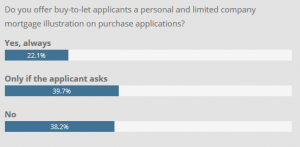

Responding to the Mortgage Solutions poll, a further 40% said they did offer them when requested but a similar proportion never did so.

The results show that only a few brokers appear to be taking a proactive approach in this evolving area, particularly given the incoming tax changes. (Click to enlarge graph)

The results show that only a few brokers appear to be taking a proactive approach in this evolving area, particularly given the incoming tax changes. (Click to enlarge graph)

This prompted a warning that they may be leaving themselves open to unhappy clients suggesting they were not aware of all the options during the transaction.

“It’s a difficult one, because when a client is buying a buy-to-let property they are making a business decision and the broker is but one part of that process,” said Mortgages for Business managing director David Whittaker.

“Is the broker obliged to act In loco parentis for the accountant or the business borrower’s inability to speak to an accountant or not, I’m not sure.

“Certainly, to avoid the potential accusation it would be good practice to say ‘I really think you should get tax advice’.

“But I don’t think if they don’t do it they are overly putting themselves at risk, they are just liable to the accusation of it,” he added.

Question the client

Whittaker’s firm specifically identifies that the client is content that the structure he or she proposes is right for their circumstance.

“We don’t necessarily give them quotes, but we make it very clear to them that most lenders offer both personal and limited company buy to let and will offer it at the same interest rate and same fees and therefore there is no disincentive to doing it,” he added.

He noted that three in four buy to let purchases completed by the firm were now done inside a limited company wrapper, suggesting this is a rapidly growing area of the market.

This continued expansion is also predicted by London and Country associate director David Hollingworth. However, he is more sanguine about the poll results.

“I think that result will probably shift over time, but the majority are clearly not sending everyone down the limited company route straight away, which I think is probably appropriate,” he said.

“There are going to be more people looking at limited companies as a way of holding properties going forward and it is important brokers are aware of that and it’s important that they understand there’s a host of complicated tax issues and costs which could arise.

“At the moment what you’re seeing is a fairly proportionate response from brokers, understanding that there will be an option for some, but it won’t be for everyone,” he added.

Direct to advice

Hollingworth suggested that it would be appropriate for brokers to be led by their client in how to deal with the process.

“The danger is a broker starts suggesting that this is definitely what someone should do, and almost talking as if they are a tax adviser, which could easily miss some important aspects of the individual circumstance,” he continued.

“But equally having an awareness of how it works is going to be important. It will be more something clients will raise as to whether it would be appropriate for them, at which point it should be for brokers to suggest that they should seek specialist tax advice.

“That’s the appropriate approach, as brokers aren’t tax advisers,” he added.