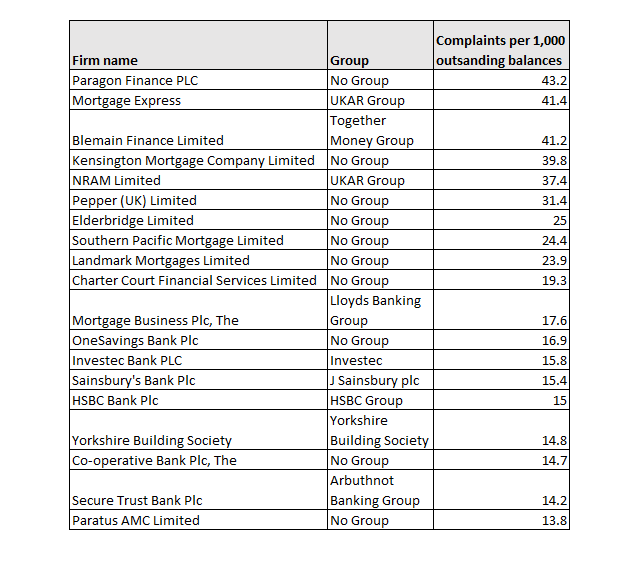

According to the Financial Conduct Authority (FCA) all three lenders received more than 40 complaints per 1,000 outstanding balances.

Paragon Finance led the way with 43.2, followed by Mortgage Express (part of the UKAR Group) with 41.4 and then Blemain Finance (part of Together Money) with 41.2 complaints per 1,000 balances.

Sixteen more lenders all had at least 10 complaints per 1,000 balances, including several high-profile firms. (Click table below to expand.)

Only three brokers had enough data to be included in the FCA data. Connells (part of the Skipton Group) stood out, recording 17.4 per 1,000 sales.

St James’s Place Wealth Management and Sesame received 2.2 and 2 complaints respectively, per 1,000 sales.

The FCA’s data for individual lenders and brokers came from different six-month reporting periods.

10% increase

In total, 3.32 million complaints were recorded by firms in the first half of 2017. This compares to 3.04 million in the second half of 2016. The total redress paid to consumers was £1.99bn in the first half of 2017.

Payment Protection Insurance (PPI) continued to account for the largest number of consumer complaints, with 82% of the total redress payments being for PPI.

The regulator said PPI made up a third of all complaints received in the first six months of the year.

Meanwhile “advising, selling and arranging” was the most complained about activity. These activities accounted for 43% of all complaints made in the first half of the year. This was down on the 59% recorded for the first six months in 2016.

Elsewhere, “general administration and customer service” accounted for 38% of all complaints. This was up on the 27% recorded for the same period last year.

Since June 2016, firms have been required to report data in a new way. The FCA said this had increased the number of complaints reported and meant making direct comparisons was problematic.

Christopher Woolard, executive director of strategy and competition, said: “We now require firms to report all complaints which gives us a fuller picture of where the industry might not be meeting customer needs.”

He added: “But even allowing for the change in reporting rules, and some progress made, the numbers are still significant. Firms need to do all they can to reduce complaints and ensure that they are working in the best interests of consumers.”