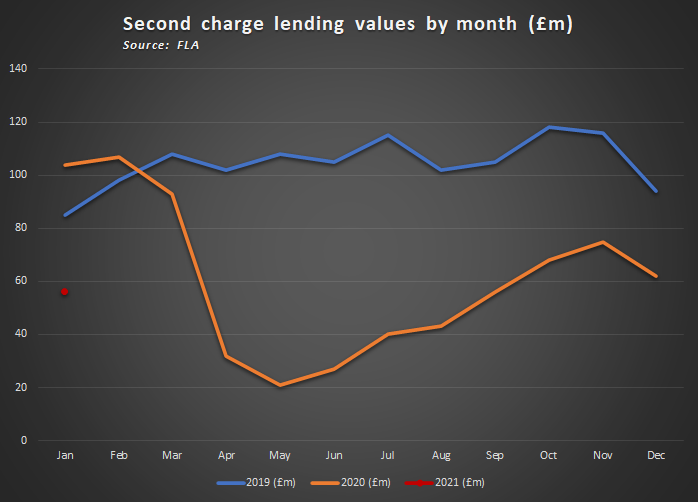

According to data from the Finance and Leasing Association (FLA) 1,302 deals worth £56m were completed in the first month of the year – down from 1,526 deals worth £62m in December.

The figures, down 15 per cent for number of deals and 10 per cent by value, continued from the December falls of 18 per cent by deals and 17 per cent for value.

Before this, the market had seen a recovery growing month-on-month since May.

The results are particularly concerning as January is often seen as a busier month following on from a slower December.

Year-on-year the results were also disappointing with the £56m being down 46 per cent from the £104m worth of deals completed in January 2020, with a similar decline seen in case numbers.

Consumer confidence vital

However, it is possible the national lockdowns and hesitation over the stamp duty holiday deadline may have put some people off.

Indeed, reflecting on the figures, Fiona Hoyle, director of consumer and mortgage finance and inclusion at the FLA, said: “The fall in new business volumes in January is not surprising given the lockdown restrictions currently in place.

“We expect demand in this market to increase significantly during 2021 as consumer confidence improves.”