The sector, as measured by the trade body, also celebrated its first £1bn quarter in the final three months of 2017.

Benson Hersch (pictured) from the ASTL gives a couple of examples of some of the key ways bridging can boost the property market.

Picking up from national builders

Bridging finance is an invaluable facilitator for ensuring that opportunities which otherwise would fall by the wayside can be grasped resulting in positive outcomes for customer and lender.

In one instance, it enabled a local developer to take advantage of a national builder’s unwanted property by converting a derelict hospital into residential units.

An old hospital in Greater Manchester was built in 1880 for the then princely sum of £4,600. It was closed in 1995 and over the next 20 or so years became progressively more derelict.

A national housebuilder acquired the site; principally for the surrounding land on which they built 60 new homes.

Planning consent for 12 flats in the old building was obtained but, as is usually the case with new house builders, the conversion of such an old building was of no interest to them.

A local developer saw potential in the site and, as the building is not listed, got buy-in from the local council on a plan to extend to a third storey.

However, he needed to buy it ahead of a viable consent and utilised a bridging loan to do this. The loan from Goldentree Financial Services enabled the purchase to go ahead, and when consent was provided, the build went ahead.

Securing a business on personal residence

Bridging can also be used to help business customers purchase their premises – as illustrated in one example.

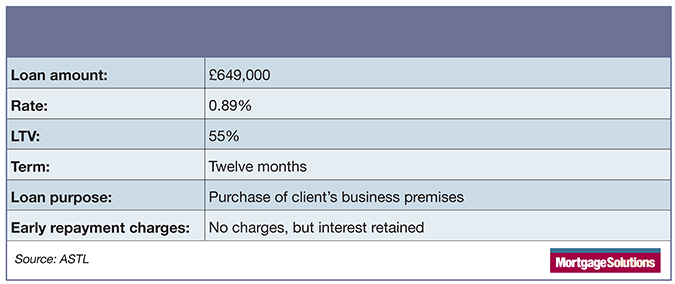

The clients were looking for £649,000 to purchase their business premises and had been given a good deal by their vendor, but needed to act very quickly.

With only three weeks to complete the purchase, their mortgage provider was unable to complete within the tight timescale.

But by taking out a bridging loan, the clients had the funds to complete the purchase of the premises, where they had operated their business from for over 25 years.

The 12-month term gave them plenty of time to arrange a commercial buy-to-let mortgage with their bank.

In just two weeks, MTF provided a £649,000 bridging loan, secured by way of second charge, at 55% loan-to-value, over the clients’ residential property.

Interest was retained at 0.89% over 12 months, with no exit fees or early repayment charges.

And no personal guarantees were required.