After last year was dominated by a price war between lenders furiously cutting rates, it appears rates may be starting to rise as the economy comes out of lockdown.

Last week saw TSB, Barclays, Halifax, Santander and Accord raise rates, while NatWest re-entered the 85 per cent LTV market and Nationwide re-introduced its 90 per cent LTV offering.

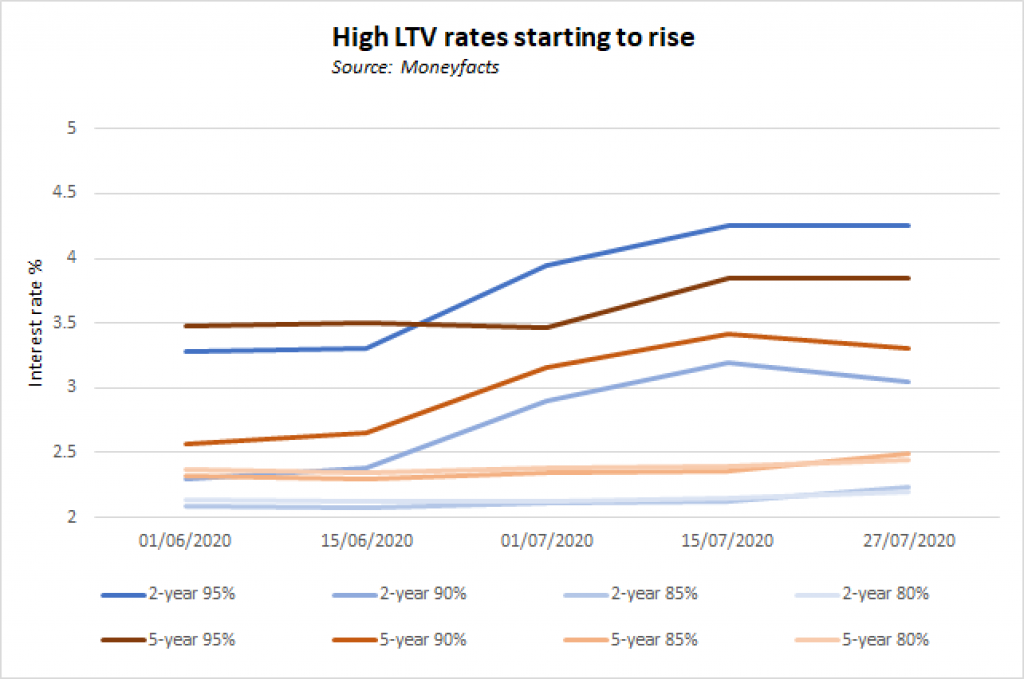

As a result, according to data provided to Mortgage Solutions by Moneyfacts, July has seen average rates in the 80 per cent, 85 per cent, 90 per cent and 95 per cent LTV bands creep up.

Perhaps unsurprisingly the highest two bands have seen the biggest increases given the turmoil in these areas as many lenders have temporarily entered and exited the markets to manage demand and service levels.

However, the 80 and 85 per cent LTV levels are now seeing rate increases as demand grows in these areas as well, especially after the stamp duty cuts announced in the last two weeks. (See graph below)

Tale of two halves

On 1 June the average 80 per cent LTV two-year fix was at 2.14 per cent, with the 85 per cent LTV equivalent being 2.09 per cent.

Both have now increased to 2.2 per cent and 2.23 per cent respectively – with the bulk of these rises taking place within the last two weeks.

The same situation occurred in the five-year fixed market – rates of 2.37 per cent and 2.32 per cent for 80 and 85 per cent LTV deals respectively have now grown to 2.44 and 2.49 per cent.

Again, most of this has been seen since 15 July.

In contrast, the 90 per cent and 95 per cent LTV bandings at two-year and five-year fixes saw the biggest moves between the middle of June and middle of July.

It is worth noting that especially in the 95 per cent sector, the majority of products remaining available are specialist options such as guarantor or family assist deals, and other limited criteria.

Rates creeping up

Eleanor Williams, spokeswoman for Moneyfacts, noted that after average mortgage rates plunged to historic lows in early July, those averages are now beginning to creep upwards.

“The spectre of negative equity should house prices drop was also a concern and likely factored into lenders risk assessments, although whether this fear will be borne out remains to be seen,” she said.

“Deals remaining for those with lower levels of equity in particular have seen unprecedented levels of borrower demand, which has implications regarding provider’s operational capacities and, of course, supply and demand.”

She added: “The mortgage landscape remains exceptionally fluid and while rates are beginning to increase, competitive deals are still available.

“Therefore those who are eligible and who are considering their mortgage options may wish to move swiftly, and also seek advice and support from a qualified, independent adviser.”