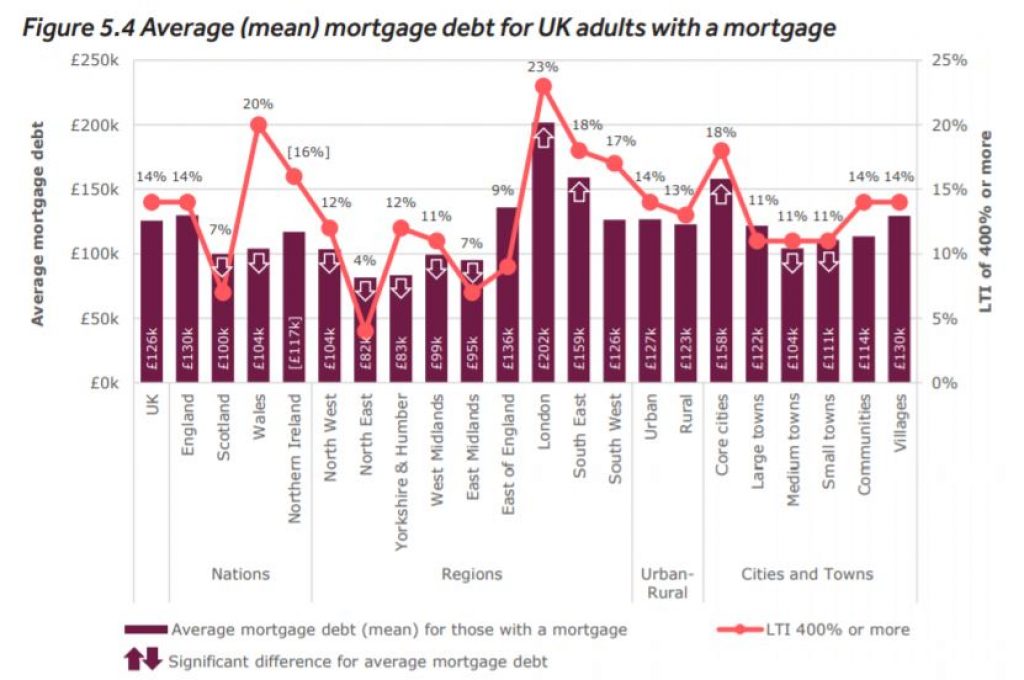

Homeowners in the capital owe a typical £202,000 to lenders, the highest out of any region in the UK, and significantly more than the national average of £126,000, the research showed.

At the same time, 23% of Londoners with a mortgage have a loan to income ratio at least four times their household income, compared to the UK average of 14%.

Mortgage debt reflects differences in house prices and incomes, the FCA report said.

Second-highest mortgage debts are in the South East, where borrowers owe a typical £159,000.

Borrowers in the North East and Yorkshire and the Humber owe the least at £82,000 and £83,000 respectively.

Mortgage homeowners in Wales are also more likely than the rest of the UK to have a loan that’s at least four times their income, with one in five falling into this category.

In the North East only 4% of adults have a loan to income at this level.

Sarah Coles, personal finance analyst, Hargreaves Lansdown, said: “The streets of London may be paved with gold, but the houses are built from solid debt.

“The highest average household earnings in the country at £63,000 don’t make up for the cost of housing and higher prices, so Londoners are working to pay their debts – and have little time to build up savings, investments or pensions.”

Regional differences in ownership

Across the UK, three in 10 adults were found to own the property they live in outright, a third of adults have bought their property with the help of a mortgage or loan, and three in 10 adults are renting.

In London more than two in five rent and only one in five own their property outright.

In the UK’s rural areas, people were more likely to own their home outright, with two in five falling into this category.

The survey also showed that only one in seven UK adults reported feeling highly knowledgeable about financial matters, yet almost two in five said they knew enough to be able to choose suitable mortgages.

People in the North East were found to have the lowest confidence in financial knowledge with only three in 10 believing they know enough to choose a suitable mortgage.