In 2019 gross lending for homeowners and buy-to-let landlords totalled £268bn, down 0.3 per cent on 2018, the figures from trade body UK Finance confirmed.

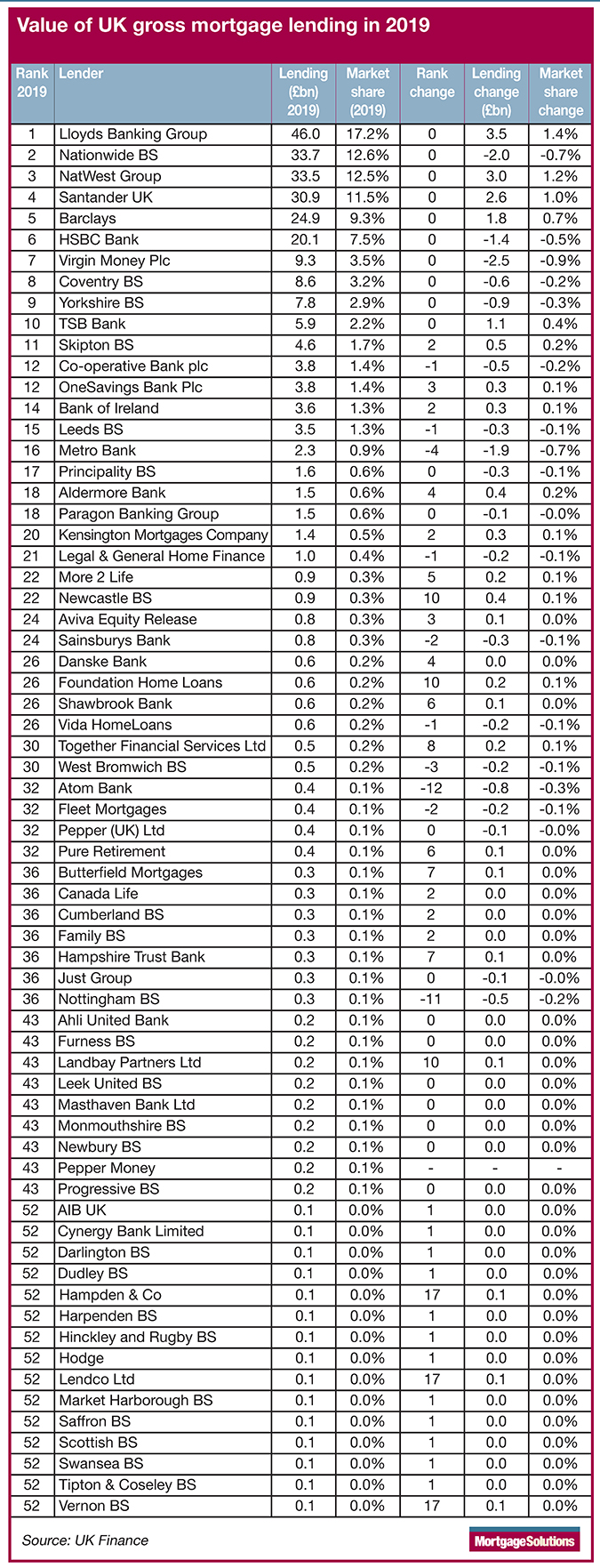

Overall, the top six lenders were responsible for £189bn of lending, up £7.5bn on the previous year and accounted for more than 70 per cent of all new mortgage business completed in 2019 – up from 67 per cent in 2018. (See table below)

However, while Lloyds Banking Group, NatWest, Santander and Barclays all saw notable increases, Nationwide and HSBC lost volume and market share.

Lloyds Banking Group, which includes Halifax, was once again the biggest mortgage lender in the country and saw the largest growth, increasing its lending by £3.5bn to £46bn and growing its market share by 1.4 per cent to 17.2 per cent.

NatWest Group, formerly known as Royal Bank of Scotland, moved to within touching distance of overtaking Nationwide for the second largest lender in the country.

NatWest gained £3bn in lending volume and 1.2 per cent of the market to take it to a total £33.5bn and 12.5 per cent share respectively.

In contrast, Nationwide completed £33.7bn in lending, a drop of £2bn and loss of 0.7 per cent of market share.

Santander and Barclays completed £30.9bn and £24.9bn of lending respectively, with gains of £2.6bn and £1.8bn respectively.

But after several years of strong growth as it continued to roll out into the broker market, HSBC lost ground, completing £20.1bn of lending, £1.4bn less than in 2018.

Overall, building societies and mid-tier lenders lost £1.8bn and £3.5bn in new business compared to 2018, according to the UK Finance figures, with banks gaining £7.5bn. Specialist lenders were largely unchanged.

While it is the first time since 2014 the big banks have controlled more than 70 per cent of mortgage lending, it remains far away from 2009 when they claimed more than 80 per cent.

Falling share

The combined Virgin Money Group, which includes Clydesdale Bank, saw its new mortgage business fall by £2.5bn to £9.3bn.

As the intense competition took hold, the lender made public statements during the year that it was not prepared to conduct higher risk lending just to gain market share.

Meanwhile, Metro Bank also saw a sharp fall in its lending by £1.9bn as it weathered the storm from regulatory and capital issues.

And Atom Bank, which had previously created much energy in the market with some of the lowest rate products ever launched saw its business shrink by two-thirds, falling by £800m to £400m.

Big gainers

Outside the big six, TSB saw the biggest gain as it increased lending by £1.1bn taking it to £5.9bn in total with 2.2 per cent of the market.

Skipton Building Society was the most positive mutual, increasing lending by £500m to take it to £4.6bn, while Newcastle Building Society and Aldermore both grew their lending by £400m.

The merged One Savings Bank, bringing together Precise Mortgages and Kent Reliance, secured £3.8bn of new lending, a £300m growth on 2018.

Ring-fencing takes effect

UK Finance analyst for data and research Callum Bilbe explained that the UK ring fencing laws were likely to have played a significant part in the gains made by the largest lenders.

“Because UK retail banking is ring-fenced, it means there are only certain things that banks can do with the money from borrower deposits,” he said.

“As deposit levels are on average higher than lending levels, these large lenders have used surplus retail deposits in the ring-fenced organisation to increase mortgage lending.

“This increase in supply of mortgages has contributed toward the average price of new mortgages dropping significantly, as larger building societies and mid-tier lenders compete with the largest banks to attract borrowers to their products.”

Bilbe added that capital weighting rules were more favourable for larger lenders which further reduces the cost of funds and helped to drive down pricing.

“However, specialist lenders continue to thrive in market segments where manual underwriting is required, such as for self-employed customers or those with more complex incomes,” he continued.

“Larger, and to some extent mid-sized firms, are less able to compete in these segments as their largely automated systems are unable to provide the tailored approach to these loans that is required.”