A Sky News report has linked the two banks with a statement issued by RBS which said it had received a number of informal approaches for its business.

But neither lender has made a formal proposal to buy the business which will consist of a network of around 300 branches.

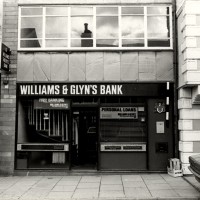

RBS has to dispose of the Williams & Glyn business before the end of 2017 as part of a condition of the government bailout.

At the end of the third quarter this year, Williams & Glyn had net loans and advances to customers of £20bn and customer deposits of £24bn.

An application for a banking licence was submitted in September and the bank confirmed it was currently working with the City regulators to get the licence approved which will allow it to separate the two businesses. Its objective is to complete the separation by quarter one 2017.

RBS said that because of the ‘strategic attractiveness’ of Williams & Glyn it had received a number of informal approaches for its business. The lender plans to continue preparations for an Initial Public Offering while preparing to launch a trade sale process in the first half of 2016. It aims to arrange a binding agreement to sell the business by the end of next year.

A Santander Group spokesman said: “As our executive chairman said at the recent Santander investor day, we will continue to analyse opportunities in our core 10 markets where they add value and benefit to our customers and shareholders. That said, we do not comment on rumours or market speculation.”

A spokesman for Virgin Money said it consistently said looks at acquisition opportunities which are a good fit with the business which come with an appropriate risk profile and at a reasonable price.