The BoE also held the total quantitative easing (QE) target at £895bn, with the pace of asset purchases remaining unchanged at £4.4bn a week.

Overall, the MPC’s “wait and see” approach continues, with the view that its next steps largely depend on the recovery of the UK economy.

To this end, we can expect further policy action if the markets worsen or inflation decreases below the two per cent target.

The MPC noted the positive attribution of the vaccine rollout and noted that the easing of Covid restrictions would increase the UK economy’s supply and demand over the coming months.

UK GDP fell by 2.9 per cent in January 2021, although this reduction was lower than expected and generally due to developments in public sector output.

However, GDP remains approximately 10 per cent lower when compared to Q4 2019, but had risen by one per cent in Q4 2020, which was slightly stronger than expected in the February report.

The 12-month Consumer Price Index (CPI) inflation measure rose from 0.6 per cent in December to 0.7 per cent in January, with a slight uptick attributed to recreation and culture.

The MPC suggested CPI inflation is expected to be above the BoE’s two per cent target by spring, as the effects of previous falls in oil prices will drop out of the annual comparative figures, reflecting recent increases in energy prices.

The February report does not account for Budget policy updates such as extending furlough, resulting in higher unemployment projections and latest Office for National Statistics figures indicate unemployment was at 5.0 per cent in the three months to January 2021.

No negative interest rates

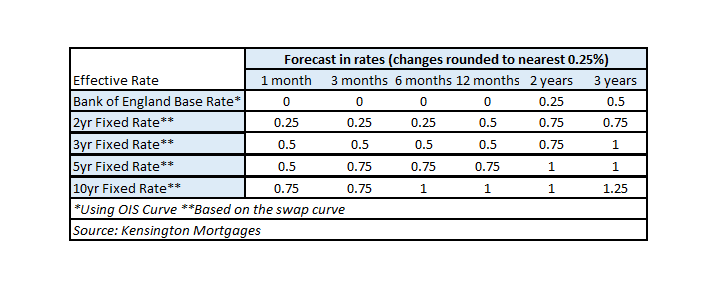

The market is no longer expecting the BoE to cut interest rates below zero and expects the BoE base rate will increase to 25 basis points (bps) in two years and then to 50bps in three years.

Generally, interest rates have been on an upward trend across the curve, with two-year and five-year rates increasing by 14bps and 36bps respectively since the end of January 2021.

Forecasts for two-year swap rates will increase to 50bps in a years’ time and then 75bps in two years, with three-year rates predicted to reach 0.75 per cent in two years and then one per cent in three years.

Five-year rates are expected to hit one per cent in two years, with 10-year rates reaching one per cent in six months’ time and then 1.25 per cent in three years’ time.

At this stage, market participants believe the likelihood of further stimulus from the BoE is diminishing.

The MPC’s view is unchanged since the last meeting, in that the next steps will depend on the recovery of the UK economy.

There was an expectation previously that a negative rate would be imminent. However, the MPC has steered clear and is awaiting the UK’s recovery before proceeding with its next steps.

As such, looking ahead, the likelihood of a rate cut in 2021 is thought to be materially lower and markets expect the policy to remain unchanged for the current year and next year.

UK Securitisation Market

Primary markets were very active and healthy in February and March, with a flurry of new issuances from various mortgage lenders, including Together Money, Belmont Green, Paratus, Fleet Mortgages, Landbay and Yorkshire Building Society.

Together brought the first deal backed by commercial loans in 14 years and YBS the first UK prime deal since last summer.

We also saw an active pipeline of legacy trades with the £4bn portfolio sold by UKAR to the PIMCO/DK Partners/Citi consortium being refinanced, with seniors pricing at the very healthy print of S+80bps.

And both Trinity Square transactions were refinanced into a single £1.1bn deal with seniors at S+85bps.

Since the beginning of February, more than £7bn of UK residential mortgage backed securitisation (RMBS) paper has been placed on the market, evidencing a functioning market’s return.