Shawbrook research has found that the consequences of a shifting tax regime and the Prudential Regulation Authority-led (PRA) changes to affordability have perhaps not been fully understood.

But when the financial impact crystallises we may well see the property investor community take action.

Rent increases are one potential response, and we are also likely to see landlords looking more closely at limited company structures.

What we have already begun to see is a slowdown in momentum – particularly on purchases – as investors consider their next steps carefully against the backdrop of recent and continuing political uncertainty.

What is perhaps safe to assume is that the political landscape will cause investors across the UK to continue to wait and see, as opposed to looking at any significant growth plans for 2018.

Split response

It is important to mention that the response may vary according to the two newly categorised investor types.

Last year we saw the PRA draw a distinction between portfolio and non-portfolio landlords and these groups are likely to differ in terms of their strategy moving forward.

Non-portfolio landlords may well be deterred (depending on their overall level of debt) from expansion in this space, and may look to sell in the first instance if not exit altogether.

Larger portfolio landlords will certainly look at their existing investment strategy, but could well seek to take advantage of opportunity to buy given the decreased competition and a slowdown in property values.

Uncertain impact

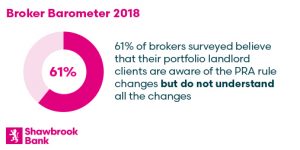

When looking at the research, Shawbrook data supports the finding that although there is awareness of the changes themselves, it is the impact around which there may be some uncertainty. This comes from our Broker Barometer survey conducted by with our network of professional broker partners.

It highlighted the need for lenders and industry bodies to step-up and support the market with educational material to help clarify what the future looks like in this new environment.

We would encourage investors to be wary of chasing yield to compensate for any decrease in activity or financial performance across their portfolios.

Some of our most successful customers focus on a particular area of the market, developing experience in one niche prior to looking at other asset classes or regions.

They maintain a sustainable approach backed with specialist advice rather than jumping up the risk curve in response to external factors outside of their control.

It is important to note that in spite of the impact of any regulatory or government-led change, arguably the biggest challenge remains the fundamental lack of UK housing stock that continues to drive the need for a robust private rented sector.