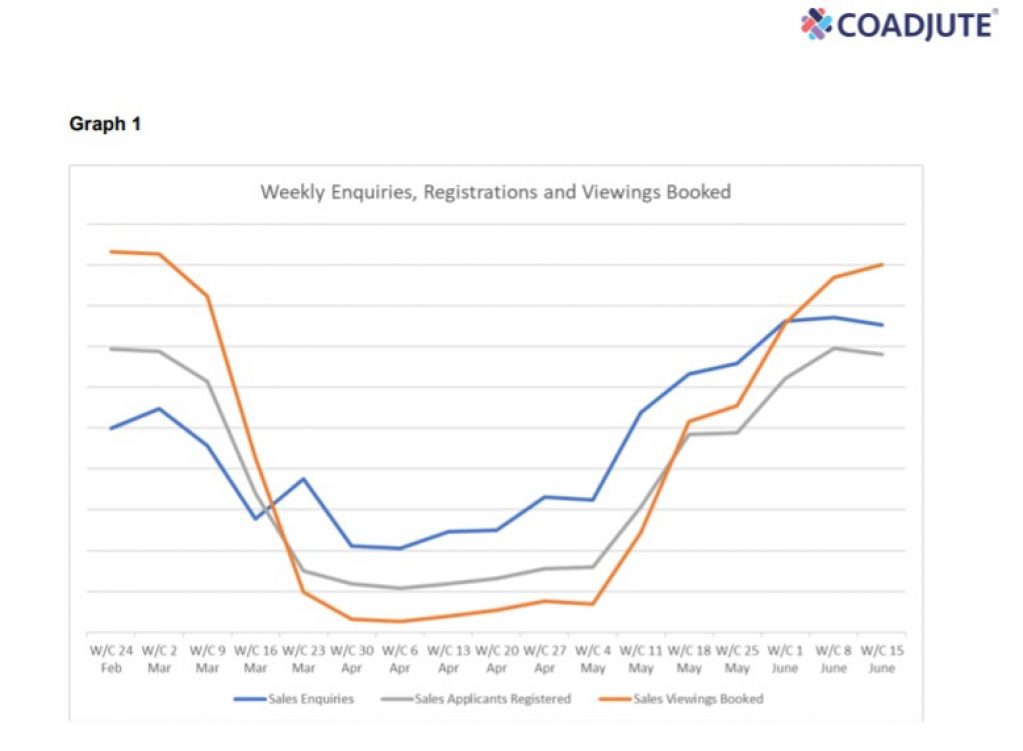

Buyers viewing homes grew by four per cent in the week from 15 to 21 June, compared to the previous seven days. Meanwhile the number of properties registered for sale rose by five per cent week on week, according to a report by prop tech firm Coadjute.

Both the number of viewings and homes listed for sale are now just three per cent off their post lockdown levels.

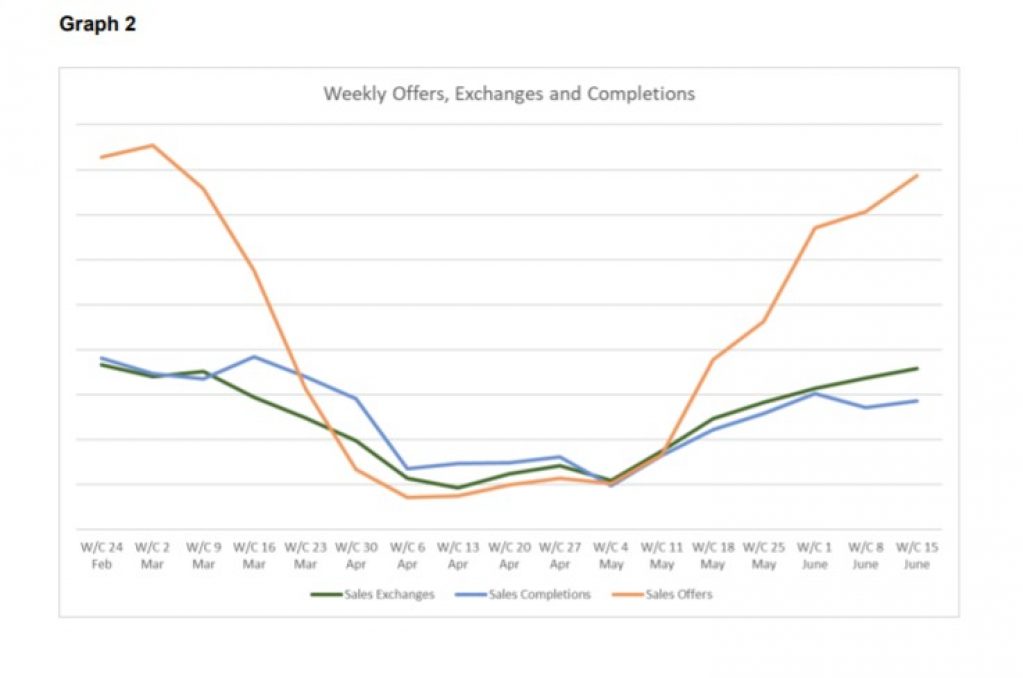

Offers made on homes for sale were also up by 11 per cent week on week. Exchanges rose by six per cent , but completions fell by five per cent.

The Property Market Insights report is complied by Coadjute from data supplied by more than 50 per cent of UK estate agents, and selected conveyancing firms.

Dan Salmons, chief executive of Coadjute, said: “Over the last three months, data from our partners has revealed both the unprecedented drop in the property market after lockdown and the impressive recovery. With levels of activity now returning to normal, and further easing of lockdown measures on the way, we hope the UK property market can start to look forward again.

The gradual recovery of the housing market after lockdown restrictions in England began to ease on 13 May will be supported by wider availability of mortgage finance to those with smaller deposits of 20 per cent of less.

Last week, several lenders brought back their 90 per cent loan to value ranges including Yorkshire Building Society and Platform while Family Building Society relaunched its family support mortgage available up to 95 per cent LTV. To be eligible for the deal, family members have to deposit savings with the bank or agree to have a charge placed on their title deeds of their own home for a period of time.

Nationwide, however, retreated from 95 per cent LTV lending two weeks ago and will now only offer loans to borrowers with a 15 per cent deposit.

Although the market appears to be enjoying a swift recovery, experts warn that it may be short lived. Between March and May, 600,000 PAYE jobs were lost due to the pandemic but the full effect on employment is not expected to be seen until the government’s job retention scheme and business support ends in October. Banks say this macroeconomic uncertainty is one of the reasons they are holding back from high LTV lending.

The Royal Institution of Chartered Surveyors’ (RICS) residential housing market survey in May suggested it would take at least nine months for property sales to fully recover to their pre-coronavirus crisis levels. And the trade body’s membership added that it is likely house prices will fall at least four per cent in the next few months.