News

Fixed-term rates starting to flatten – Moneyfacts

Fixed term mortgage rates are continuing to fall, however the pace of change has slowed dramatically.

First-time buyers and longer-term deals have seen an increased focus during the first half of the year as deals and rates continue to improve.

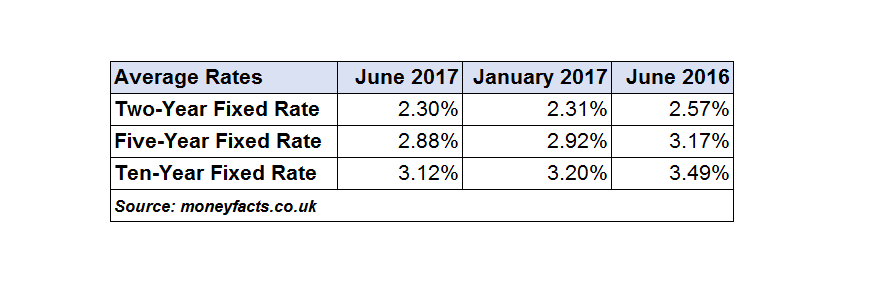

According to data from Moneyfacts, average interest rates across two-year, five-year and ten-year fixed mortgages have fallen by just 0.01, 0.04 and 0.08 percentage points respectively between January and June.

These compare with falls of 0.26, 0.25 and 0.29 percentage points over the last six months of 2016.

Moneyfacts also noted there was a significant increase in supply within the market during the first half of the year – for example it cited the number of deals available at 75% loan-to-value (LTV) increasing by 81 to 904.

How to get your first-time buyer clients mortgage ready

Sponsored by Halifax Intermediaries

Market saturation

However, the comparison site highlighted that the traditional two-year fixed rate market seemed to have become saturated due to heavy competition among providers.

Instead, it suggested many providers had shifted their focus to longer-term deals.

“First-time buyers have had a good start to the year, too, with the number of products at 95% LTV increasing from 242 in January to 287 today,” said Moneyfacts press officer Charlotte Nelson.

“Rates have also fallen in this key area, with the average five-year fixed rate at 95% LTV dropping from 4.63% to 4.58% over the same period.”

She added: “There are signs the housing market is starting to stagnate.

“If this continues, it can have a serious impact on the mortgage market, causing the growth we have seen at the very least to slow, however this might be compensated by borrowers looking to remortgage. This could be partly to blame for the small reduction in the average two-year fixed rate over the past six months.

“Given the increased choice in the market, it is even more important for everyone to shop around to ensure they get the best deal for them,” Nelson added.