While some brokers say they are able to juggle their finances to manage cash flow, the time taken for some lenders to pay out for business has been branded ‘ridiculously long’ with calls for improvements to be made.

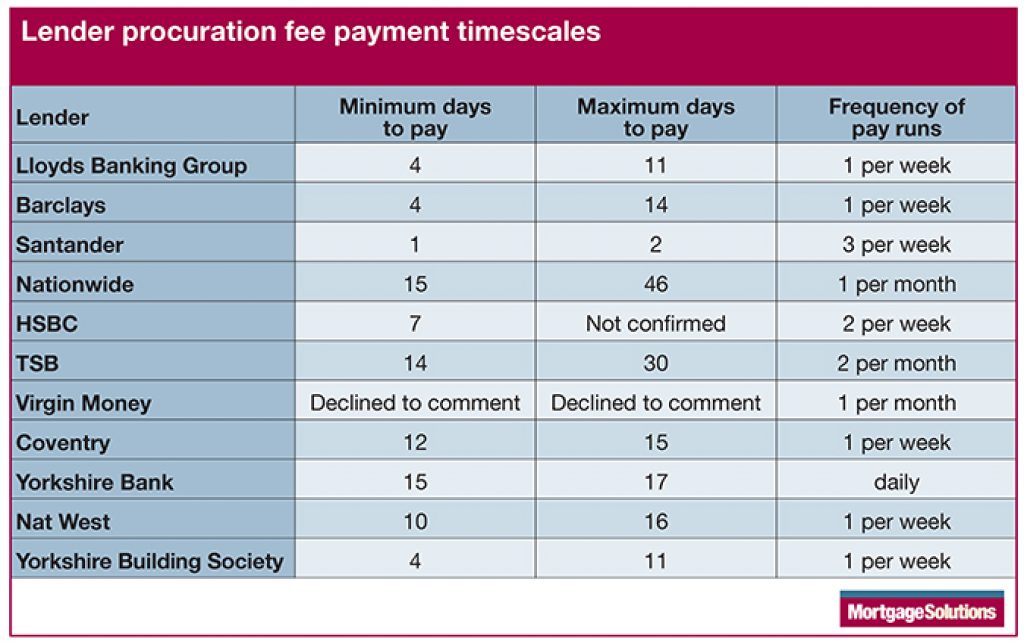

Mortgage Solutions asked 11 lenders to disclose their minimum and maximum timescales for releasing proc fee payments and the number of payment runs they carried out in a month (see table). Timescales are in calendar days.

The findings revealed over 40 calendar days difference in the maximum time it could take to receive a payment from the quickest payer Santander, and the slowest, Nationwide.

Mortgage Solutions is calling for all lenders to have at least one payment run a week and have a maximum payment timescale of 7 calendar days.

To secure the quickest payout for brokers, Santander has three payment runs a week; Tuesday, Wednesday and Friday. The payment run includes cases that completed midnight the day before. Nationwide, in contrast, conducts one payment run a month and Virgin Money, which would not disclose minimum and maximum timescales, pays once a month for cases completed in the previous month.

Dean Mason, director and mortgage and protection adviser, Masons Financial Planning, said: “My only real issue is Nationwide and TMW which pay the month after completion so for example if a case completes on 1 March, we finally get paid by the network on or around the third Friday in April. This is ridiculously long bearing in my they could have had two mortgage payments from the client by then.”

A spokesperson from Nationwide said: “Investing in our systems remains a priority and we continue to focus on improvements in this area.”

‘just grin and bear it’

John Azopardi, mortgage and protection adviser, New Leaf Distribution, said his business was affected by some lenders’ lengthy delays in making payments but said he felt like he had to ‘just grin and bear it’.

He added: “I make regular use of my overdraft and just see it as part of the dynamics of being involved in the mortgage market.

“I have a pretty good application to completion ratio – but just accept the fact that it’s going to take four to six months to get paid on anything I do.”

Cash flow facilitators

Some brokers are shielded from payment delays by their network or club which pay their members on the day mortgage contracts exchange. This is instead of waiting to receive the money from lenders. However, not all distributors have such favourable arrangements.

Of the distributors Mortgage Solutions approached, L&G Mortgage Club, TMA mortgage club and Pink network (on the broker’s request) said they paid brokers’ commission on exchange of the mortgage contracts, instead of waiting to receive the money from lenders.

Sesame and PMS, Paradigm, TenetLime, Openwork and First Complete while adopting efficient processes to pay fees out quickly, waited for receipt of the commission from lenders. Timescales for payout ranged from the same day to a week after receipt of funds.

Openwork said it pays brokers at a frequency which matches their firm’s cash flow and administrative needs.

“There is no reason why it should take this long”

Small business owner and mortgage adviser Daniel Bailey, Middleton Finance, said: “One of the main reasons I joined my network, Pink, was because it pays me within 24 hours of the completion. It was the deciding factor.

“Before joining Pink, I worked for a directly authorised firm so I have seen first hand the difficulties it can cause a business, waiting over a month to get paid.”

Bailey said it was a particularly an issue with purchase cases. He explained it can take two months for the case to be processed, offered and for contracts to exchange. “Add another six weeks to receive the money from the lender and you are looking at a period of three to four months before you get paid for one client,” he said.

Bailey said the issue would pose the biggest problem to those setting up a mortgage broking business. “New business owners would have to go through a significant period without getting paid. I feel for people in this position. There is no reason why it should take this long.”

Even mortgage brokers who say their cash flow is unaffected by the delays, want to see improvements to the lenders’ payment systems.

Michael Tickner, principle, KT Partnership, said it would make his life easier if online systems were used between networks and lenders to confirm payments sent. He said networks and lenders still relied on emails and statements being sent by post which can go astray or extend the time it takes for the payment to come through.

Tickner agreed there were some lenders which could improve their payment timescales. “It would be better if all lenders reviewed payments on a weekly or fortnightly basis for continuity. This would allow us to monitor errors easier,” he said.

Distributor back calls for proc fee improvements

Distributors also want to see improvements from the lenders over paying out for broker business.

Christine Newell, mortgages technical director, Paradigm said she wants to see manual elements of lenders’ proc fee payouts removed. She said this would remove delays caused by human error, or reliance on an individual to carry out a manual part of the process who is suddenly unavailable.

She added: “In an ideal world, we would like lenders to pay out on the same day at the same time each week or month.”

Mortgage Solutions has launched a campaign, Faster Lender Intermediary Payments (FLIP), and has written to the Council of Mortgage Lenders and Intermediary Mortgage Lenders Association highlighting brokers’ frustrations.

#FLIP