Signs of greater resilience suggest that private sector landlords are adjusting to the less generous income tax treatment and three per cent stamp duty hike announced by George Osborne back in 2015.

Phasing of the tax changes means that the full effect will only be felt from the 2020-21 tax year onwards, however, so the sector will continue to face headwinds for some time to come.

Landlords have adopted a range of coping strategies, including a geographic shift in their businesses to higher yielding areas away from London and the South East.

But, as the Intermediary Mortgage Lenders Association (IMLA) has repeatedly forewarned, this risks hollowing out the availability of private rental properties in high-demand areas and driving up rents.

Rising rents adding pressure

Although rental growth remains below earning growth, rents are now rising at their fastest pace for three years, according to Zoopla, with the annual rate of UK rental growth at two per cent, up from 1.3 per cent a year ago.

Office for National Statistics (ONS) figures for October show that rental growth was stronger than a year ago across much of the UK, including in six of the nine English regions.

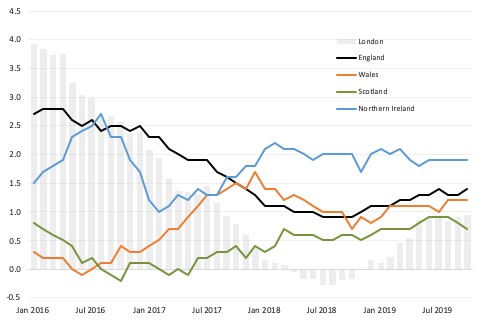

Chart 1: How rental prices have changed, percentage year-on-year

Source: ONS Index of Private Housing Rental Prices

The mood music for London has changed the most, with rent decreases a year ago now giving way to growth of nearly one per cent.

Although this does not sound worrying, the ONS covers existing as well as new tenancies, and so its figures understate the upward pressure on new rentals.

Criticism will continue

Even modestly higher rents will be unwelcome news for those hoping to buy and so this throws into sharper relief the challenges facing so-called rental prisoners – those capable of renting but deemed unable to afford to buy their first home because of regulatory stress tests.

This is a significant issue around the capital, where first-time buyer numbers have been restrained in recent years, even with the benefit of London Help to Buy.

Meanwhile, criticism of private landlords looks set to continue.

Expectations of the sector have mounted as it has grown to become the second largest tenure after home-ownership and now houses a wider spectrum of tenants, including more families, older households and people in receipt of Housing Benefit.

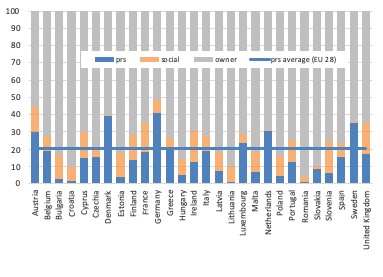

But critics would do well to bear in mind that our private rented sector is in fact smaller, and our social housing sector much larger, than the European Union average.

This matters because policy actions over the past few years have deliberately tilted the market in favour of first-time buyers and away from private landlords.

Chart 2: UK housing tenure pattern differs from much of Europe, in per cent

Source: Eurostat

The resulting near-stagnation of the private rented sector shrinks its ability to fulfil the wider social role that successive governments have devolved to it over the years.

From a wider overall housing market perspective, this policy direction only makes sense if the government is willing to pick up the tab for delivering more social housing, as economist Kate Barker and others advocate.

With fiscal liberality back in vogue, this may be a policy that is taken up by the new government after 12 December.

Let’s hope so.

If not, then fresh policy actions – however well-intentioned – that bear down further on private landlords risk undermining the recent stability that we have seen and prompting a worrying exodus and disinvestment.

And be in no doubt, fewer properties for market rent will mean poorer housing outcomes.