The estate agent noted that this meant prices had only risen 3.1% in the last year, with the average price of property coming onto the market at £313,663.

Despite growing transaction numbers according to the index, the summer has seen July prices rise just 0.1%, following a 0.4% dip in June.

Miles Shipside (pictured), Rightmove director and housing market analyst said: “With newly-marketed property seeing a monthly fall of 0.9% and a muted yearly rise of just 3.1%, the heat has come off much of the market.

“A combination of traditional summertime price blues and the chill of uncertainty in the air has cooled price growth in some parts of the country, and affordability also remains very stretched. But despite these factors, high demand and limited supply are still driving momentum, especially in the counties in the middle of the country.

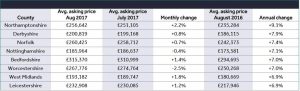

“Here, year on-year rises at over twice the pace of the national average are widespread, in contrast to southern and northern counties where none have approached these heady heights,” he added.

Best performing counties

Of the English counties that out-performed the 3.1% national average annual rate, over half are in the mid-regions of the country. This contrasted to only a quarter in the north and just a fifth in the south.

Of all the counties in England, 22 saw more muted price rises below the national average of 3.1%. Of those above the benchmark, only six were in the north and just five were in the south.

Jeremy Duncombe, director of Legal & General Mortgage Club said: “Even amid the ongoing uncertainty resulting from Britain’s Brexit negotiations, the fundamentals of the housing market remain constant as low interest rates play their part in keeping demand high.

“However, we need a long-term solution rather than a quick fix. Even if house price inflation is slowing slightly, there is still a chronic lack of suitable homes to buy and very little in the way of incentives to this. The campaign for Stamp Duty reform is starting to gain real momentum as the constraints of the tax are laid bare.

“The issue is deterring buyers from purchasing and stopping younger families who need extra space, or older homeowners looking to downsize from moving. The government needs to seriously reconsider the use of Stamp Duty and address the ways in which it is acting as a barrier to home ownership.”