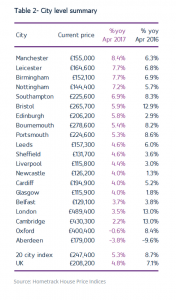

According to the Hometrack UK Cities House Price Index, residential property prices rose 5.3% in the year to April.

This is down from 8.7% in the year to April 2016, and largely consistent with the last six months.

Perhaps encouragingly, price growth slowdown is most noticeable in the most unaffordable cities.

London, Cambridge, Oxford and Bristol all saw the rate of growth slow from double to single digits over the last year.

Hometrack suggested this steep deceleration in growth reflected weaker levels of demand from home owners and investors in the face of affordability constraints, tax changes and weaker market sentiment.

Aberdeen saw the biggest house price fall from those cities sampled (down 3.8%) but this was actually a stabilisation from the year to April 2016, when prices fell by almost 10%.

Manchester and Midlands

Manchester and Midlands

Manchester continues to register the fastest growth rate across the country of 8.4%, up from 6.3% a year ago. (Click graph to enlarge.)

It is followed by three midlands cities: Leicester (7.7%), Birmingham (7.7%) and Nottingham (7.2%).

Price growth in London is the slowest for five years at 3.5%, compared to 13.0% in April 2016.

Hometrack added that the current trends were consistent with mortgage demand

According to data from the Council of Mortgage Lenders (CML), only in London were mortgaged homeowner numbers materially lower (down 19%) in the first quarter of 2017.

“Taken together with a 30% decline in buy to let purchasing it is clear that demand for housing in southern England is moderating and impacting price inflation,” Hometrack noted.