Second Charge Lending

Exclusive: Lenders urged to support brokers with technology evolution – UTB research

A poll of British Specialist Lending Senate 2019 delegates has revealed that lenders must do more to support broker and distributor firms in embedding and utilising new technologies.

However, despite plans to invest hundreds of thousands of pounds, many believe this will not be enough to achieve their technological goals.

The survey conducted by United Trust Bank (UTB) found that key mortgage industry figures want to learn more about fintech opportunities and threats.

Four out of five respondents believed lenders were not doing enough to help them use technology to improve their customers’ journeys.

The lender quizzed 37 of the mortgage industry’s leading figures prior to attending the event. The overwhelming sentiment was that greater knowledge on all parts of fintech within the mortgage industry was required, as 95 per cent of respondents felt they should know more about the technology available.

Are you up to date with the latest vulnerability requirements?

Sponsored by Halifax Intermediaries

More than a third indicated that Open Banking would be at the top of the list of fintech advancements they would like to know more about. A similar number suggested artificial intelligence (AI) and automated advice was key for them.

Spending over £500,000

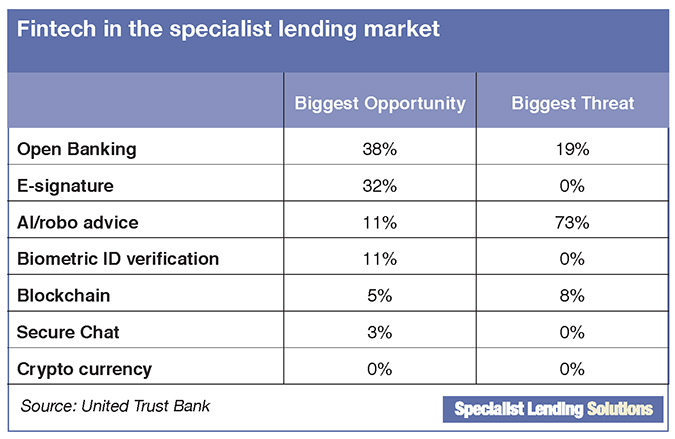

When asked which fintech developments were most likely to benefit or harm their businesses in the next five years, AI and automated advice was seen as the biggest risk by 73 per cent of respondents. (See table below.)

Meanwhile, Open Banking and electronic signatures were seen as the initiatives likely to have the greatest benefits, by 38 per cent and 32 per cent respectively.

Most business were looking to invest more in technology, with 41 per cent of delegates indicating that their businesses would be likely to spend up to £50,000 on new IT development and process changes in the next 12 months.

One in five believed that their spend would be over £500,000.

However, despite the sums involved, over a third felt that their budget would be insufficient to achieve everything they would like to.

Potential to streamline

United Trust Bank commercial director of mortgages Buster Tolfree (pictured), who presented the findings at the Senate, noted the results prompted an interesting discussion during the lender’s presentation.

He highlighted that while some key people in the mortgage industry were excited about the ways in which fintech could transform their businesses over the medium term, others were worried.

“Easily the biggest area of concern surrounded AI and what’s become known as robo-advice,” Tolfree said.

“It’s clear that this technology has the potential to streamline steps in the process, especially when gathering information during fact finds.

“However, it is also clear that we are some way from an entirely digital journey, and that this will likely never happen for many specialist lending solutions where a person will always be needed to understand the nuances.”

Tolfree was also encouraged by the “overwhelming willingness” to find out more, and to work collaboratively with peers to understand and build future developments.

“We at UTB would certainly look to engage in, support and facilitate that learning process as we explore how fintech can best benefit our partners and customers,” he added.