As I enter the offices just off Holloway Road, I can immediately tell this space doesn’t belong to your average mortgage broker.

A woman on reception asks me to sign in using an iPad which proceeds to snap a photo of me for identification, but feeling sheepish, I’m not sure they got my best side.

These are the offices inhabited by Trussle, a start-up digital mortgage broker, and it shares this space with numerous other budding entrepreneurs. Twenty and thirty-something year olds fill the communal area, propped up on bar stools or lounging on sofas while typing away on their Macbooks.

I am greeted by CEO of the firm, Ishaan Malhi (pictured, top) and after taking a seat on a large sofa in the centre of the room, I start off by asking Malhi what he thinks about the current state of the mortgage advice market.

“The market is crying out for a proactive approach rather than a reactive one, which is how it seems to have been for some time now,” he says.

“When I first told my family and friends about what I was looking to achieve with Trussle, the most common response was ‘surely that already exists?’”

Malhi came up with the idea for a digital mortgage broker after he received what he calls “terrible advice” from a mortgage adviser (who he won’t name) when buying his home. It was this same adviser that Malhi revisited when he had the idea for Trussle, to find out how the entire advice journey worked, allowing him to determine what could and could not be automated.

Launched solely by Malhi at the end of 2015, Trussle now has 20 employees on board and and is managing £1bn worth of mortgages including those on its mortgage monitoring service, but would not be drawn on completion figures to date. However, just last month the start-up secured £4.5m of backing from a group of fintech investors.

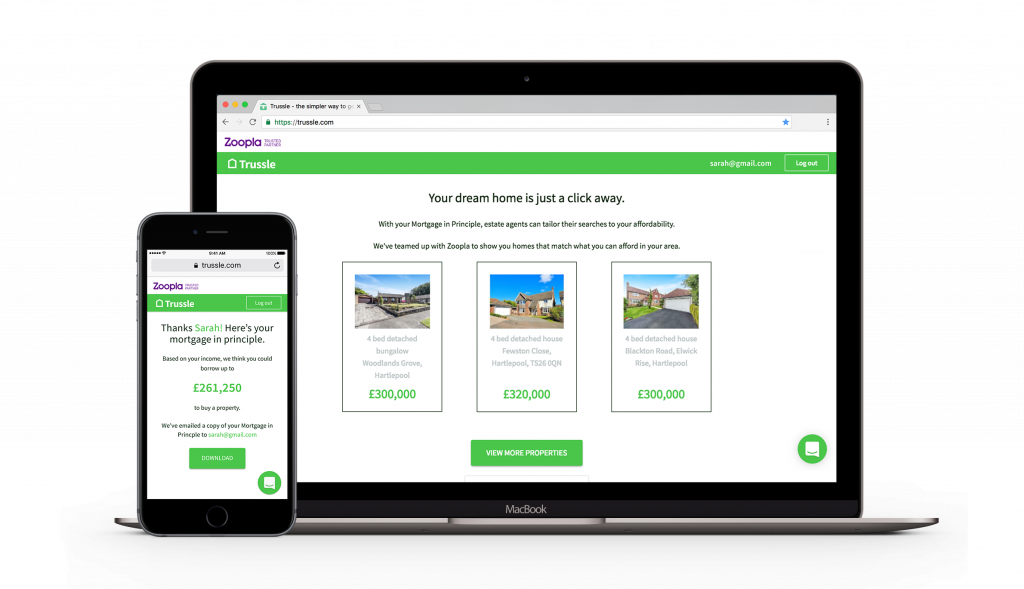

Through its most recent partnership with online property portal Zoopla, Trussle aims to give house hunters a ‘mortgage in principle’ within five minutes. Malhi explains the reasoning behind the partnership: “98% of people start their property search online, so we thought, why not support that by helping them find out whether they can afford that property at the same time?”

Algorithms over muscle memory

Trussle’s model is built using an algorithm which learns and adapts to information fed in by the firm’s mortgage brokers, helping it to become more intelligent over time, hence improving the efficiency and speed of processing a mortgage application. By using technology instead of what Malhi calls ‘muscle memory’, it’s impossible for clients to receive a product recommendation that is influenced by the human adviser’s preference.

“Technology allows you to be a lot more exhaustive, consistent and unbiased,” Malhi explains.

However, he adds: “We view technology as a means to improve things rather than an explicit replacement for advice, although it definitely could be a replacement in the future.”

Indeed, in a recent white paper published by the Intermediary Mortgage Lenders Association (IMLA) on lender and broker relationships, one lender responded that financial regulators were likely to approve of algorithms adopted by online advisers, as these could deliver more consistent advice than the human touch.

But while there are many supporters of these digital models also adopted by the likes of Habito and Dwell, they have come under a degree of scepticism among the more traditional advisers in the industry, who argue that face-to-face advice will always come up top trumps over new technology.

Malhi believes the financial services sector has no choice but to shake up the way it operates, as customer expectations have shifted significantly since the financial crisis and technology infiltrates every part of daily life.

“Nowadays, people are a lot less brand sensitive but more service sensitive,” he says. “For example, Atom Bank [a new mortgage lender only accessible through a smartphone app] has been built from the ground up, taking into account what is best for the customer.”

Malhi also believes that for many mortgage brokers who have been operating for decades and made it through the financial crisis, being told that new and different players are trying to crack their industry “is not a nice feeling”.

He adds: “But we think the way we have positioned ourselves through branding and presence means our customer journey is more personable than that offered by many brokers.”

Malhi is encouraging of other broker firms that are planning to or have already implemented technological changes to shake up the way they do business with clients.

“We would have no real traction if there wasn’t competition,” he admits.

The advice bit

I wanted to find out the experience of one of Trussle’s brokers first hand, someone a little less well-versed in the intricacies of the fintech sector.

I sat down with Trussle’s senior adviser, Ryan Tuff, who has worked both as a telephone adviser and face-to-face broker for the likes of Knight Frank and Connells, as well as on a self-employed basis.

I sat down with Trussle’s senior adviser, Ryan Tuff, who has worked both as a telephone adviser and face-to-face broker for the likes of Knight Frank and Connells, as well as on a self-employed basis.

In his previous jobs, Tuff felt that he was constantly booked up weeks in advance and would struggle to make time for extra appointments that suited the immediate needs of his clients.

Tuff was attracted to joining Trussle when he realised he would be able to help more customers in a way that was at the convenience of the client, rather than the adviser.

“I’m still an advocate of making the mortgage journey a personal experience – giving the client what they want is a nice feeling,” he says.

Tuff tells me that individual advisers are still mentioned and thanked in customer reviews despite the whole process being conducted online and over the phone.

“What would you say to those who are still sceptical of the Trussle model?” I ask Tuff.

“It’s impossible for advisers to work 24/7 and as a traditional broker there’s always going to be room for human error,” he says. “This way, you’re saving time and making it more convenient for both parties.”

User experience

Trussle then invites me to sit in on one of their regular product meetings, where Tuff discusses with the design and development team the changes that should be made to make customers’ experiences more enjoyable and efficient. Trussle gets regular customer feedback through the its LiveChat functionality and through consumer review website, Trustpilot.

Tuff tells the team where his clients would like an improved experience, which varies from wording used on the site, to introducing a call scheduling service to reduce the amount of organisational ping pong between an adviser and the client. I’m impressed by the speed at which they agree to and action decisions – the meeting is over within 20 minutes.

From a user experience perspective, it seems to have helped that most of Trussle’s team – advisers aside, of course – have no background in the mortgage industry. Trussle’s software developer, Jonny Arnold, tells me this has helped him to improve the customer experience from the perspective of a ‘naïve user’.

“I didn’t know what ERC [early repayment charge] meant when I first joined the company, but I felt stupid for asking,” he says. “A lot of the terms in the mortgage industry are complete gobbledygook to the outsider, so we took that experience and applied it to building a glossary for our users.”

“I didn’t know what ERC [early repayment charge] meant when I first joined the company, but I felt stupid for asking,” he says. “A lot of the terms in the mortgage industry are complete gobbledygook to the outsider, so we took that experience and applied it to building a glossary for our users.”

Lead designer, Fred Seale, agrees: “We wanted to make the system as simple to use as possible – so if you put a five-year old in front of it, they’ll be able to use it.”

In reality, all Trussle is doing is helping to make the initial advice that little bit more appealing, meaning they can start the journey to securing a mortgage during their lunch break or on the commute to work, for example.

Much like what Martin Lewis has done for consumer spending and saving, brands like Trussle are giving the mortgage advice market a more accessible and friendly face.

A recent remark made at an industry awards ceremony by Mark Holweger, managing director of Legal & General Insurance, seems fitting:”Innovation is now a given and it can be seen as an opportunity or a threat. There are a lot of people in the world and the likelihood is that if we’re thinking about something, someone else probably will too – the big difference is making it happen.”