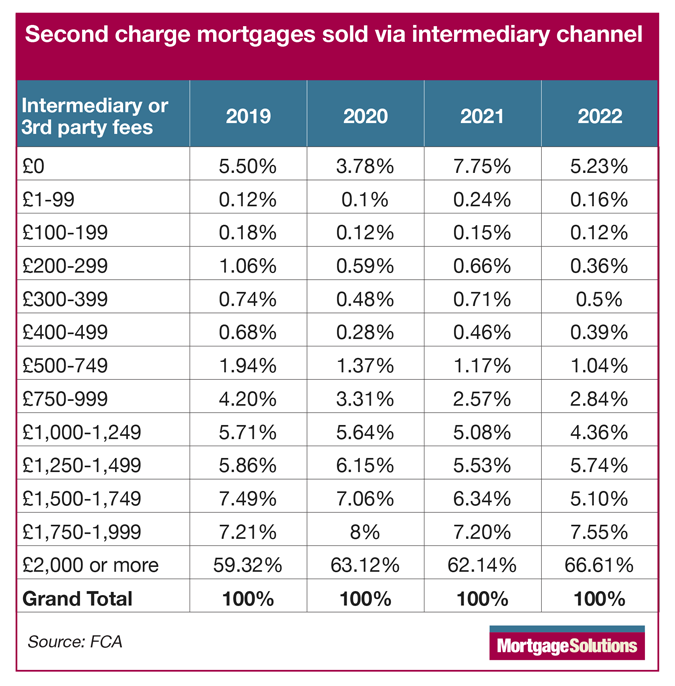

According to a Freedom of Information request sent to the Financial Conduct Authority (FCA) by Mortgage Solutions, this continues an upwards trajectory since 2019, driving up from 59 per cent to 63 per cent in 2020 and 62 per cent in 2021.

The figures also show that the proportion charging no advice fee at all also fell from nearly eight per cent in 2021 to 5.23 per cent in 2022.

The segment of brokers charging up to £1,000 has contracted going from around nine per cent in 2019 to 5.41 per cent currently.

The proportion of brokers charging between £1,000 and £2,000 has fallen steadily from 26 per cent in 2019 to 24 per cent in 2021 to around 23 per cent in 2022.

Regulatory step change

The second charge mortgage market has been under regulatory scrutiny for some time, having come within scope of the Financial Conduct Authority’s (FCA) mortgage rules in 2016.

In 2018 the regulator issued a Dear CEO letter which said that it had found “significant issues” in the second charge lending market and told firms at the time to review their processes.

First and second charge fee structures incomparable

Liz Syms, chief executive of Connect for Intermediaries, said that broker fees for second charges had historically been higher than mainstream mortgages due to the “specialist nature of the products and the different processing requirements”.

She explained that second charge loans demand several requirements beyond those standard on a first charge mortgage.

“These requirements include obtaining the credit report, checking with the existing lender that a second charge is acceptable and obtaining written consent, obtaining statements from the current mortgage company and any other credit companies if that debt is being consolidated, obtaining a desktop valuation and knowing when a full valuation needs to be done and instructing this, checking land registry for restrictions or covenants and so on,” Syms added.

She continued that other obligations included setting up accounts with credit agencies and valuation providers and incurring a cost for every search, which must be completed before a lender reviews the application.

“The adviser effectively becomes the initial underwriter, and not all advisers have the skills, knowledge or systems to complete this work. Hence an adviser will usually turn to master brokers who specialise in this sector, and the work this firm does will need to be included in the fee charged to the client,” Syms said.

She said it’s important we don’t compare the fees on first and second charges as the “skills, process, knowledge and amount of work required are completely different”.

Nicholas Mendes, mortgage technical manager at John Charcol, agreed that the approval processes were more manual with second charge, adding that less technology was used to automate parts of the approval side.

He added that growing fees could also be attributed to higher demand and lending criteria getting tighter due to rising rates and squeezed affordability.

Operational costs rising for second charge

Paul McGonigle, chief executive of Positive Lending, said that while the headline was that two thirds were paying £2,000 or more that was not the experience of his firm, where the average fee was £1,000-1,249.

“What I would state is that these larger fee charging firms do cover the cost of the client’s mortgage survey and reference request costs and absorb losses for down-valuations at no cost to the client.

“If the mortgage broker was to take this stance I am sure that the average mortgage fee would also increase significantly,” he added.

McGonigle said that the second charge mortgage process was without doubt “more costly” where loans, and operational costs had risen by 11 per cent on this product line.

“That said we have absorbed the majority of the cost and still maintain a business that is profitable,” he noted.

FCA will ask who benefits the most from deal?

Robert Sinclair, chief executive of the Association of Mortgage Intermediaries said that the regulator would look at who was getting the “most out of this deal”, the broker or the customer? The customer had borrowed money elsewhere, moved onto a second charge secured against the property, which in turn heightened their risk profile.

“All you’ve done is take the existing money and added your fee to it which means the customer had no incremental benefit out of doing this,” he explained.

Sinclair said that the figures could be hiding larger fees and there could also be a “big number” charging £3,000 or more.

“I think there are problems in this sector in terms of how you justify your value and how you justify that fee. How many hours does it take and how much is done by an experienced adviser and how much is done by an admin person?

“A large part of the work in seconds is actually done by admin people, completing the legal documentation and paying off the existing debts and that’s done by clerical people, not by mortgage advisers,” he added.

Sinclair said that the bulk of business was “run through relatively few businesses” so the regulator would “know exactly where this sits”.

Consumer Duty: the catalyst for fee alignment

Sinclair said that second charge mortgage brokers would try and justify the fee on the cost of acquisition and on the amount of work they do as there is a lot of administration around it.

“They are doing a lot more as outsourcers of the work for the lender in terms of that process and transaction because they will do all the legals and the packaging and many of them have in-house underwriters sitting in their premises,” he explained.

Sinclair said that the “question mark” was around how much the regulator would accept in “relation to other products and other relative costs”.

“I think there’s that challenge as to how fees operate, often within the same building, but not the same legal entity,” he noted.

Sinclair said that when seconds became more mainstream there was an expectation that the fees would align more, but there was “still a push-pull around this in terms of the dialogue that happens between first charge firms and those who recommend seconds”.

“There was some movement in fees but there’s clearly still a distance to go and Consumer Duty may cause this to align a bit more,” he noted.

Sinclair said that it would be “interesting” to see the figures for this year and next year, and he hoped the fees “would come down a bit because ultimately, I’m struggling to work out, given what I know about how the industry operates, that size of price differential”.

Some second charge brokers will need to ‘change their model’

McGonigle said Consumer Duty would “without doubt” ensure that the regulator reviews the fee date and visits key players in the market to look at the cost to consumers for the service provided.

“Some will need to change their model,” he added.

McGonigle has said that as a firm it had championed the reduction of fees for consumers for years and he was “sure that the market will react where it can”.

“Many businesses in our space are not charging the higher fees. I fear this data is being driven by a few key market players that generate business which is not necessarily introduced by intermediaries,” he added.

Nicholas Mendes, mortgage technical manager at John Charcol, agreed that Consumer Duty would mean second charge brokers would need to “closely review their fee models” and justify them under fair value.

“The FCA is likely to look at comparative charges among similar size firms. Whilst there is justification to charge higher fees over first charge, the extent to which some firms push this is not defendable in our opinion,” he noted.

Mendes continued that the FCA insisting on parity with first charge would be “unfair” and second charge options could become “scarce” through brokers due to “profitability issues”.

“This would restrict competition and it is unlikely the FCA will go there as it would go against one of their key strategic objectives. The key point would be to have well-justified Fair Value assessments on file ready for inspection by the FCA,” he said.