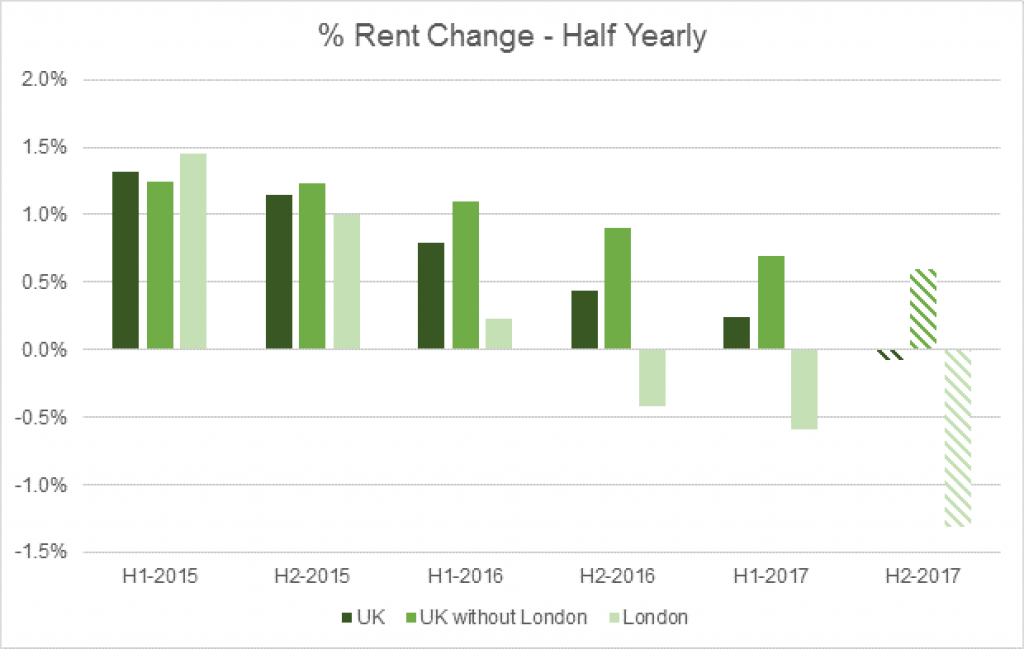

It said the average rent of a new rental property in the UK grew by 0.24% in the first six months of 2017, a third of the 0.79% growth seen during the same period in 2016.

The slowdown, which began in April 2015, suggests that the supply of rental accommodation is still high, and that landlords have yet to leave the market in large numbers, despite the more punitive tax regime.

London has led the rest of the UK in falling rents, with rents negative for the past year. It remains the only region in Britain to have seen rents actually fall, by -0.59% in H1 2017, and -1.01% over the full 12 month period.

This compares to growth of 0.69% across the rest of the UK in H1 2017, and 1.59% over the past year.

Nine London boroughs are still seeing rents rise, with Havering (0.73%), Waltham Forest (0.61%), Bexley (0.58%), Barking and Dagenham (0.41%), and Enfield (0.20%) experiencing the greatest uplift over the first half of 2017.

Outside of the capital, rents have yet to begin falling, but Landbay said there has been a “notable deceleration” in growth.

John Goodall (pictured), CEO and founder of Landbay, said: “While there remains a huge degree of regional variation, the overall trend has been a slowing of rents across the UK, most markedly in London, where we’ve now seen a full year of falling prices.

“Wherever they’re based, landlords have had to face a catalogue of challenges over the past two years, from stricter regulation, a reduction in tax reliefs, and a significant Stamp Duty Tax spike when buying a buy-to-let property. Yet despite these disincentives, they has been little sign of them leaving the market, and even less of them passing on these costs to tenants in the form of higher rents.”

Excluding London, England saw rents increase by 0.70% in the first half of 2017, compared to 1.14% in H1 2016.

In Wales, growth slowed to 0.59% compared to 0.83% the year before, while in Scotland rental growth has remained fairly steady, slowing by only 0.04%, from 0.69% in H1 2016 to 0.65% in H1 2017.

Only Northern Ireland has seen rents on new tenancies start to decline, falling to -0.23% in H1 2017 from 0.70% in the first six months of 2016.

Tenants in the East of England experienced the greatest growth in rents in H1, with an average increase of 1.10%, or £120 over the year. At a country level, Edinburgh City (2.19%), Peterborough (1.89%) and East Lothian (1.86%) saw the fastest rent increases.

Should the overall trend continue into the second half of 2017, UK rents would begin to fall, decreasing to -0.08% over H2.

Goodall said, however, that this is unlikely to happen. “Demand for rental properties can be expected to increase as we come out of the seasonal summer slowdown, and October’s PRA changes give landlords yet another incentive to push through transactions before the new regulations kick in.”

He added: “The changes will require any landlord with more than four properties to be assessed against their full portfolio when applying for finance. There’s no avoiding the extra workload this will cause in the short term, and lenders and brokers alike should be preparing for both a rush to beat the deadline and also the extra valuations work that will need to be done on the other side. Rents may be decelerating, but brokers will need to keep their foot on the gas throughout H2 and beyond.”