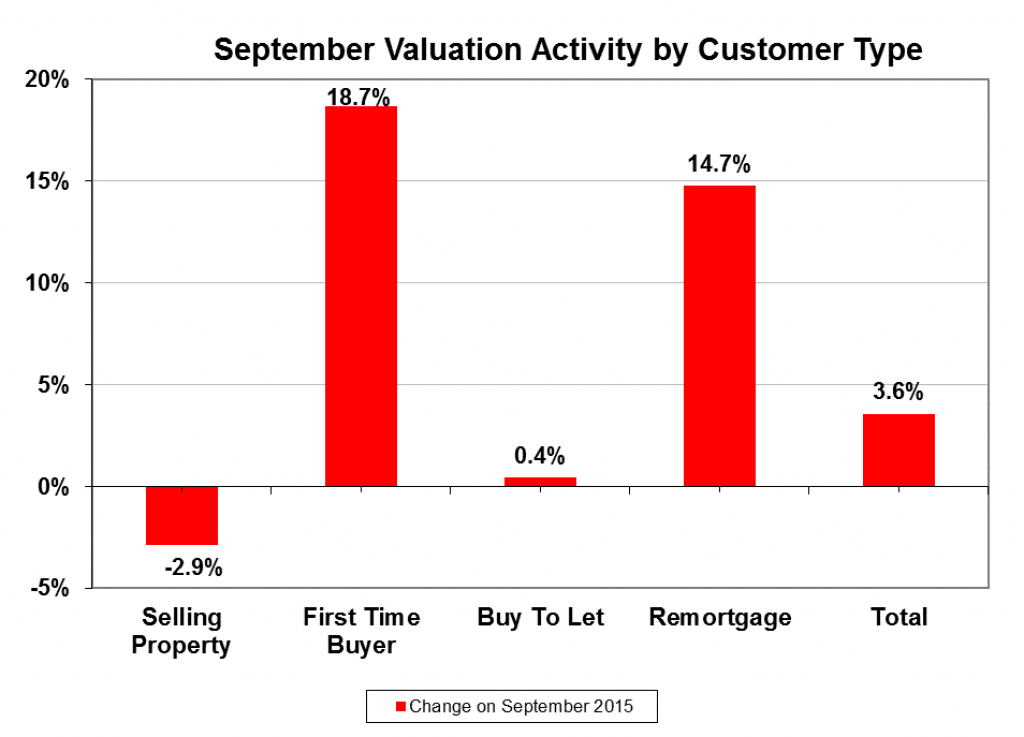

September saw the number of valuations for first-time buyers up by 19%, based on research from Connells Survey and Valuation.

Remortgaing valuation activity rose 15% year-on-year and despite significant changes in buy to let, valuations for the market were up 0.4% compared to last year.

The number of all property valuations was up 4% compared to the same time last year.

John Bagshaw, corporate services director of Connells Survey and Valuation, said he had expected the market to experience a flurry of activity in response to the Chancellor’s announcement of the Help to Buy: Mortgage Guarantee Scheme closing at the end of the year.

He added he was optimistic that first-time buyer activity would not plummet once the scheme ended as buyers now had alternative options.

“There are now more than 30 lenders offering 90 to 95% loans outside Help to Buy so the scheme is not as important to the market as it was.

“Other Help to Buy schemes will continue until 2020, including the five-year, interest free equity loans for new build homes and the Help-to-Buy ISA,” said Bagshaw.