News

Consumers expect further rate rise despite Bank of England move

The number of consumers expecting another increase in the base rate has dipped only slightly despite the Bank of England’s 0.25% rise earlier this month.

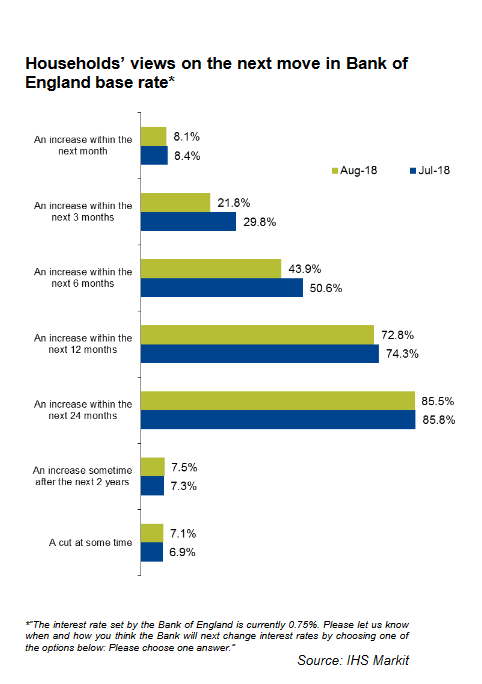

According to the IHS Markit household finance index, 44% of adults surveyed this month predicted another rise in the next six months – down from 50% in July.

There was an even smaller fall in the number expecting a further move in the next 12 months, down to 73% from 74%. And one in five still thought a rate rise was possible in the next three months.

The results suggest messages from the Bank of England to prepare for a steady phase of rate rises have been reaching consumers. (see chart below)

Overall results from the 1,500 adults surveyed by Ipsos/Mori showed that households gave the least downbeat assessment of current financial wellbeing since January 2015, with the index score rising from 45.0 in July to 45.9 in August.

How to get your first-time buyer clients mortgage ready

Sponsored by Halifax Intermediaries

However, while present circumstances were generally good there were significant concerns for the future of the economy.

The rating for the coming 12 months showed the second greatest level of pessimism since March 2017, slipping from a 28-month high of 51.7 in July to 46.0 in August.

Brexit concerns

IHS Markit economist Sam Teague said: “The August HFI survey unveiled a myriad of positive data around UK household budgets, underlined by the lowest degree of pessimism towards current financial wellbeing since January 2015.

“Furthermore, income from employment rose at the fastest pace since the survey began in 2009. Strong labour market conditions gave households the confidence to continue ramping up spending levels in August.”

However, he warned that there were significant concerns in the short term.

“That said, the spectre of higher living costs on the horizon and ongoing Brexit uncertainty both contributed to renewed worries towards future household finances, with August’s findings seeing the lowest level of optimism among respondents since Article 50 was triggered in March 2017,” he said.

“Meanwhile, following the Bank of England base rate increase in early August, around three-quarters of UK households expect a further hike in the next 12 months.”