Landlord mortgage demand will remain hampered by low confidence over the coming years, as tax and regulatory changes continue to take their toll, the financial service trade body said in its 2018-2019 forecast released today.

Extra stamp duty, stricter lending criteria and a cut in tax perks are among the recent changes dampening buy to let.

Overall, UK Finance said it is only slightly more optimistic about the mortgage market over the next couple of years than it was 12 months ago.

The trade body expects £122bn of residential property transactions in 2018 – up from its forecast of £115bn this time last year.

At the same time, £260bn of gross advances are predicted next year – re-forecast up from £252bn.

In 2019, the trade body expects £122bn of residential transactions and £271bn of gross advances.

Brexit economic uncertainty is predicted to keep pressure on the market until 2019.

And UK Finance added that its forecasts also carry more uncertainty than usual, as the outcome of Britain’s withdrawal from the European Union remains unknown.

Buyers and sellers are expected to remain on the sidelines, as they wait for a clearer idea of the economic outlook, the trade body said.

Buy-to-let activity levels

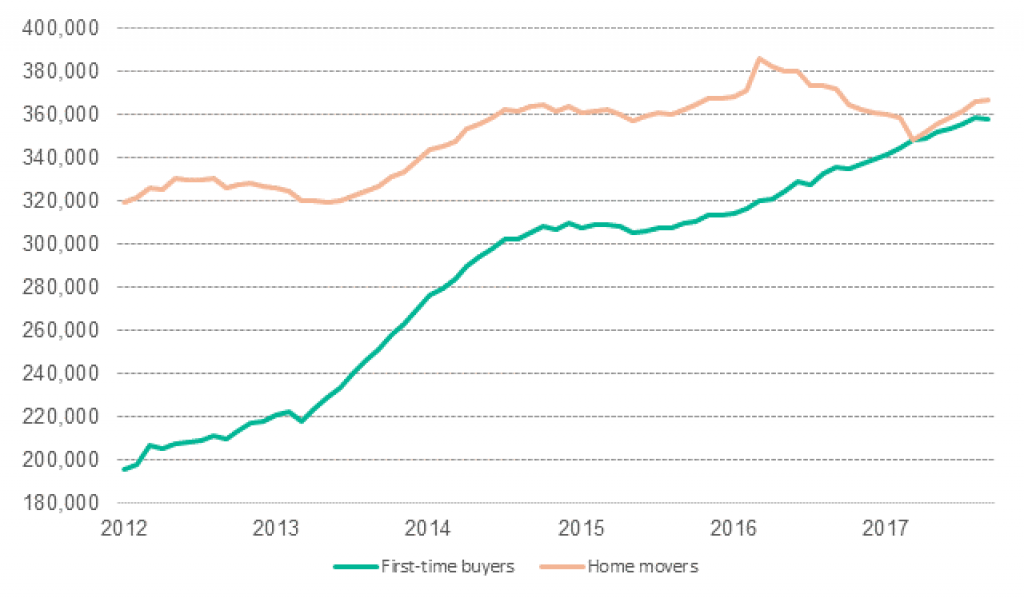

Number of first-time buyers and home movers

Homemover mortgages are forecast to make just a slight recovery from 2017 levels.

First-time buyers are set to underpin mortgage activity, after lending this year came in above expectations, the trade body said.

The remortgage market is also expected to stay strong over the next couple of years after a bumper 2017.

Low interest rates and competition within the mortgage market will help to buoy the market over the coming years, according to UK Finance.

Mohammad Jamei, senior economist at the organisation, said: “Regulatory and tax changes are amongst several factors that are reducing confidence in the buy-to-let market.

“This has led to subdued house purchase activity by landlords since the middle of 2016 and we expect more of the same over the next two years.”

He added: “We expect more first-time buyers over the next two years, helped in part by competitive mortgage rates and government housing schemes.

“Home mover numbers have recovered a little in 2017, but look set to remain flat over 2018 and 2019, as they have benefited less from government support and have been largely left to fend for themselves.”