The consensus for leaving rates unchanged comes despite more pronounced optimism from the Bank on the UK economy’s prospects.

It raised Q3 forecasts of growth from 0.4% to 0.5%, following 0.4% in Q2 and 0.6% in the three months to July.

Stronger consumer spending and UK wages rising faster than expected support its optimism. Average wages in the three months to the end of July were 2.9% higher than for the same period last year – the fastest growth in three years, and unemployment continued to fall in the last quarter.

At 4%, it is at its lowest since February 1975.

Inflation issues

Moreover, the hold on interest rates came while inflation was still 2.5% in July – above the bank’s 2% target.

The MPC’s most recent economic projections, set out in the August Inflation Report, have it coming down to the target only in 2021.

Partly, the explanation for the MPC’s stance can be found in the two previous increases in rates in the last year – most recently in August.

At the same time, the 2.5% Consumer Prices Index (CPI) rate is actually 0.1 percentage points lower than projected, continuing a trend of CPI modestly undershooting forecasts since the start of 2018.

All about Brexit

Mostly, however, the bank’s reluctance to further raise interest rates is explained by Brexit.

As it put it: “The MPC continues to recognise that the economic outlook could be influenced significantly by the response of households, businesses and financial markets to developments related to the process of EU withdrawal.

“Since the committee’s previous meeting, there have been indications, most prominently in financial markets, of greater uncertainty about future developments in the withdrawal process.”

The bank’s aim therefore remains essentially unchanged from August – gradual and limited rate rises will hopefully return inflation to a stable 2% by the end of Q3 2021.

However, this is on the condition that there is a smooth exit from the European Union and an agreed trade deal.

Next rate hike in 2019

The markets are largely doing the same. Despite the uncertainty, they remain broadly optimistic.

Positive economic releases have lifted market sentiment, and the pound closed at its highest level for more than a month in mid-September at $1.31.

Market pricing still puts the next rate hike one-year ahead, although forecasts for base rates in two and three years’ time have risen since August, from 1.0% to 1.25%.

Again this is likely to be heavily dependent on Brexit.

Currently, markets put the probability of no deal at about 20% and a negotiated withdrawal agreement at about 60%.

Anything that substantially changes that estimation one way or another is likely to be reflected in future base rate forecasts.

Swap market shifts

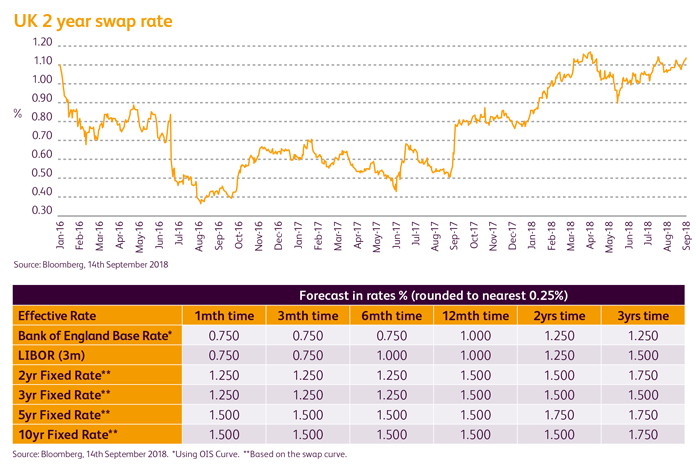

In the swap markets, current market predictions put the two-year rate at 1.25% for the next six months, rising to 1.5% around the one-year mark (both estimates up 0.25% percentage points on last month).

Five-year swap rate predictions have increased similarly, to 1.5% up to a year, and thereafter to 1.75%.

And 10-year fixed rate swap forecasts remain unchanged at 1.5% for the next two years, but are then expected to rise to 1.75% in three years’ time.