The Monetary Policy Committee’s February vote – the first of 2018 – was as the markets expected, with every member of the panel seeking to maintain the current base rate.

However, the committee indicated that the next rise could happen soon, due to the sustained high rate of inflation in the UK.

With inflation standing at 3% in January, well above the 2% target, the Bank of England now believes that tightening monetary policy in the short term is the most appropriate measure, given that it is not falling as fast as previously hoped or thought.

Markets are now forecasting that the next 0.25% will take place by May, with another 0.25% increase before the end of 2018.

Swap rates rally

Following the message of a rate hike potentially happening sooner than expected, markets reacted positively, with sterling increasing to $1.40 against the US dollar immediately after the meeting.

The two-year swap rate rallied to more than 1% – its highest level in more than two years (see graph).

By contrast, this was around 76bps following the December rate call and at 90bps in November, shortly before the bank raised the base rate for the first time since 2007.

However, there was a word of warning once again from the central bank as it continued to highlight the economic issues surrounding the UK’s withdrawal from the European Union.

The Bank of England believes any decisions it makes on the base rate will have much less impact on the UK economy, households and businesses than the success of the Brexit negotiations between the UK and Europe.

It also revised its forecast for UK growth up slightly, from its previous prediction of 1.7% to 1.8% on the back of a stronger outlook for the global economy.

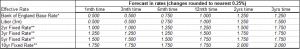

Following the guidance issued by the MPC at this meeting, the market now forecasts a 0.25% rise in the base rate within the next six months (see table).

Further rises will see the base rate reach the 1% mark in the next 12 months before rising again to 1.25% in the following year.

The three-month Sterling Libor is expected to trade close to 0.75% in the next six months before reaching 1% within the year.

The data suggests a revised upwards prediction for the two-year swap rate following this month’s developments.

Indeed, two-year swap rates are forecasted to remain at 1% for around six months, before rising to 1.25% in the summer while the five-year swap rate is expected to increase to 1.5% for the next six months and to trade around 1.75% thereafter.

The 10-year fixed swap rate is expected to be at the 1.75% mark for the next 12 months.

A clearer picture of how the market is looking for the year ahead is now starting to emerge, and over the next couple of months it will be interesting to see how banks and borrowers alike prepare for the next rise.