Award

The British Mortgage Awards 2026

The British Mortgage Awards recognise the extraordinary accomplishments of the Intermediary mortgage market’s most worthy individuals who raise the bar and challenge others to follow.

We recognise individual excellence, not companies.

It is the people who raise standards, drive change, innovate, collaborate, and facilitate positive change in the mortgage market.

Our Award winners are mortgage advisers, lender employees, business leaders and innovators, all who have demonstrated an improvement to their own businesses, but also the wider market.

Nominations for the British Mortgage Awards 2026 will open in March 2026.

For table sales or sponsorship opportunities please contact andrew.morris@ae3media.co.uk

Park Plaza Westminster Bridge London

BROKER

Broker: Rising Star – Distributor supported by Vida Homeloans

Emma Atkinson – L&C Mortgages

Winner’s Comments:

This was a very difficult category to judge, with a high level of candidates who were commended by all the judges. However, Emma won because of her authentic passion for delivering good customer outcomes through service excellence.

Broker: New Build supported by Leeds Building Society

Ben Walker – Mortgage Advice Bureau

Winner’s Comments:

Ben has an infectious passion for what he does, taking a sincere, customer-centric approach to his work and is always there for colleagues and clients, as well as being hugely knowledgeable. It’s clear this is more than just a role for him.

Broker: Large Loans supported by Coutts

Rahul Nath – L&C Mortgages

Winner’s Comments:

Rahul was a very strong candidate. He is an individual who operates across the spectrum of high-net-worth clients and influences policies with lenders, his business and the wider market.

Broker: Later Life Lending supported by Family Building Society

Louise Stevens – Coreco Lifetime

Winner’s Comments:

Louise takes a wider, collaborative approach and embodies true later life advising, looking at all solutions for her clients.

Broker: Buy to Let supported by Coventry for Intermediaries

Teddy Cenaj – Habito

Winner’s Comments:

Teddy provides an impressive technical depth of knowledge, with almost 500 buy-to-let submissions making him a well-rounded expert. He also works closely with lenders to effect change across the sector.

Broker: First-time Buyer supported by Skipton Building Society for Intermediaries

Carmen Green – Xpress Mortgages

Winner’s Comments:

Carmen is passionate, caring and identified the vulnerability of first-time buyers. She is an authentic champion of the first-time buyer and used her own experience and desire to get on the housing ladder to empathise with her clients.

Broker: Complex Credit supported by Nottingham Building Society

Ceri Evans – Remoo Mortgages

Winner’s Comments:

This category was extremely close between all three finalists; the judges said this was the highest calibre category they’ve ever judged. Ceri eventually edged it as a champion for customers with difficult circumstances, with her consummate knowledge of the industry and also her work lobbying at government level for the good of the customer.

Broker: Protection supported by HSBC Life

Rhys Walker – Habito

Winner’s Comments:

Rhys demonstrated a keen awareness of the impact of his advice on clients, making everything as clear and simple as possible, and cutting through the jargon. He impressed the judges with his passion for income protection, alongside the work he’s done within the business to grow this area.

Broker: General Insurance supported by Uinsure

Scott Malpas – Just Mortgages

Winner’s Comments:

Scott demonstrated impressive self-generation of leads, a customer-centric approach, and an authentic belief in general insurance, which is exactly what the sector wants to develop in advisers.

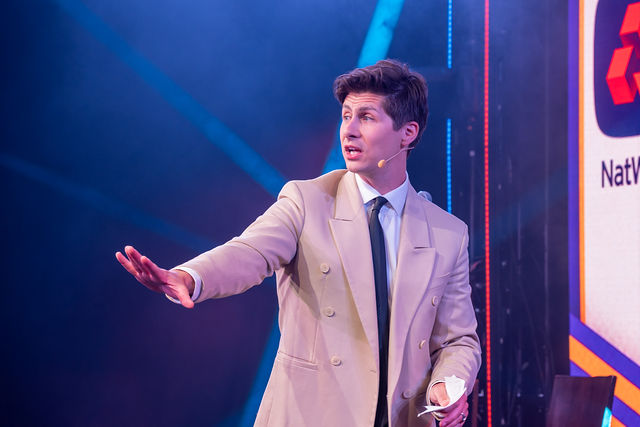

Broker: Overall supported by NatWest

Adam Thomas – Thomas Group Financial Services

Winner’s Comments:

Adam demonstrated a clear customer focus whilst embracing and delivering through technology to enhance the customer journey. He is committed to educating the public on the home-buying process.

Broker: Administrator supported by Pepper Money

Mark Donnigan – L&C Mortgages

Winner’s Comments:

Kind, inclusive, and deeply passionate about the industry, Mark pairs strong knowledge with a drive to succeed — always celebrating the success of others along the way.

LENDER

Lender: Rising Star – Product Provider supported by Sesame & PMS

Andrew Miller – Lloyds Banking Group

Winner’s Comments:

A tight category of exceptional stars, but Andrew took his knowledge and passion further to help more people. He is clearly thinking beyond just the lender and aiming to implement positive change across the whole market.

Lender: Operations/Credit Risk supported by Phoebus Software

Diane Harrison – Skipton Building Society for Intermediaries

Winner’s Comments:

Diane has made considerable progress in changing the outdated perception of the lender risk function and has applied her enthusiasm and focus to make real change.

Lender: Telephony Relationship Manager supported by Target Group

Joe Geldart – HSBC UK

Winner’s Comments:

Joe clearly demonstrated his ability to influence change at all levels and was able to effectively articulate the voice of the broker into his organisation to ensure the continual development of the proposition. His passion was evident, as one judge commented.

Lender: Business Development supported by Alexander Hall Associates

Sim Sahota – Barclays

Winner’s Comments:

Sim described his version of exceptional service as ‘supporting brokers in ways that they didn’t realise they needed support with’ and this set the benchmark. He is a focused individual who always gives a holistic view, with a clear mindset of doing the right thing for each broker partner.

Lender: Head of Sales or National Accounts supported by L&C Mortgages

Alan Longhorn – Bank of Ireland for Intermediaries

Winner’s Comments:

Alan is a passionate leader who wears his heart on his sleeve, driving operational efficiency while leading from the front. His clear focus on service and colleague development sets a powerful example.

BUSINESS LEADER

Business Leader: Development & Innovation Advocate supported by PEXA

Toni Roberts – Accord Mortgages

Winner’s Comments:

Toni is an innovative and determined professional who embraced the opportunity to deliver genuine impact. She is passionate about supporting underserved customers, breaking barriers and building a lasting legacy through true customer-centricity.

Business Leader: Specialist Distribution supported by OSB Group

Liz Syms – Connect for Intermediaries

Winner’s Comments:

Liz is a passionate and visionary leader whose deep industry expertise and innovative approach are driving real growth and transformational change. She is a standout leader when it comes to building impactful partnerships and shaping the future.

Business Leader: Surveyor supported by Mortgage Brain

Joe Miller – Home Surveying

Winner’s Comments:

Joe is leading an innovative and highly respected surveying practice and his people-centric approach has delivered impressive results and real innovation. His incredible enthusiasm is infectious, according to our judges.

Business Leader: Conveyancer supported by Loans Warehouse

Dev Malle – Simplify

Winner’s Comments:

The impressive business results over the last 12 months speak for themselves, but what made Dev stand out was his obvious commitment to improving the conveyancing process, his passion for doing the right thing, and his commitment to improve the wider market.

Business Leader: Protection or General Insurance Provider supported by Primis Mortgage Network

Julie Godley – L&G

Winner’s Comments:

Julie is a humble yet passionate champion of the industry, known for empowering others and delivering meaningful change through support and vision. She is a true force and makes a positive impact.

Business Leader: Broker (fewer than 10 advisers) supported by Barclays

Lea Karasavvas – Prolific Mortgage Finance

Winner’s Comments:

Lea is a passionate and resilient individual whose infectious positivity and humility shine through. Proudly supportive and quietly inspiring, he has faced adversity with strength and continues to lift those around him.

Business Leader: Broker (11 to 50 advisers) supported by NatWest

Jon Stones – Mortgage 1st

Winner’s Comments:

A really close category of exceptional leaders, but Jon stood out with a business performance that demonstrated growth and diversification, a culture that focuses on people before results, and an ambition and commitment to his firm and market that was really impressive.

Business Leader: Broker (over 51 advisers) supported by HSBC UK

Peter Brodnicki – Mortgage Advice Bureau

Winner’s Comments:

Peter is a leader who goes above and beyond when delivering a solution, by always thinking about what benefit that solution should really deliver for the customer. Changes he has made to the culture in the business show that he recognises the importance of people as the differentiator to success.

Business Leader: Mortgage Club supported by BM Solutions

Clare Beardmore – L&G Mortgage Club

Winner’s Comments:

Clare came across as truly authentic and deeply proud of her team. She takes her responsibility as a leader seriously, with a strong focus on fostering a positive and inclusive culture within the business. Clare has built a team that is not only forward-driving but also deeply connected to both brokers and lenders, creating a powerful and cohesive force within the industry.

Business Leader: Network supported by Halifax Intermediaries

Rob Clifford – Stonebridge

Winner’s Comments:

Rob shared a truly compelling story and impressed the judges with the significant contributions he has made to the industry beyond his day-to-day role. His passion and enthusiasm were infectious throughout the interview, leaving a lasting impression.

Business Leader: Intermediary Lender (less than £5bn gross lending p.a) supported by One Mortgage System

Adrian Moloney – OSB Group

Winner’s Comments:

This category was incredibly tough to judge, with an outstanding calibre of finalists. One judge described it as a ‘heavyweight battle’. Ultimately, Adrian stood out for his genuine humility and the clear pride he has taken in his achievements over the past year. His unwavering dedication to supporting the intermediary community truly sets him apart.

Business Leader: Intermediary Lender (£5bn or more gross lending p.a) supported by Mortgage Advice Bureau

Charlotte Harrison – Skipton Building Society for Intermediaries

Winner’s Comments:

Charlotte impressed the judges with her genuine focus on her team and the individuals within it. She demonstrated openness, honesty, and a deep sense of humility. Her commitment to supporting the intermediary market and placing the customer at the heart of everything she does was clear. The admiration she expressed for her team shone through.

Lifetime achievement award

Lisa Martin

Winner’s Comments:

This year, we’re honouring Lisa Martin and her 45-year career in financial services. Though she initially aspired to a sports career and left school at 16, a teacher steered her towards banking. Starting in branch banking in 1980, she later moved through influential roles at Coventry Building Society, Commercial Union, Aviva, Bankhall, PMS, and Sesame, eventually joining the Financial Services Executive Team at LSL in 2015.

Lisa played a key role in growing the TMA Mortgage Club and was active in promoting Diversity & Inclusion, serving on the AMI Board and as Deputy Chair. Known for her integrity, leadership, and people skills, Lisa has built a respected and impactful legacy. Now stepping back in 2025, she leaves behind a significant mark on the industry while embracing some well-earned personal time.

Broker

Rising Star – Distributor sponsored by Vida Homeloans

Emma Atkinson – L&C Mortgages

Conor Batters – Mortgage Advice Bureau

Matthew Moralee – First Mortgage NE

New Build sponsored byLeeds Building Society

Ben Walker – Mortgage Advice Bureau

Neil Waller – Just Mortgages

Carole Weston – The Mortgage Brain

Large Loans supported by Coutts

Narinder Gill – Coreco

Ian Gray – Gray Advisory

Rahul Nath – L&C Mortgages

Later Life Lending supported by Family Building Society

Darren Johncock – LDN Finance

Steve Paterson – Later Life Money

Louise Stevens – Coreco Lifetime

Buy to Let supported by Coventry for Intermediaries

Teddy Cenaj – Habito

Chris Naya – Just Mortgages

Nicola Pratt – L&C Mortgages

First-time Buyer supported by Skipton Building Society for Intermediaries

Jeremy Blair – NxtGen Mortgages

Jarrad Combellack – Cox & Flight Financial Solutions

Carmen Green – Xpress Mortgages

Complex Credit supported by The Nottingham Building Society

Ceri Evans – Remoo Mortgages

Kate Fuller – Mortgage Advice Bureau

Stephanie Seddon – Right Choice Mortgages

Protection supported by HSBC Life

Ravneet Sokhi – Just Mortgages

Rhys Walker – Habito

Charlie Zahra – Alexander Hall Associates

General Insurance supported by Uinsure

Scott Malpas – Just Mortgages

Alyson Robertson – Mortgage Advice Bureau

James Taylor – Nest GI

Overall supported by NatWest

Rafael Ferreira – Alexander Hall Associates

Simon Hartley – L&C Mortgages

Adam Thomas – Thomas Group Financial Services

Administrator supported by Pepper Money

Ryanne Bean – Dynamo

Mark Donnigan – L&C Mortgages

Elizabeth Robertson – Just Mortgages

Lender

Lender: Rising Star – Product Provider sponsored by Sesame & PMS

Gemma Atkin – NatWest

James Houston – Lloyds Banking Group

Andrew Miller – Lloyds Banking Group

Operations/Credit Risk supported by Phoebus Software

Ashley Dewhurst – HSBC UK

Laura Gren – NatWest

Diane Harrison – Skipton Building Society for Intermediaries

Telephony Relationship Manager supported by Target Group

Joe Geldart – HSBC UK

James Nicholson – Virgin Money & Clydesdale Bank

Linzi-Ann Stafford – Newcastle for Intermediaries

Business Development supported by Alexander Hall Associates

Hayley Jones – Bank of Ireland for Intermediaries

Sim Sahota – Barclays

Kelly Stowell – NatWest

Head of Sales or National Accounts supported by L&C Mortgages

Rachael Hunnisett – April Mortgages

Alan Longhorn – Bank of Ireland for Intermediaries

Richard Walker – Virgin Money & Clydesdale Bank

Business Leader

Development & Innovation Advocate sponsored by PEXA

Tim Merrey – Revolution

Toni Roberts – Accord Mortgages

Ying Tan – Habito

Specialist Distribution supported by OSB Group

John Doughty – Just Mortgages

Liz Syms – Connect for Intermediaries

Matt Tristram – Loans Warehouse

Surveyor supported by Mortgage Brain

Matthew Cumber – Countrywide Surveying Services

Simon Jackson – SDL Surveying

Joe Miller – Home Surveying

Conveyancer supported by Loans Warehouse

Dev Malle – Simplify

Abi Tanner – Habito

Kevin Tunnicliffe – Sort Group

Protection or General Insurance Provider supported by Primis Mortgage Network

Lauren Bagley – Uinsure

Louise Colley – Zurich

Julie Godley – L&G

Broker (fewer than 10 advisers) supported by Barclays

Lea Karasavvas – Prolific Mortgage Finance

Stephen Kerr – Kerr & Watson

Rachel Lummis – Xpress Mortgages

Broker (11 to 50 advisers) supported by NatWest

Will Rhind – Habito

Jon Stones – Mortgage 1st

Sarah Tucker – The Mortgage Mum

Broker (over 51 advisers) supported by HSBC UK

Peter Brodnicki – Mortgage Advice Bureau

Mark Harrington – L&C Mortgages

Richard Merrett – Alexander Hall Associates

Mortgage Club supported by BM Solutions

Clare Beardmore – L&G Mortgage Club

Richard Howes – Paradigm Mortgage Services

Martin Reynolds – SimplyBiz Mortgages

Network supported by Halifax Intermediaries

Rob Clifford – Stonebridge

Richard Howells – PRIMIS Mortgage Network

Scott Thorpe – TMG Mortgage Network

Intermediary Lender (less than 5bn gross lending p.a) supported by One Mortgage System

Mark Eaton – April Mortgages

Adrian Moloney – OSB Group

Louisa Sedgwick – Paragon Bank

Intermediary Lender (£5bn or more gross lending p.a) supported by Mortgage Advice Bureau

Esther Dijkstra – Lloyds Banking Group

Jeremy Duncombe – Accord Mortgages

Charlotte Harrison – Skipton Building Society for Intermediaries

Broker

Rising Star – Distributor sponsored by Vida Homeloans

The category is open to employees of businesses that distribute products in the intermediated mortgage channel. This could include, but is not restricted to, employees of mortgage brokers, mortgage networks, mortgage clubs, and distributors of legal, surveying, insurance and other mortgage related products.

Nominees should have up to three years’ experience in the intermediary mortgage market as of January 2025 (not up to 3 years in a new role, having had further experience in the intermediated mortgage channel – whether that is in the mainstream or specialist markets). The award is aimed at those individuals who have made exceptional progress in their respective businesses in the last 12 months. They will have demonstrated first class results, attitude and ambition and have ample evidence that they have consistently overachieved and have taken on further responsibility within the business.

All candidates in the following broker categories must demonstrate that a minimum of 50% of their role involves advising clients.

New Build sponsored by Leeds Building Society

The award will go to the adviser who is a true new build expert (over 60% of their business is specifically new build). They will be able to demonstrate the delivery of a significant volume of quality new build business during the last 12 months. They will have a first-class knowledge of the relevant New Homes schemes and will have used their knowledge to effectively engage clients with quality advice in this sector.

Large Loans sponsored by Coutts

This award will go to the adviser who has made a positive impact in the large loans sector. They will understand the different needs of clients in this part of the market, have delivered significant volumes of business in the £1m plus loan sector, demonstrate strong relationships with multiple high street lenders and private banks and intuitively know how to deliver comprehensive advice to a range of client requirements.

Later Life Lending sponsored by Family Building Society

Nominees will have proven expertise in dealing with clients in later life. This will include, but is not restricted to, equity release advice, or advice across the wider later life lending product suite. They will demonstrate empathy with clients and an exhaustive knowledge of the changing product spectrum, and the concerns and needs of their client base. Nominees should clearly demonstrate their specialism in this sector.

Buy to let sponsored by Coventry for Intermediaries

The award will go to the adviser who has delivered a consistent level of quality business to lenders over the last 12 months. They will have strong relationships with lenders, a excellent understanding of the buy-to-let market and have demonstrated they are working in the best interest of their clients.

First-time buyer sponsored by Skipton Building Society for Intermediaries

Nominees will have consistently delivered high quality advice over the last year (over 60% of their business is specifically to first time buyer clients). They will understand the specific needs of the first-time buyer using a high level of product knowledge. They will have also demonstrated their initiative by offering advice on saving, budgeting and the options around parental help.

Complex Credit sponsored by The Nottingham Building Society

This award is aimed at those brokers who concentrate on the prime first charge market, dealing with client with complex income. This includes but is not restricted to borrowers with multiple incomes, self-employed or clients with credit blips. The winner will have good relationships with specialist lenders or the specialist parts within mainstream lenders, a deep understanding of specialist product niches and a proven track record in delivering the most appropriate advice to their customers.

Protection sponsored by HSBC Life

This award will go to the broker who has performed exceptionally well in protection business in the last 12 months. We would expect advisers to complete a minimum 10 cases a month. The chosen individual will have demonstrated an increase in protection penetration and conversion rates to both new and existing clients, ensuring customers have appropriate cover.

General Insurance sponsored by Uinsure

This award will go to the broker who has performed exceptionally well in general insurance business in the last 12 months. We would expect advisers to complete a minimum 10 cases a month. The chosen individual will have demonstrated an increase in general insurance penetration and conversion rates to both new and existing clients, ensuring customers have appropriate cover.

Overall sponsored by NatWest

This award will go to the intermediary who has outshone their peers. Someone who knows where to find the most appropriate products across a mix of customer types, whose customer service is second to none and who has made a clear difference to their firm over the last 12 months.

Administrator sponsored by Pepper Money

This category is open to individuals in an administrator role at an adviser whose main job function is to process mortgage applications for their firm. This category is not applicable to individuals who are involved in the advice process. The successful candidate will show consistently high-quality case submission, getting it right first time to a broad spectrum of lenders. They will demonstrate a high level of product and criteria knowledge and act with confidence and authority in their dealings with lenders, their adviser colleagues and customers. They will consistently exceed all regulatory and fraud prevention obligations.

Lender

Rising Star – Product Provider sponsored by Sesame & PMS

The category is open to employees of mortgage lenders, general insurance and protection providers, legal services providers, and surveyors.

Nominees should have up to three years’ experience in the intermediary mortgage market as of January 2025 (not up to 3 years in a new role, having had further experience in the intermediated mortgage channel – whether that is in the mainstream or specialist markets). The award is aimed at those individuals who have made exceptional progress in their respective businesses in the last 12 months. They will have demonstrated first class results, attitude and ambition and have ample evidence that they have consistently overachieved and have taken on further responsibility within the business.

Operations/Credit Risk sponsored by Phoebus

The nominee will have delivered strong initiatives in the last year to improve the quality of business, business standards and overall performance and/or controls within their lender which demonstrates that they are exceptional in their position. They would be able to demonstrate a clear visible impact that their initiatives have had on the business. This award category is open to anyone with Operations, Credit Risk or Recoveries in their job title (directors, officers or managers).

Telephony Relationship Manager sponsored by Target Group

This award is aimed at those working in a telephony business development role. This individual will have a first class understand of a lenders’/providers’ processes and products and will be able to communicate these in a way that the broker understands. They will quickly understand and promote change in a way that fits the relationship. They will support the brokers’ business and will react and be there for their brokers when required. They will bring energy and passion to their role, displaying genuine advocacy for their brand.

Business Development sponsored by Alexander Hall

The award will be given to the individual responsible for business development, in a face-to-face capacity. This individual will always go the extra mile for their brokers. Someone who is always available, knows their products inside out and offers support and suggestions to the distribution channels they serve. They will take ownership of the relationships, ensuring that they consistently achieve positive results for the intermediary and their business.

Head of Sales or National Accounts sponsored by L&C Mortgages

The nominee will either manage a sales force that successfully delivers core and cross sales targets and/or design and implement the national/corporate account strategy with key intermediary partners. In either case the nominee must show an extensive understanding of intermediary business models and show that they can deliver value to both lender and intermediary. They should have the ability to act strategically and demonstrate outstanding leadership skills.

Business Leader

Development & Innovation Advocate sponsored by PEXA

Nominees will have demonstrated that they are bringing new thinking and development to any aspect of the process within the intermediated mortgage market. This includes, but is not limited to, technology, product design, training and development, customer contact strategies and business efficiency. The successful person will have made a proven positive impact on their own business in the last 12 months, while delivering change that could potentially have positive implications for the wider market.

Specialist Distribution sponsored by OSB Group

This award category will be applicable to those individuals that have demonstrated an exceptional commitment to the specialist arena. They will be able to demonstrate their depth of lender and broker relations and an entrepreneurial spirit which has seen their business adapt to the challenges of the changing specialist landscape.

Surveyor sponsored by Mortgage Brain

Nominees will embody the ethos of their firm; delivering a consistently high-quality offering, accurate valuations and reports and a quick and efficient service.

Conveyancer sponsored by Loans Warehouse

Nominees will have demonstrated an innovative approach to problems, while pushing for a speedy and faultless service to clients. They will also have demonstrated a desire to contribute to a more efficient homebuying process. This category is open to both leaders of conveyancing firms and leaders of a conveyancing platform that directly facilities the delivery of the conveyancing function.

Protection or General Insurance Provider supported by Primis Mortgage Network

The nominees for this award will have demonstrated effective leadership of their business over the last 12 months. They will be able to show growth in sales and illustrate how their actions have helped embed insurance advice into the fabric of the mortgage intermediary channel. This category is open to both leaders of Protection or GI providers and also leaders of a Protection/GI platform that directly facilities the delivery of Protection/GI sales.

Broker (fewer than 10 advisers) sponsored by Barclays

Nominees will have improved their firms standing through effective management and will have over the last 12 months made their business model more robust and valuable. Nominees may have also made an impact on the market outside of their firm over the last 12 months. Someone who has delivered consistently for their firm, but who has also worked for the good of the intermediary market itself.

Broker (11 to 50 advisers) sponsored by NatWest

Nominees will have improved their firms standing through effective management and will have over the last 12 months made their business model more robust and valuable. Nominees may have also made an impact on the market outside of their firm over the last 12 months. Someone who has delivered consistently for their firm, but who has also worked for the good of the intermediary market itself.

Broker (over 51 advisers) sponsored by HSBC UK

Nominees will have improved their firms standing through effective management and will have over the last 12 months made their business model more robust and valuable. Nominees may have also made an impact on the market outside of their firm over the last 12 months. Someone who has delivered consistently for their firm, but who has also worked for the good of the intermediary market itself.

Mortgage Club sponsored by BM Solutions

The successful nominee will be someone who has successfully managed their business in the last 12 months, who understands the needs of both brokers and lenders and delivers a proposition that adds value to both parties.

Network sponsored by Halifax Intermediaries

This award will go to the nominee who has led their firm very effectively over the last 12 months, whether this is strengthening their lender relations, launching new services for ARs or taking a stand on issues that affect members.

Intermediary Lender (less than £5bn gross lending p.a) sponsored by One Mortgage System

This award is for a star performer who is successfully running their business, which lends less than £5bn gross per year, with great leadership and authority. They will have shown a willingness to work with all parties to sustain and evolve the marketplace.

Intermediary Lender (£5bn or more gross lending p.a) sponsored by Mortgage Advice Bureau

This award is for a standout individual who provides leadership and authority. They will have overseen growth in their business in the last 12 months and shown a willingness to work with all parties to sustain and evolve the marketplace.

The Lifetime Achievement Award

Sponsored by Simplify

The winner will be someone who is acknowledged by many to have devoted themselves to the sector for a significant period of time, and who has made a significant and positive difference to the market.

NB: Please note Our Lifetime Achievement Award category is not open to public nominations. The shortlist and judging are carried out by the editorial and publishing teams at Mortgage Solutions.

The British Mortgage Award winners are nominated by people from across the spectrum of the UK mortgage industry. The winners were selected using a transparent, robust, three-tier process designed to make selection as fair and independent as possible.

The process

The first stage of the process is an invitation to the industry to nominate the individuals deemed worthy of recognition for their achievements over the last 12 months (please note that all nominations received from members of the public, including customers, will not be counted).

Once the first phase of the process is closed a shortlist is drawn up in each category based on the number and spread of nominations for a particular individual. A weighting system is applied to the overall number of nominations cast to ensure greater emphasis is placed on the relevant nominations cast from outside the nominees’ own business. Please note that there is a cap of 5 nominations received from within the nominees’ business.

Those nominees that make the shortlist of 3 in each category are then asked to submit a supporting testimonial based on the following criteria:

- The key achievements they have delivered in the last 12 months. In this context, this may include, but not be restricted to, new initiatives they have delivered in the last 12 months which have improved service levels, internal processes or customer outcomes. It also includes any positive contributions they have made to the prosperity of the wider market beyond their own business performance.

- An indication of their successful business performance over the last 12 months. This could be measured in growth in transaction volumes and/or profit versus the previous year, but also, depending on the relevance of the category, include further performance indicators such as an increase in positive feedback from either clients or lenders that demonstrates both the right customer outcomes and improved business partner relations, or an increase in business won by recommendation, or increasing net promoter scores or reducing customer complaints, or the delivery of any change and innovation that has had a positive effect on the business beyond just financial results. This will also include commitment to the ESG agenda and in particular a proactive approach to improving Diversity & Inclusion within their own business or across the wider market.

- Reasons why they should win the award

A respected industry panel is used for the next stage of the process.

The judges are handpicked for their experience and knowledge of the market and are a representative sample of providers, distributors and supporting services who can give a reasoned and balanced view on each of the candidates on the shortlists.

We conduct the judging remotely, with interviews taking place over Zoom. Each finalist will be invited to attend a 15-minute interview on either the 4th or 5th June.

One of the awards is decided separately. Our Lifetime Achievement Award is chosen by the Mortgage Solutions publishing team and is given to the key industry figure that has made a significant contribution to the intermediary market above and beyond their day-to-day role over a significant number of years.

Sales director, Pepper Money

Paul Adams is the sales director at Pepper Money, with responsibility for leading the lender’s first charge sales and distribution strategy working exclusively with brokers and intermediaries.

He joined Pepper from Santander for Intermediaries, where he worked for nearly 10 years, becoming the lender’s head of intermediary distribution. Prior to HSBC, Paul worked at GMAC-RFC, where he was head of product and strategic insights.

Kensington Mortgages

Director, Legal & General Mortgage Club

Clare Beardmore has held various positions during her five-year tenure at Legal & General, including head of broker and propositions and head of mortgage transformation. She is currently the director of the Legal & General Mortgage Club, a key business area within the company’s mortgage services team.

Legal & General Mortgage Club is the largest and longest-running mortgage club in the UK and is involved in nearly one in five of all mortgages in the UK and nearly one in three of all intermediated mortgages. It is a part of Legal & General Retail, which covers the savings, protection, mortgage, and retirement needs of 12 million retail policyholders and workplace members.

Clare is committed to driving the digitalisation of the mortgage market and is also a prominent advocate for gender parity in the industry. She regularly uses her platform to raise awareness about issues affecting brokers, particularly those at smaller firms.

TBS

Nationwide

Head of mortgages and housing, Building Societies Association

Paul was born in Manchester and started his career with the then Halifax Building Society.

He joined the BSA and set up its mortgage team in November 2008.

Paul regularly works with government, politicians and regulators. He is also a frequent media commentator and conference speaker on matters relating to mortgages and housing in the UK. He is a member of the government’s Commonhold Council and the Consumer Policy Working Group of the European Association of Co-operative Banks.

Paul lives in Crick, Northamptonshire and enjoys spending his weekends watching his sons play sport and following Northampton Town up and down the country.

Head of Halifax Intermediaries and Scottish Widows Bank

Amanda joined Lloyds Banking Group in August 2022 as head of Halifax Intermediaries and Scottish Widows Bank. Nurturing relationships with mortgage brokers across the UK, the Halifax Intermediary team delivers over 85% of LBG’s mortgage business and helps to turn homeownership dreams into a reality.

Amanda has enjoyed a successful career in the mortgage industry that spans more than 26 years. Her career in the sector started as a mortgage broker and she has gone on to enjoy a variety of senior roles across three of the top six mortgage lenders.

Amanda’s experience brings the insight to support mortgage brokers in delivering excellent customer outcomes, and the depth of knowledge to ensure the partnerships between lenders and brokers can continue to be meaningful and mutually beneficial.

HSBC UK

Stonebridge

Leeds Building Society

Regional sales manager, Accord Mortgages

Gurpreet has spent nearly 13 years at Yorkshire Building Society and Accord Mortgages working in various roles including mortgage adviser, relationship management, large operational team leader, and working within the mortgage distribution senior management team. Gurpreet is responsible for managing and growing strategic relationships with key lending partners while delivering new and exciting propositions to the intermediary market and supporting brokers with common-sense lending.

Chief executive, AMI

Stephanie joined the Association of Mortgage Intermediaries (AMI) as chief executive in February 2025, having held previous roles within key distributors spanning 27 years.

Most recently, she was group partnerships & propositions director at Sesame Bankhall Group and previously director of mortgages at specialist distributor Positive Lending, and head of mortgages & insurance at Mortgage Intelligence.

Throughout her career working across the intermediary sector, Stephanie has been a passionate promoter of the need for, and value of, advice.

Distribution director for PMS and Bankhall, Sesame Bankhall Group

Claire recently joined Sesame Bankhall Group as distribution director for PMS and Bankhall, a role that now also sees her leading propositions for lenders and providers, as well as driving strategic partnerships across the business.

Previously, Claire spent over two decades at Lloyds Banking Group, rising through the ranks from a fresh-faced accountant to a tech-savvy innovator. Whether running the current account business or shaping strategic technology collaborations, Claire has always been someone who rolls up her sleeves and gets things done.

Her passion? Making a difference through technology, whether it’s transforming the housing market or supporting breakthroughs in medical research. Claire is also a mentor many aspire to have, championing diversity and openly sharing her experiences as a female aeronautical engineer.

Stonebridge

OSB Group

Director of retail protection, Zurich

Louise has worked in the financial services sector for over 34 years, operating at executive level across a variety of disciplines. She is the managing director of the retail protection business at Zurich and joined in December 2020. She was appointed to a newly created role to bring together the various business functions and drive an end-to-end focused retail protection business.

She is known for her straight talk on all matters protection and her passion for the sector, having won numerous industry accolades.

Louise is hugely passionate about supporting talented women to better manage their personal development and actively shape their future careers. In her spare time, Louise offers executive coaching and is an associate certified coach with the International Coaching Federation (ICF).

She is an executive board director of the Zurich Global Employees Benefit Solution business.

Head of strategic accounts - lender, Legal & General

Greg is Head of Strategic Accounts – Lender at Legal & General Mortgage Services (LGMS). He co-heads the lender team at LGMS, overseeing lender relationships across the mortgage club, the Ignite technology platform, and Legal & General Surveying Services.

Greg joined Legal & General in April 2024, following a successful career in the mortgage intermediary sector. He began his career at Alexander Hall, a London-based mortgage brokerage and part of the Foxtons Group (London’s largest estate agency), joining straight from university in 2007 on a trainee mortgage adviser scheme. Greg spent several years as a mortgage adviser, becoming one of the company’s top performers, before progressing to a team leader role.

Three years later, Greg was promoted to Operations Director, where he was tasked with creating and managing a New Homes adviser department within the business. After two successful years in this role, he was appointed to the senior management team as Director of Lender Relationships and New Homes, taking responsibility for all lender relationships across the company.

In 2022, Greg joined LDN Finance, a City of London-based brokerage specialising in high net worth and specialist lending, as Chief Operating Officer. In this role, he oversaw the creation of LDN Private Clients, a sub-brand focused on HNW clients, and established a later life lending division within the business, including equity release advice. Greg also held the SMF16 (Compliance Oversight) function, carrying responsibility for the firm’s compliance oversight as part of his role.

Alexander Hall Associates

Head of intermediary sales, Family Building Society

Darren Deacon joined Family Building Society in 2017 as a business development manager covering the Midlands and was promoted to head of intermediary sales in 2022. He has over 36 years of financial services experience and has worked for both high street and specialist lenders. Deacon has worked as an underwriter, mortgage adviser and, latterly, within mortgage business development, and now leads a team of nine BDMs. In his current role, he uses his extensive experience and knowledge of the mortgage market to deliver lending solutions for the older borrower. Deacon is a firm believer in providing excellent customer service and thinks it is the best, and perhaps the only, way to build lasting business relationships.

Newcastle Intermediaries

Head of NatWest intermediary distribution, NatWest

Nadine Edwards is the head of NatWest intermediary distribution, operating within the Retail Banking division.

She has over 16 years of experience in the mortgage industry, having previously worked as a mortgage broker, business development manager, and corporate account manager before joining NatWest Group in February 2022 as national account manager and being promoted to head of intermediary distribution in February 2025.

Dynamo

Equity release specialist lead, Royal London

Strategic lender relationships director, Mortgage Advice Bureau

With 20 years of experience in the financial services sector, including roles at Santander and Countrywide, Rachel joined Mortgage Advice Bureau 13 years ago and has managed her own brokerage for the last 10 years. She has extensive expertise in helping customers who require more specialist support and providing in-depth training to brokers in niche areas of lending.

As strategic lender relationships director, Rachel works closely alongside MAB’s lender partners to identify additional opportunities for innovation. A champion for customer support and education, Rachel works closely with AR firms and brokers, providing the resources and training they need to boost lead generation, expand their expertise, and ensure the best possible customer outcomes.

Head of strategic partnerships and growth, Aldermore

Nicola has over 15 years’ experience in the financial services industry and currently leads the strategic partnerships strategy for growth at Aldermore.

She is focused on bringing the Aldermore purpose of ‘backing more people to go for it in life and business’ to life. She is also co-deputy chair of IMLA and leads the IMLA Diversity and Inclusion Group.

Paradigm Mortgage Services

Finance Leasing Association

CEO, L&C Mortgages

L&C was established in 1999, and over the last 25 years has grown to become the UK’s number one online and leading fee-free mortgage broker. It currently employs over 450 advisers offering mortgage and protection advice to customers from over 90 lenders and 11 insurers.

Mark was appointed chief executive officer of L&C in April 2024 and has over 20 years’ experience in the business, having started his career as a mortgage and protection adviser in 2003.

He has a detailed knowledge of all aspects of L&C’s market-leading proposition, working across a wide range of roles including estate agency and new build in addition to the core mortgage and protection offering.

Mark became mortgage & protection advice director in 2019 before more recently taking up the position of chief operating officer, playing a key role in shaping the direction and strategy of L&C, overseeing the move to a hybrid working model.

Mark is determined to develop L&C’s customer journey to provide the very best customer experience whilst maintaining top quality advice with no broker fee charged to customers.

He’s also passionate about developing an inclusive and equitable culture for L&C colleagues.

Santander for Intermediaries

Bluestone Mortgages

Chief distribution officer, PRIMIS Mortgage Network

Paymentshield

Sales director, Nottingham Building Society

Matt is sales director at Nottingham Building Society, where he leads a growing team focused on supporting brokers across the country. He’s responsible for the overall distribution strategy, deepening key intermediary relationships and helping shape the mortgage proposition to meets the needs of today’s diverse borrower landscape.

Matt joined Nottingham Building Society in February 2023 from LiveMore, and previously worked as an adviser at Clifton Mortgages, as well as holding senior roles at Legal & General, Bank of Ireland, Aviva plc, and RSA.

The Brightstar Group

Bank of Ireland for Intermediaries

Director, SPF Prviate Clients

SPF Private Clients is one of the UK’s leading independent mortgage brokers, specialising in the high-value mortgage market.

Gareth has been with SPF since 2001. He is a director with responsibility for developing and maintaining relationships with its lender partners.

Virgin Money

Risk director, Finance Planning Group

Dan is managing director at The Finance Planning Group, where he oversees adviser recruitment, business development and the strategic management of introducer relationships.

As a member of the Chartered Insurance Institute (CII) and a board director at the Association of Mortgage Intermediaries (AMI), he actively supports professional development in the industry and promotes the vital role of mortgage intermediaries.

Dan takes pride in being a coach and mentor to advisers and colleagues alike, with a leadership style focused on culture, innovation, profitability and sustainable growth.

United Trust Bank

Equity Release Council

Managing director, Coreco

Andrew started in the mortgage industry in 1994 at John Charcol before joining Cobalt Capital in 2001.

In 2009 he was a founder of Coreco, responsible for growing the brand, marketing and communications, as well as lender liaison. He was made managing director in 2019.

As Coreco’s media spokesperson Andrew can often be seen or heard on TV and radio as well as regularly commenting in the national, local and trade press.

Winner of several industry awards; Andrew is also chairman of the Association of Mortgage Intermediaries and continues to advise clients.

Group intermediary director, OSB Group

Adrian joined OSB Group in December 2015 and took on the role of group sales director in 2020, which involved being responsible for all field and telephone-based sales teams across all group lending brands.

At the beginning of 2022, Adrian became group intermediary director and unified the intermediary sales leadership which brought together Precise, Kent Reliance for Intermediaries and InterBay.

Adrian joined from Nationwide, where he was a senior member of the corporate account teams. He has over 21 years of industry experience, including time spent at both Mortgage Trust and Portman Building Society.

He’s a highly respected industry spokesperson and keynote speaker, and is a three-time winner of the Business Leader: Complex Buy-to-Let Lender at the British Specialist Lending Awards and won Business Leader: Intermediary Lender (less than £5bn gross lending p.a) in 2023 and again in 2025 at The British Mortgage Awards. Adrian has also been on the board of IMLA since 2019.

Metro Bank

Group chief commercial officer, Advise Wise, Age Partnership & Pure Retirement

The Mortgage Lender

Uinsure

HSBC UK

COO, Target Group

Phoebus

National partnership manager, Bank of Ireland for Intermediaries

Dave Rogers has over 20 years of experience in financial services, including 13 years at Barclays UK, where he most recently served as Intermediary Business Director and previously as Intermediary Partnership Director. With a deep understanding of the intermediary market, Dave has extensive knowledge and expertise in intermediary lending.

Managing director - mortgages, Paragon Bank

Louisa has been working in the financial services industry for over 30 years, primarily in mortgages, with a real focus on buy-to-let.

She has held a number of senior roles and is currently commercial director at Paragon Bank, where she is responsible for mortgage products and distribution.

Paragon Bank is a specialist buy-to-let lender and has been helping landlords to deliver flexibility for those who rent their home for over 30 years.

The Openwork Partnership

AMI

Robert helped establish the Association of Mortgage Intermediaries (AMI) as an independent entity on 1st February 2012.

Robert joined the former parent trade body, AIFA, in October 2006, initially looking after the Association of Finance Brokers (AFB) and, since 2008, AMI.

He looks after the day-to-day running of AMI and AFB by delivering member information and services, lobbying regulators and policy-makers and developing press relations.

Market Harborough Building Society

Vida Homeloans

Growth director, Target Group

With over 24 years of experience in financial services, Melanie Spencer has built a distinguished career across the mortgage and lending industry. She began her journey at just 17 with Abbey National Bank, where she laid a strong foundation by gaining qualifications in mortgages, protection, equity release and investment and pensions.

Melanie joined Target Group as sales and growth lead and now serves as growth director. In this role, she leads the company’s strategic expansion, driving awareness and adoption of Target Group’s solutions across the lending sector.

Her career spans influential roles at Personal Touch Financial Services, Twenty7Tec, Finova and One Mortgage System, where she worked closely with both brokers and lenders to deliver innovative solutions. As group business development director at Finova, she was instrumental in shaping the proposition for MCI Mortgage Club and supporting lenders in their digital transformation journeys, particularly in mortgage origination and servicing.

Melanie’s deep industry knowledge, combined with her passion for growth and innovation, continues to make her a driving force in the evolution of financial services.

Head of intermediary relationships, Coventry for Intermediaries

As head of intermediary relationships, Jonathan leads the intermediary development team and has overall responsibility for the intermediary distribution strategy including all key partner and corporate relationships, field and TBDM teams as well as telephone and administration support. Jonathan has been in financial services since 2000 and has been with the Society since 2008, previously holding a position in corporate accounts.

Habito

HSBC Life

LV= General Insurance

Alexander Hall Associates

Website

Alexander Hall Associates

Website

Alexander Hall is an award-winning mortgage broker based in London. The business is hugely regarded for training, people development and nurturing new talent into the finance industry. It prides itself on consistently demonstrating excellent customer service and quality standards as well as building strong relationships with customers and business partners.

Alexander Hall promotes a culture of hard work, integrity and collaboration which empowers its diverse and inclusive workforce to provide customers with a five-star service.

Barclays

Website

Barclays

Website

Barclays is a top five mortgage lender with an unwavering commitment to the intermediary market. It provides competitive, flexible, innovative products and actively participates in government housing schemes to offer its intermediary partners a comprehensive range of solutions to meet their clients’ evolving needs.

In addition to an established remortgage proposition, Barclays offers extensive purchase options including Green Home mortgages, new build, joint borrower sole proprietor and Family Springboard products. Through its highly competitive Reward range and easy-to-use product transfer tool, it is also a major player in the retention space, as well as incorporating an extensive buy-to-let proposition.

As a lender that is constantly striving for simplicity, Barclays’ policy changes, processes and service enhancements aim to streamline the mortgage journey. All with the ultimate goal of making it even easier for intermediary partners to conduct more business with the lender now, and in the future.

BM Solutions

Website

BM Solutions

Website

BM Solutions is dedicated to supporting intermediaries. Their competitive products and award-winning service can be accessed through their forward-thinking technology, BM Solutions Online. They aim to support the traditional sector of the Buy to Let market for landlords with small to medium sized portfolios.

Their team of experienced BDMs have consistently been there to complement their consistent and award-winning 5-star service but they don’t take things for granted. They’re continually refining their products and criteria to suit your needs so that you have everything you need to do business with BM Solutions.

Coutts

Website

Coutts

Website

Coventry for Intermediaries

Website

Coventry for Intermediaries

Website

Coventry’s expert, knowledgeable people are here to give you the clarity, confidence and reassurance you need to deliver for your customers.

Its commitments to you:

- It will give you the information you need when you need it

- It will be proactive and helpful in every conversation

- It will use tech to speed up common sense, but not replace it

- And it will recognise that your clients are your clients.

Its wide range of mortgage products includes:

- Its simple offset, with just one easy-access savings account linked to the mortgage.

- An interest-only product range including fixed rate and offset mortgages.

- First-time buyer-only rates to help your clients get on the property ladder.

- A green offering that supports homeowners and landlords who want to make energy-efficient home improvements.

Its aim is for every part of your professional world to work all together, better.

Family Building Society

Website

Family Building Society

Website

Family Building Society doesn’t believe in a ‘one size fits all’ approach to lending and will work with you to find mortgage solutions for your clients regardless of their circumstances.

It’s focused on delivering innovative and flexible products to meet the needs of the modern family across all generations and individuals not well served by the mass market.

Why choose Family Building Society?

- Human underwriters – not computers

- Flexible criteria – not just black-and-white cases

- Tailored credit checks – no credit scoring.

It provides solutions for a wide range of customers

- First-time buyers

- Landlords

- Self-employed

- Expats

- Those in and nearing retirement.

Lending into retirement

- No upper age restrictions (max mortgage term may be limited)

- Five-year term to a qualifying 90 year old

- 25 year term to a qualifying 70 year old

- Earned income up to 70 and pension income beyond that

- Rental/investment income evidenced on SA302.

Halifax Intermediaries

Website

Halifax Intermediaries

Website

Halifax is committed to making life easier for intermediaries. That’s why it continues to deliver excellent products and service for you and your clients—making it simpler to do business with Halifax Intermediaries.

The lender’s product proposition spans home movers, remortgages, large loans, new build, affordable housing, and now includes First Time Buyer Boost, designed to support those taking their first step onto the property ladder. You can also retain existing Halifax clients by securing great deals through product transfers and further advances.

HSBC Life

Website

HSBC Life

Website

HSBC Life (UK) Limited is part of the HSBC Group, one of the world’s largest banking and financial services organisations. HSBC Group serves more than 40 million customers worldwide through a network that covers 64 countries and territories in its geographical regions: Europe, Asia, North America, Latin America, and Middle East and North Africa.

It aims to be present where the growth is, enabling businesses to thrive and economies to prosper, and, ultimately, helping people to fulfil their hopes and realise their ambitions.

HSBC Life (UK) Limited was founded in the UK in 1988 and offers insurance services to meet protection and investment management needs. Its services and solutions are available through HSBC banking channels and selected third parties, including financial advisers and aggregators.

HSBC UK

Website

HSBC UK

Website

HSBC is one of the world’s largest and most successful banking and financial services organisations, with a proud history of serving customers and communities for more than 160 years.

Its purpose is a simple yet powerful reminder of why it’s here and where it’s going. Whether individuals are saving for a better home, companies growing their business, or institutions investing for future generations, HSBC is here to understand and serve them all and open up a world of opportunity.

HSBC UK’s dedicated intermediary mortgage channel continues to transform the broker journey through digital integration, offering flexibility and functionality to provide a high-quality service to its intermediary partners.

Experienced field and phone business development managers and UK-based telephony Broker Helpdesk continue to provide a superior level of support that HSBC’s intermediary partners have become accustomed to.

L&C Mortgages

Website

L&C Mortgages

Website

L&C is the UK’s largest fee-free mortgage broker. L&C’s online and telephony proposition enables customers to receive mortgage advice without requiring a face-to-face meeting.

The company works with over 90 lenders to offer customers the widest choice of mortgages in the UK market, all from a single platform.

L&C’s fee-free model and award-winning customer service helps customers throughout the mortgage process – no hidden costs or surprises, just straightforward, honest, mortgage advice.

Leeds Building Society

Website

Leeds Building Society

Website

Leeds Building Society exists to serve its members and intermediaries, so it puts them at the heart of every decision it makes.

The mutual’s diverse lending range is crafted to support mainstream residential and affordable housing – it’s an award-winning Shared Ownership lender. Leeds puts home ownership in reach of more people, generation after generation, and helps them borrow in ways that are important to them.

It’s supported by the lender’s buy-to-let proposition which helps professional, portfolio and limited company landlords offer tenants good quality homes.

Mortgage Hub, its advanced broker system, makes doing business with Leeds quick and easy, from decision in principle to completion, and it has an experienced team of people waiting to help.

Loans Warehouse

Website

Loans Warehouse

Website

Loans Warehouse is one of the UK’s leading specialist finance brokers, renowned for its expertise in second charge and bridging loans. Established in 2006 and based in Watford, it has built a reputation for fast, reliable service and award-winning customer care. Working with a wide panel of lenders, it provides tailored solutions for clients with complex borrowing needs. Its dedication to innovation, education and adviser support has helped raise the profile of specialist lending across networks and broker firms. With over 100 industry awards and a five-star Trustpilot rating, Loans Warehouse continues to set the standard in specialist finance.

Mortgage Advice Bureau

Website

Mortgage Advice Bureau

Website

Mortgage Advice Bureau (MAB) is one of the UK’s leading consumer intermediary brands and specialist appointed representative networks for mortgage intermediaries, winning over 250 awards for the quality of its advice and service.

MAB has more than 2,000 advisers offering expert mortgage, protection and general insurance advice on a local, regional, and national level to consumers.

MAB’s proposition is aimed at supporting high-quality, ambitious mortgage adviser firms to deliver the best outcomes for their customers via proprietary technology and services.

MAB handles over £25bn of loans annually and is listed on the Alternative Investment Market (AIM) of the London Stock Exchange.

Mortgage Brain

Website

Mortgage Brain

Website

For over three decades, Mortgage Brain has been at the forefront of mortgage technology in the UK, committed to addressing the complexities faced by mortgage intermediaries and lenders.

Its vision is to reimagine mortgage distribution, bringing about a dynamic shift that unites all key stakeholders, giving borrowers certainty earlier in their search for a mortgage. Serving over 15,000 daily intermediary users, it is steered by its values of working ‘better together’, with a focus on ‘driving change’ and doing the right thing’.

Mortgage Brain’s robust offering includes an integrated suite of software sourcing solutions, submissions and CRM. And it is backed by some of the largest lenders, including Barclays, Lloyds Banking Group, Nationwide Building Society, Royal Bank of Scotland, and Santander.

NatWest

Website

NatWest

Website

NatWest can help you turn possibilities into progress for your clients, whether they’re first-time buyers, movers, landlords or those looking to product transfer or remortgage.

It provides the tools and support you need to raise the bar for them, on its dedicated intermediary website and broker portal.

Its Intermediary Support Team is on hand to support you on the phone or via live chat when you need them, to provide your clients with the very best service. Its business development managers are committed to helping you make your business successful through dedicated support.

One Mortgage System

Website

One Mortgage System

Website

One Mortgage System (OMS) goes beyond being just a customer relationship management tool. It’s the future of the way mortgage intermediaries work, designed to streamline processes and save up to three to four hours of administrative tasks per case.

OMS does more than just store customer information; it’s packed with powerful features that include sourcing the most suitable mortgage product for your clients and submitting applications directly to integrated lenders.

With a comprehensive audit trail, OCR capabilities, DIP generation, and more, OMS offers everything from document uploads and sourcing to KFIs, evidence of research, real-time updates, AVMs, and credit searches. These features are all geared towards significantly reducing the time brokers spend on administrative work.

Developed by mortgage intermediaries for mortgage intermediaries, OMS has quickly become a multi-award-winning platform. It has earned the trust of over 4,000 users, who, in the past 12 months alone, have submitted over 46,000 applications through the system.

OSB Group

Website

OSB Group

Website

OSB Group’s proposition is delivered by our three specialist lending brands – Precise, Kent Reliance for Intermediaries and InterBay.

Precise is dedicated to helping customers with less-than-perfect credit histories or who are underserved by mainstream lenders.

Kent Reliance for Intermediaries provides handcrafted solutions to those whose complex cases may not fit high street criteria.

InterBay is an expert in delivering bespoke solutions to help brokers meet their clients’ borrowing needs.

The Group’s offering is backed up by a secure and solid retail savings model, provided by Charter Savings Bank and Kent Reliance.

Pepper Money

Website

Pepper Money

Website

Pepper Money is a broad specialist lender. It exists to help people succeed. Championing individuality. Embracing difference. Acting responsibly. And looking for opportunities to say yes, rather than reasons to say no.

Pepper understands that brokers have a wide range of needs, because its customers do, too. These clients may want to take the next step in their homeowning journey – or move on from a difficult financial situation. Brokers want to give them the best service, in the most efficient and profitable ways.

Pepper Money’s aim is to help both parties fulfil their ambitions by offering simple, inclusive products. Broad criteria. Competitive pricing and a positive lending attitude – so brokers are able to help more of their customers. Taking a human approach to decision-making. So fairer – often more generous – lending decisions are reached, because it considers people, not credit scores.

Being easy to work with, through direct access to a decision maker.

And providing specialist expertise that can be relied on in a rapidly evolving marketplace.

When you keep an open mind and listen to people, everyone succeeds. That’s Pepper Money.

PEXA

Website

PEXA

Website

PEXA is a secure digital platform that seamlessly handles financial settlements and title lodgement simultaneously. It is at the centre of the property transaction, where money is exchanged for homeownership, delivering that moment with certainty, security, and confidence.

PEXA’s trusted technology is used for over 90% of property transactions in Australia, helping over 20,000 families a week safely settle their homes. Now, it has developed a platform tailored to the UK’s unique challenges – helping to reduce the administrative and risk burden on conveyancers.

Phoebus

Website

Phoebus

Website

Building societies, banks, specialist lenders and third-party servicers use Phoebus to service over £120 billion of mortgage and savings assets in the UK and Ireland.

For over 30 years, Phoebus has been trusted to deliver automated servicing solutions to over 25 clients in the UK and Ireland. Its approach is to create a true working partnership with clients which drives measurable results and ROI.

The ability to service many different product types on the Phoebus servicing solution is recognised as a key strength. Multi-tenancy capability allows different brands to be serviced in accordance with different SLAs.

Phoebus manages even the most complex servicing needs and is widely recognised as the market’s most robust and accurate servicing platform. The Phoebus API ecosystem integrates customers to their accounts via mobile and web application and also integrates Phoebus with any internal or external applications required as part of an implementation.

If you’re seeking to digitise your operations and customer experience whilst driving impressive efficiencies through automation, Phoebus should be your partner of choice.

PMS

Website

PMS

Website

PRIMIS Mortgage Network

Website

PRIMIS Mortgage Network

Website

Primis is the market-leading mortgage and protection network. It is passionate about supporting brokers in running stronger and more robust businesses, through a combination of technology, education and training.

Primis aims to support brokers grow, diversify and protect their businesses whilst making sure they are ready to meet challenges, so they can continue delivering the high-quality advice that their customers rely on.

Sesame

Website

Sesame

Website

Simplify

Website

Simplify

Website

Simplify is the UK’s leading independent conveyancing and property services group, comprising six of the UK’s leading conveyancing firms, a market-leading property services specialist and a direct-to-consumer conveyancing brand.

Through its relationships with estate agents, mortgage intermediaries, house builders and property administrators, Simplify plays a vital role in helping the country move home.

As the market leader, Simplify has successfully helped hundreds of thousands of families move, and continues to help thousands more every year.

Simplify’s ambition is to simplify moving through a combination of hands-on customer care, legal expertise and innovative technology.

Skipton Building Society for Intermediaries

Website

Skipton Building Society for Intermediaries

Website

Skipton Building Society is known for its innovation, great service, and a common-sense approach to lending. Whether that’s using the latest technology to help straightforward cases fly through its system, giving you direct access to underwriters for more complex scenarios, or having a dedicated network of local BDMs and TBDMs to support you with questions and ideas.

With a clear purpose to help more people buy homes and supporting first-time buyers, Skipton listens to brokers and strives to drive meaningful change, influencing the market with solutions that truly make a difference.

Visit its website to explore products, criteria, and services designed with you and your clients in mind.

Target Group

Website

Target Group

Website

Target Group is a leading provider of software and servicing solutions for the lending and payments industry. With over 45 years of financial services experience, it combines cutting-edge technology, FCA regulatory expertise, and data-driven insights to deliver scalable, compliant platforms that enhance customer outcomes.

Trusted by major financial institutions and household brands, it manages over £17bn in assets, services 19 million customer accounts, and processes 14 million direct debits annually. Its end-to-end solutions span loan and mortgage servicing, collections, and automated payments — all designed to streamline operations, reduce costs, and improve customer satisfaction.

Target Group offers unmatched regulatory assurance. Its commitment to innovation has earned it industry recognition, including accolades for technology, inclusion and client partnerships.

Backed by Tech Mahindra and a $6bn balance sheet, Target Group is built for scale, resilience, and growth. But its greatest asset is its people — a team of dedicated professionals who turn service into partnership and transactions into long-term value.

Uinsure

Website

Uinsure

Website

Uinsure’s long term goal is to see insurance offered alongside every mortgage application and our industry-leading technology has completely removed the complexities from GI to allow this to happen.

We put our partners and their clients at the heart of everything we do, meaning buying insurance has never been easier and the support we offer has never been more thorough.

Vida Homeloans

Website

Vida Homeloans

Website

Virgin Money has 6.6m retail and business customers across the UK, bringing the best of the Virgin brand to make banking better and enable customers to achieve their financial goals.

As part of Nationwide Building Society since October 2024, Virgin Money is a purpose-led organisation offering a range of straightforward, award-winning products including current accounts, credit cards, savings, investments, mortgages, pensions, loans and more.

Rewarding customer experiences are delivered through its digital channels, branches, contact centres and relationship managers.

Through the Virgin Money Foundation and key partnerships, the bank also delivers positive change in society as part of its progressive sustainability and ESG agenda. An inclusive and ambitious culture encourages around 7,000 colleagues to work in a healthy, flexible, and digitally led environment. It is headquartered in Glasgow with major offices in Newcastle upon Tyne and London.