News

AI is ‘not going away’, says Koodoo, as tech achieves 94% CeMAP score

Artificial intelligence (AI) is not a “hype” or “fad” and is “not going away”, fintech and mortgage advice firm Koodoo said.

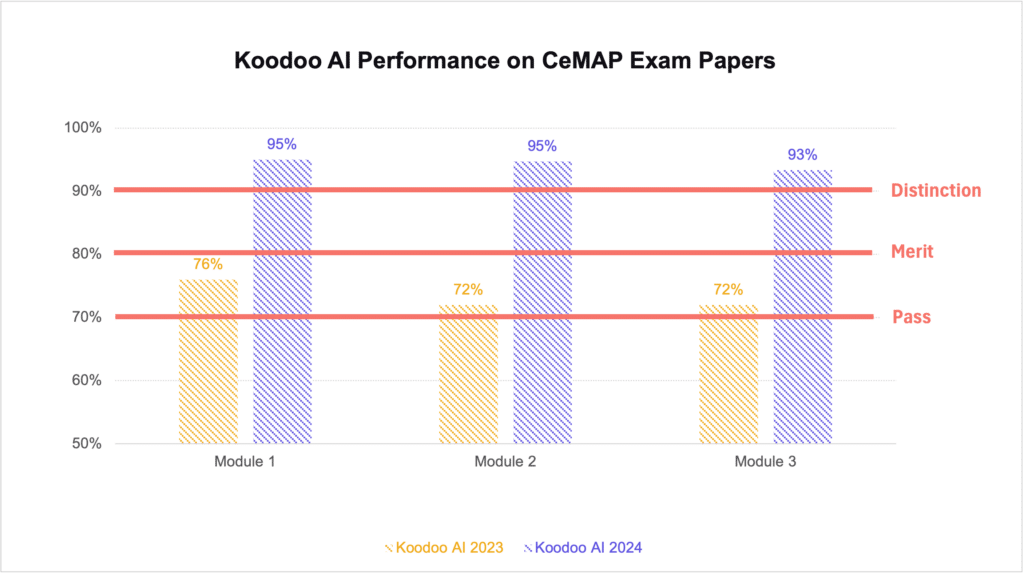

Speaking at its AI Decoded event today, Andrei Lebed (pictured), co-founder and CEO of Koodoo, announced its AI tool had been improved to pass the CeMAP exam with an average score of 94%, higher than the previous average of 70%.

The Koodoo large language model (LLM) was designed to support the advice process by answering mortgage questions comprehensively.

The firm said this was not expected to replace human advisers, but “underpin the ability to empower” them when advising.

The improved capability of its LLM made it more reliable and would give advisers confidence, Lebed said.

An LLM is technology that can recognise and generate text and is sometimes used to power chatbots.

How to get your first-time buyer clients mortgage ready

Sponsored by Halifax Intermediaries

Lebed said: “At Koodoo, we’re more convinced than ever that with the right approach, our AI can excel in structured, data-heavy exams and complex data processing. However, real-life scenarios are far more complex than any paper exam.

“That’s why our mission is to equip human advisers with top-tier tools that allow them to focus on what truly matters – engaging with clients, understanding their unique needs, and delivering tailored advice.”

He added: “Thanks to the enhanced reliability and precision of our AI applications, we’re seeing more effective decision-making, fewer mistakes in interpreting mortgage data, better support for our advisers, and, most importantly, happier customers.”

Getting on board with AI

Lebed said companies should be investing in upskilling employees to use generative AI to “hack their productivity”, adding that there were practical ways this could be done.

Generative AI is technology that uses images, video, text and synthetic data to create content.

Lebed predicted there would be a move away from more simplistic chatbots to full AI agents for assistance, with tools that would produce text, images and video and be powered by speaking instead of typing.

He said AI agents did not only have the ability to give and summarise information, but could also perform tasks.

Lebed used Klarna as an example, mentioning the firm’s decision to stop hiring customer service assistants after its AI tool managed two-thirds of queries and received favourable customer feedback.

Mansi Behl, lead mortgage and protection consultant at Koodoo, shared her experience and said the use of AI had “saved a lot of time”.

She said it helped the firm “massively” and allowed them to spend more time speaking with clients.

Jess Bateson, commercial and operations director at Koodoo, said it was helpful that the firm had its own mortgage advisers, as it allowed the firm to work its tech through any pain points.

Lebed said he wanted Koodoo to become the first 99% digital broker in the UK, with 1% of activity dedicated to relationship building, final checks and soft skills, but said the firm was not yet in a position to do this.

When asked if its technology could potentially exclude less-tech-savvy people, Bateson said the current mortgage process was “quite baffling” and “a little bit challenging” and Koodoo wanted to make the process more seamless.

Lebed said AI could be leveraged to make the process of identifying vulnerability more consistent.

Enhancing the mortgage process

Lebed said early-stage mortgage borrowers were not “served well” by existing rate comparison processes, and some applications dropped off or had to be restarted because of missing information.

Koodoo then announced the launch of its mortgage in principle (MIP) chatbot, which will go live next week.

It gives detailed responses to mortgage questions submitted by customers and can provide an estimate of how much they will be able to borrow.

Lebed said this could improve borrower understanding and the early mortgage process.

The MIP certificate can then be shared with an estate agent or builder.

The tool has been developed to ensure it does not cross the advice boundary, Lebed said, as it does not give advice or make recommendations even when prompted.

Lebed said: “What we’ve been worried about at Koodoo is if we put this in front of customers and we have regulated mortgage advisers, how do we make sure that this doesn’t accidentally try to do too much? How do we make sure it doesn’t pass the interaction trigger and actually provide advice to customers?”

“Specific guardrails” have been put in place so the tool will always encourage customers to seek advice, Lebed said.

Improving efficiency

Discussing Koodoo’s call checking tool, the firm it enabled 100% of calls to be screened and assessed within 5-15 minutes.

The tool flags any cues that a broker has missed or failed to follow up on during a call, such as potential vulnerabilities.

It also scores each interaction a broker has with a client with suggestions for improvements.

Jon Painter, chief executive of loan provider Oakbrook Finance, also spoke about his firm’s pilot of Koodoo’s document checking tool for income verification.

He said this had made a “massive improvement” to the firm’s operations. It said the old process took “1-2 hours” because customers had to submit information more than once to get it right.

Since using Koodoo’s technology, Oakbrook Finance has achieved a 98% first-time-right completion rate for documents.