Despite the impact on business investment from Brexit, economic growth has remained stronger than expected.

The BoE said that should Brexit pass smoothly, it would need to raise interest rates in the future.

Markets currently expect these rate increases to be gradual and to be limited to 0.25 per cent over the next three years.

However, the BoE also warned that failure to reach a Brexit deal could result in other potential emergency measures.

Improving global growth

Externally, the slowdown in global activity has continued and was highlighted by the MPC as a key point of concern.

Global financial conditions have, however, improved slightly since the last MPC meeting.

In Europe for instance, GDP growth recovered slightly to 0.3 per cent in Q1 2019 after weak figures in Q4 2018.

UK volatility

In the UK, recent economic data has been mixed and GDP has been more volatile than in Europe, with UK GDP falling by 0.4 per cent in December 2018 but rising by 0.5 per cent in January.

The MPC also noted that inflation expectations remain on track with CPI inflation up to 1.9 per cent in February, close to the 2 per cent target.

This is mainly explained by an increase in the cost of food offsetting a decline in clothing prices.

The labour market also tightened as wage growth remained stable at 3.4 per cent and unemployment decreased to 3.9 per cent in January.

According to the Office for National Statistics, house prices across the UK increased by 1.7 per cent over the 12 months to January but decreased by 1.6 per cent for London over the same period.

Brexit uncertainty remains

Meanwhile, the recent news of parliament’s intention to avoid a no-deal Brexit has pushed Sterling to highs of $1.33 USD, but the currency remains highly volatile as a disorderly no-deal Brexit is still a possible scenario.

Once again the BoE stressed that the performance of the UK economy would be highly dependent on how Brexit unfolds and Brexit concerns continue to weigh on confidence and short-term economic activity.

For instance, business investments have now fallen continuously for the past four quarters as most UK companies have implemented contingency plans for a disorderly departure from the EU.

The BoE’s dovish outlook looks likely to continue, however, after the EU agreed to an extension of Article 50 which should prolong uncertainty and postpone the risk of a no-deal Brexit to mid-April.

BoE decisions will depend on the nature and timing of the EU withdrawal, on any new trading arrangements between the EU and the UK, on whether the transition is abrupt or smooth and on how households, businesses and financial markets respond to the changes.

With the situation changing daily, future MPC rate decisions could be in either direction.

Market expectations

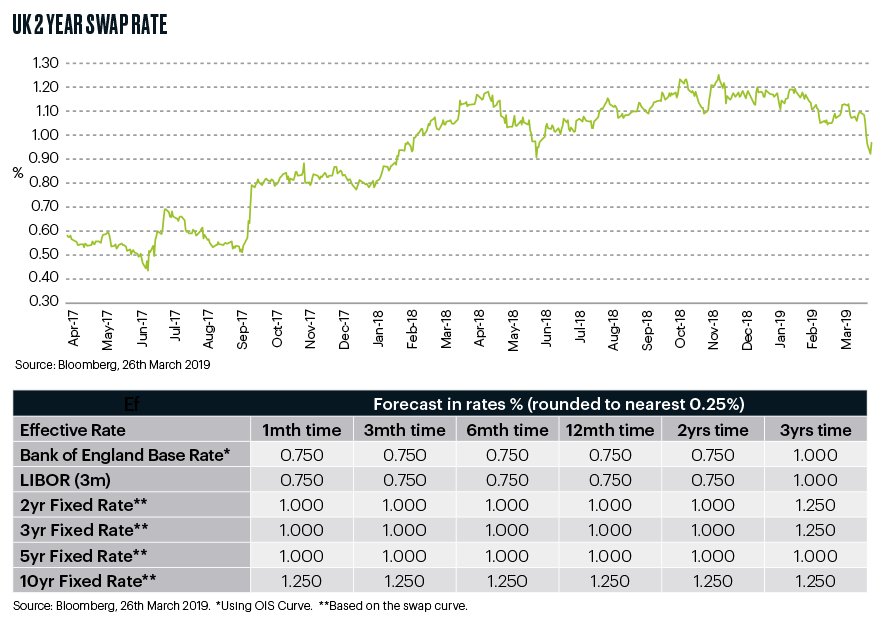

In light of these considerations, the markets forecast the BoE base rate to hold at 0.75 per cent for the next two years, before rising to 1 per cent in three years’ time.

Similarly, the three-month London Inter-bank Offered Rate (LIBOR) is now expected to remain steady at 0.75 per cent, before rising to 1 per cent in three years.

As the deadlock in parliament continues, the swap markets have already started to price in anticipation of a potentially disorderly Brexit.

The current market prediction is that the two-year rates will stay close to 1 per cent, before rising to 1.25 per cent in three years.

Meanwhile, five-year swap rates are expected to remain around 1 per cent for the next three years. The 10-year swap rates are also expected to stay at 1.25 per cent for the next three years.