News

Updated: Habito launches 40-year fixed rate mortgage with £1bn fund and stepped LTIs

Habito is launching a 40-year fixed rate mortgage which it claims is the longest ever product of its kind.

The mortgage is available at up to 90 per cent loan to value (LTV), has no early repayment charges or exit fees. However, all versions have a £1,995 product fee which must be paid again if additional borrowing takes place.

It is also fully portable with only valuation and legal fees required if borrowers decide to move home.

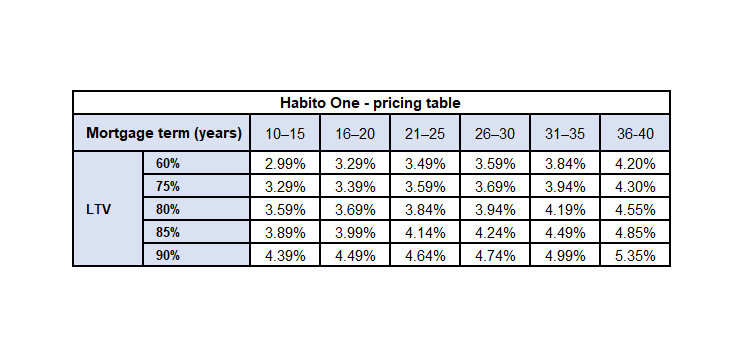

It will be available from 60 per cent LTV up to 90 per cent LTV with a range of terms from 10 years to 40 years from launch with plans to roll out 95 per cent LTV mortgages from early summer.

Rates start at 2.99 per cent and are fixed for the full contractual term of the mortgage. (See table below)

How to get your first-time buyer clients mortgage ready

Sponsored by Halifax Intermediaries

By comparison, the lowest rate 10-year fixes currently available include the Barclays version at 1.99 per cent with a £999 fee while Halifax has a zero-fee option at 2.15 per cent, but both these have early repayment charges (ERCs) throughout the whole term.

Affordability and £1bn fund

Martijn van der Heijden, chief financial officer at Habito, told Mortgage Solutions the lender had an initial allocation of £1bn for the product and would then assess the situation with its funders once this had been exhausted.

He added that it was adopting a “generous prime” approach to its eligibility assessments.

A loan to income (LTI) multiple of 4.5 times will apply as standard, but it will be extended to five times income for those with gross income over £50,000.

New build properties are eligible as are flats, but with a lower maximum LTV of 85 per cent for flats, and property values of £50,000 to £10m will be considered with a maximum loan amount of £1m.

“We’re keen to assess eligibility and affordability really well as its for life,” van der Heijden added.

The product is only available through Habito’s in-house advisers from launch, but van der Heijden noted that there was the possibility for rolling it out to other brokers depending on how it progressed.

More prominent subject

The mortgage is available from 15 March for first-time buyers, home-movers and remortgagors in England and Wales but only through Habito.

“Monthly repayments will stay the same throughout the lifetime of the mortgage guaranteeing peace of mind and full control over monthly budgeting forever, removing the need for the continual and often costly cycle of remortgaging every two to five years,” Habito said.

The subject of longer-term fixed rate mortgages has become more prominent over the last 18 months.

Prime minister Boris Johnson pledged a government-backed long-term fixed rate scheme in the build-up to the last election in 2019 and repeated that promise in the Conservative party conference last year.

However so far only the temporary 95 per cent LTV mortgage guarantee scheme has been announced at last week’s Budget.

Start-up lender Perenna has also been signalling its intent to enter the market with a range of mortgages fixed for up to 30 years.

‘Homeowners want flexibility and certainty’

Daniel Hegarty, founder and CEO of Habito, (pictured) said the mortgages available to borrowers today were remnants of a different age and a different power dynamic between customers and lenders.

“The vast majority of us on a mortgage that’s fixed for two to five years are effectively trapped in a system that doesn’t fit our financial future or our home-buying habits,” he said.

“Worse still it demands that we continually switch to a new product before we get stung by a higher rate.”

He argued this cycle was costly, time consuming and repetitive, costing roughly £1,000 each time over the length of the mortgage.

“Our extensive research into long-term fixed rate mortgages tells us that homeowners value flexibility and certainty above all else,” Hegarty continued.

“The current system is designed to offer neither. Our Habito One mortgage will allow people to plan their lives, make their next move, pay off their mortgage – all without punitive charges.”

Kevin Roberts, director of Legal & General Mortgage Club welcomed the innovation from Habito for providing wider choice, but queried how popular it would be.

“Borrowers have so far taken little interest in existing long-term fixed rate mortgages and it remains to be seen just how popular Habito’s new product will really be,” he said.

“Further information on Habito’s loan-to-income limits for these mortgages for example will also help to determine exactly which borrowers could benefit from these solutions.”

And he noted that for many borrowers, a two or five-year fixed rate mortgage may still prove to be more financially appealing in the short term.