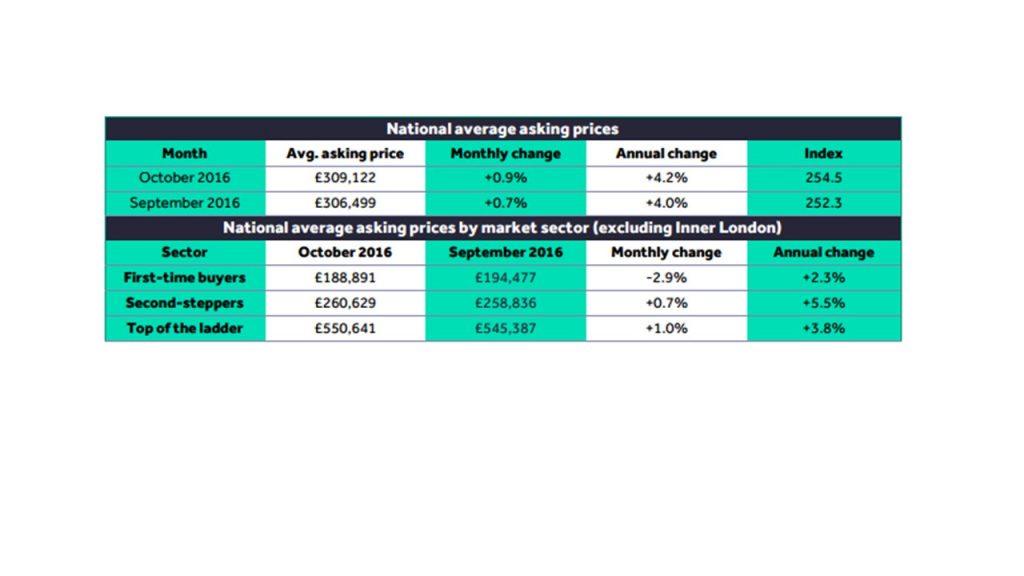

The Rightmove House Price index reported a 0.9% increase in prices last month However, this was 0.4% shy of the record set in June in year.

The six northern regions of the country, including North West, North East and Yorkshire, saw an 11% fall in the total number of houses available for sale.

Whereas the south of the country, including greater London, the South East and the South West, experienced a 16% rise in available stock for sale, despite the number of agreed sales down across all four regions by 10%.

Despite the dip, September saw the total number of sales agreed recover nationally after the summer lull and sales were only down by 4% compared to the same time period in 2015, but the number was up 6% on 2014.

Miles Shipside, Rightmove director and housing market analyst, said: “Agents in the northern half of the country reported a quiet week or two after the surprise result of the Brexit vote, but most then saw a quick return to good levels of buyer enquiries and subsequent sales agreed.

“In contrast many in the southern regions saw more prolonged hesitancy among buyers, with it taking until September before a marked pick-up in activity.”

Shipside was optimistic of the numbers and said it indicted a continued upward trajectory in the price of property in the market but said there was still work to be done to maintain the momentum for the coming months.

“While many properties are still selling, in market sectors where there is now a lot more choice, buyers need enticing by an attractive price or by properties with special finish or appeal. If sellers fail to take this into account, then buyers will choose to buy elsewhere or bide their time,” said Shipside.