Earlier today, the advertising regulator published details of a complaint received about the estate agent’s website which stated that it was “advertised on all major property portals”.

A complainant believed this was misleading.

The ASA said it had “received an assurance from Purplebricks that it would amend the claim.”

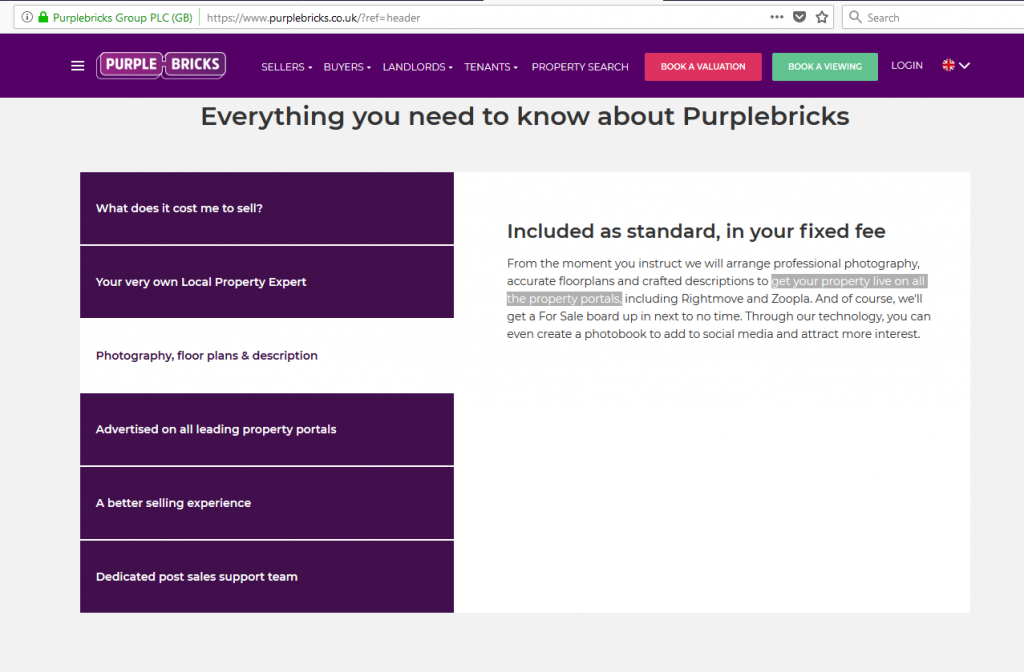

However, Mortgage Solutions today found that the estate agent’s website still includes the claim that its service will “get your property live on all the property portals” and that it will be “Advertised on all leading property portals”. (See image below)

As a result, the ASA confirmed that its complaints and investigations team had taken a dim view of the website claim.

“It does appear this claim (which is not the one brought to our attention) is likely to run contrary to our ruling. We will be contacting Purplebricks to get it amended,” the regulator said.

Purplebricks has been the subject of several ASA complaints including having TV ads banned but also having its claim to have local property experts upheld.

Purplebricks said it did not wish to comment on the situation.

Lendy

Peer-to-peer investment service and lender Lendy was also subject to a complaint received by the ASA.

A testimonial in an investment brochure stated: “They’re simple, easy to understand and give a very high rate of return.”

However, a complainant challenged whether this was misleading because it was a new investment product but the testimonial implied that there was a history of strong returns.

The ASA said it approached Lendy with the concerns and it agreed to remove the testimonial.

“On that basis we considered the matter resolved and closed the case informally,” the regulator said.

Lendy has not responded to a request to comment.