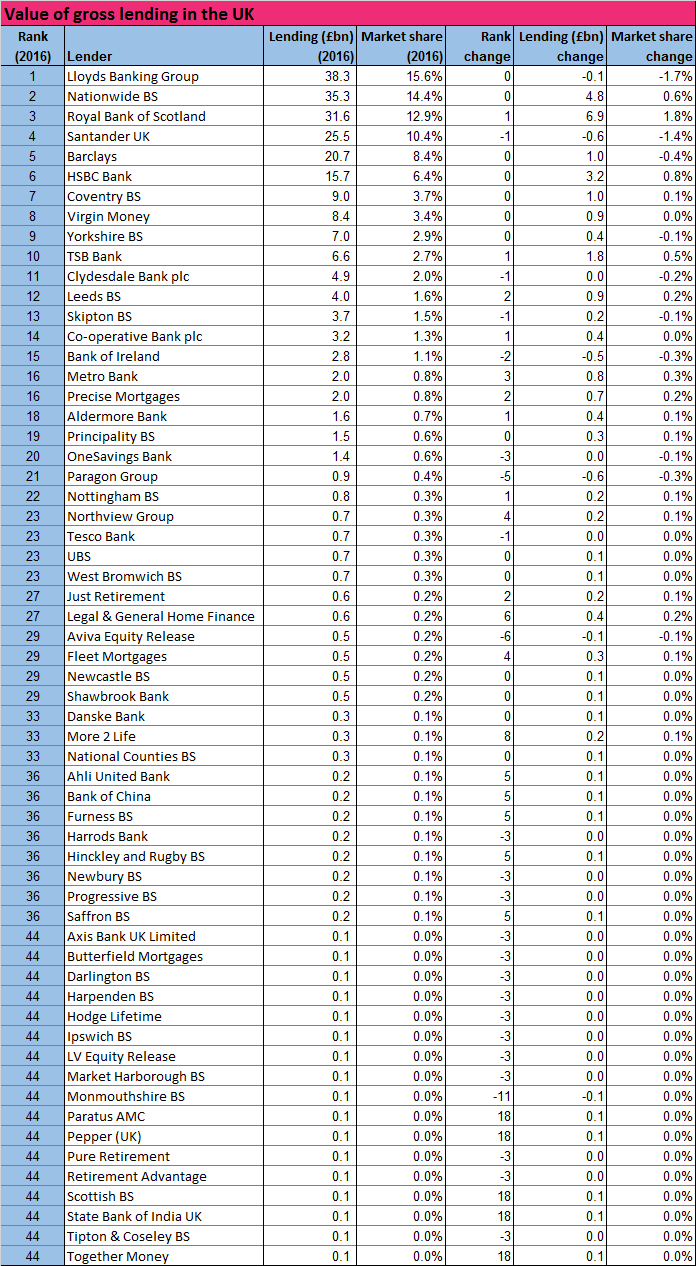

Mortgage lending data from the CML showed that the mortgage market’s giants still accounted for 84% of new lending in 2016, but they were experiencing different individual fortunes.

The CML added that a number of challenger banks and specialist lenders continued to make headway.

Gross lending overall in 2016 totalled £245bn, up 11% on 2015, which was a slightly higher rate of market growth than the 9% seen in the preceding year.

Lloyds Banking Group remained the largest mortgage lender in the UK but continued to shrink its market share, from 17.3% in 2015 to 15.6% last year. Santander also saw a contraction in market share, from 11.8% to 10.4%.

Moving in the other direction, Royal Bank of Scotland grew its share by 1.8% to 12.9%, rising one place in the table to become the UK’s third largest lender in 2016. Among the challengers, TSB Bank saw the most significant growth, increasing market share by 0.5% and moving up one place in the table to tenth position.

Challengers grow

While the 10 largest firms continue to undertake the bulk of lending, smaller players made a noticeable contribution to lending growth, and are expected to continue doing so over the next two years. (see graph)

This contrasts with performance in 2015, when medium-sized lenders saw particularly strong growth, with a 56% increase in annual lending volumes. They accounted for 12% of total lending, compared to 8% in the preceding year.

In 2016, however, these medium-sized lenders saw a gentler rate of growth, and it was the turn of those in the next tier down – those ranked 21-30 by volume of lending – to forge ahead. These firms saw lending volumes grow by 60% in aggregate.

A number in this group saw a significant expansion of activity, said the CML. It highlighted Precise Mortgages with lending growth of 54%, Metro Bank (67%), Fleet Mortgages (150%) and Legal & General Home Finance (200%).

Increasing competition

There was an increase in marketplace competition. Sixty lenders appear in the CML’s 2016 table for gross lending, below, up from 55 in the preceding year.

The very smallest firms – those with under £50m of lending – do not feature in the table. Virtually all CML members provided data, although a small number did not give permission to publish figures. The data included account for 97% of the total mortgage market.

The table below shows gross lending for all lenders who lent more than £50m in 2016.