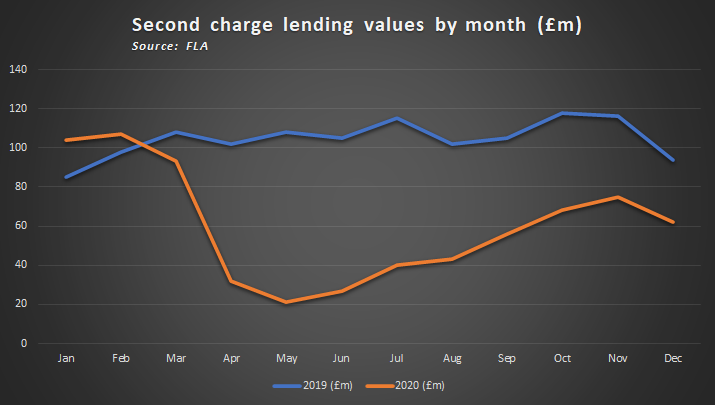

The figures were down from £1.25bn in finance with 28,016 transactions during 2019, the trade body noted, as the market continues to recover slowly from the pandemic. (See graph below)

December, a traditionally quieter month for the market, saw £62m in lending from 1,526 cases – both down 34 per cent and 26 per cent respectively on the same month in 2019.

FLA head of consumer and mortgage finance Fiona Hoyle (pictured) remained upbeat, highlighting the continued improvement in the market throughout the year.

“The second charge mortgage market has seen new business levels gradually pick up since the crisis-low reported in May 2020,” she said.

“The quarterly rate of contraction has eased – compared with the same period in 2019, new business volumes fell by 73 per cent in Q2 2020, by 52 per cent in Q3 2020, and by 30 per cent in Q4 2020.

“With consumer confidence expected to improve as 2021 progresses, demand in this market is expected to increase.”

Meanwhile, figures from Loans Warehouse suggest second charge lending totalled £60.8m in January 2021, down from December’s £66.8m.

The brokerage takes its data from lenders Optimum Credit, Oplo, United Trust Bank, Together Money, Masthaven, Norton Home Loans, Equifinance, Evolution Money, and Clearly Loans, along with its own insight, resulting in slightly different figures to the FLA.

Loans Warehouse noted that despite the dip in month-on-month lending it had seen an increase in loans written above 85 per cent loan to value (LTV).

These rose from 5.63 per cent of cases in December to 9.48 per cent in January, with the firm noting there were a range of second charge products available above 90 per cent LTV where most first charge lenders have heavily restricted lending.

“The reintroduction of Equfinance’s plus range of second charges in January would have contributed to this increase, a product that offers loans up to 95 per cent LTV for borrowers with a good credit profile,” Loans Warehouse managing director Matt Tristram said.

“Second Charge lenders have continued to enhance criteria and lending options throughout January, with probably the biggest change coming from Oplo, who have increased their maximum loan to £100,000 and dropped their headline rate to five per cent.”

And notably the proportion of loans being completed for debt consolidation fell from 74 per cent to just 52 per cent month-on-month.