While the total quantitative easing (QE) target remained at £745bn, the pace of bond purchases slowed to £4.4bn per week.

And surprisingly, the Bank of England (BoE) has indicated the economy will recover quicker than initially feared.

The MPC stated that this year’s GDP is now expected to fall by 9.5 per cent, compared to 14 per cent forecast in May.

A strong demand in consumer spending supported by several government schemes is expected to drive a recovery in the next few months.

For reference, GDP fell by a record 20.4 per cent in the three months to June.

This is the second successive quarter of decline, confirming that the UK is in recession, however, the June monthly figures did show a growth of 8.7 per cent, indicating the economy was recovering quicker than expected as lockdown eased.

Positive economic data

The MPC expects a significant rise in unemployment to 7.5 per cent by the end of the year, which was lower than the nine per cent peak expected in May.

On the positive side, according to the latest Office for National Statistics (ONS) numbers, the unemployment rate remained at 3.9 per cent in May.

However, as the chancellor’s furlough scheme is unwinding, we would expect the rate of unemployment to rise.

Recent ONS data indicates that inflation increased from 0.7 per cent in May to 0.8 per cent in June, highlighting an incremental improvement in the economy.

The BoE forecast inflation to fall towards zero at the end of this year, but recover to the two per cent target within the next three-years.

The MPC noted that lower energy prices and the government’s announcement to cut VAT will drag inflation over the second half of the year.

Negative rate outlook

With the fear of a second Covid-19 wave and the risks of a no-deal Brexit, the market is seeking guidance on whether the BoE will consider cutting interest rates below zero.

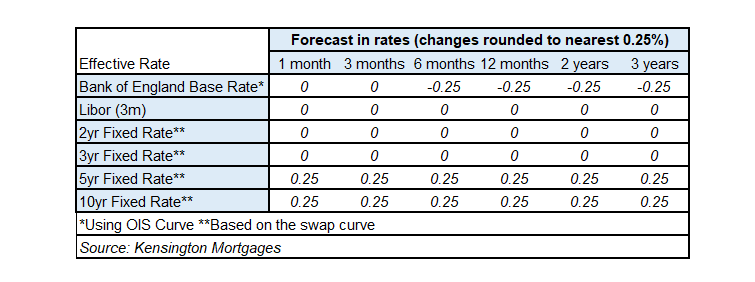

The market expects that the BoE base rate will fall to negative 25 basis points (bps) in the next six months and remain at that level until 2023.

However, the BoE has noted that at this stage, negative interest rates would not work to stimulate the economy but indicated it would continue to review its negative rate policy.

This suggests the potential usage of QE, or other related methods, later this year.

Forecasts for the three-month London Interbank Offered Rate (LIBOR), two-year and three-year swap rates remain at zero for the next three years, and five-year and 10-year rates to remain at 25bps for the next three years.

Overall, the markets expect short-term and long-term rates to remain within the same range until 2023, thereby implying that mortgage rates will likely remain stable or potentially decrease until such time.