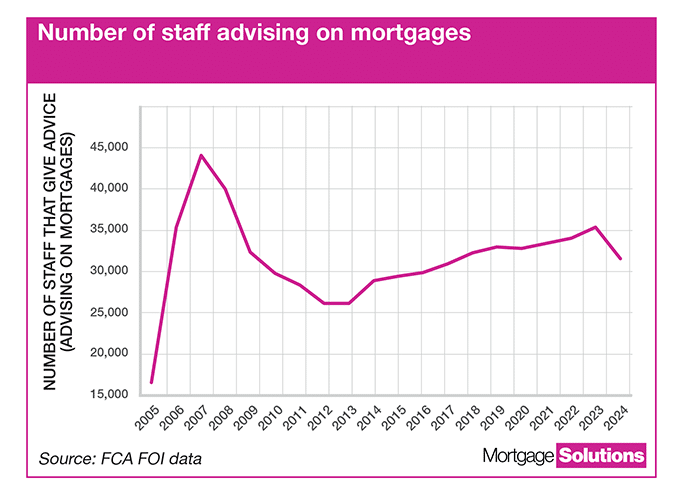

According to a Freedom of Information (FOI) request sent to the Financial Conduct Authority by Mortgage Solutions, the number of staff who give advice on mortgages had been relatively steady since 2020, increasing by between 2% to 4% each year.

The last time adviser numbers fell was in 2020, with a slight decline of 1% year-on-year, and the last time adviser numbers fell by double digits was in 2009, when numbers crashed by 19% year-on-year to 32,381.

The fall in advisers has been attributed to a variety of factors by industry professionals, including increasing regulatory pressure, a volatile economic environment, struggles with recruitment and retention of new talent, and an ageing adviser population.

Aldermore Insights with Jon Cooper: Edition 5 – Feeling enthusiastic about next year’s run-of-the-mill market

Sponsored by Aldermore

The decline highlights the importance of recruiting younger people to the mortgage market, many industry professionals have said.

Stephanie Charman, chief executive of the Association of Mortgage Intermediaries (AMI), said that while the fall in adviser numbers was “disappointing”, it was “sadly not unexpected”.

“The last time we saw such a significant decline was after the financial crisis. This recent decrease reflects the cumulative impact of a challenging few years. The demands of the role as an adviser are significant, with increased regulation, a negative work/life balance, coupled with rising business costs and falling revenue, have made the role unsustainable for many. Combined with an ageing adviser population, this presents a pressing challenge for the sector,” she added.

She said that the sector was at an “inflection point”, pointing to the growing role of technology in the advice process.

Charman said the industry recognised the “urgent need” to attract new talent, but “recruitment is not without its challenges”.

However, she pointed to national and network-led academies or individual firms locally expanding their businesses, as well as the Working in Mortgages mentoring platform and Mortgage Industry Mental Health Charter as two initiatives “dedicated to supporting the outstanding individuals who make up the profession today and ensuring the long-term sustainability of the sector”.

“As the sector continues to evolve, we must champion the next generation, bringing fresh perspectives, diversity, energy, and innovation. Futureproofing advice businesses means not just attracting young talent but creating clear, visible pathways for development.

“We have a real opportunity to help people build meaningful, rewarding careers in mortgages, but raising awareness of the advice role itself is the first step,” Charman concluded.

Market size and adviser numbers connected

Ben Thompson, deputy CEO at Mortgage Advice Bureau, said there was a “correlation between market size (gross lending and product transfers) and adviser numbers”.

He explained that in 2023, there was a 29% fall in the purchase market, followed by muted activity in 2024, meaning “fragile recovery stalled”, and adviser numbers decreased.

Thompson said that the period from 2020 to 2022 was “financially rewarding but incredibly tough”, and the “sheer demand was difficult to service, and advisers worked hard to keep up”.

“The subsequent mini Budget crash meant that many advisers had had enough – especially those without large client banks or consistent new leads,” he said.

Thompson said the market tends to see a “lag effect” as it takes around 12 to 18 months for adviser numbers to pick up, so confidence and heightened activity need to come back before recruitment opportunities rise.

However, Thompson said the “adviser recruitment landscape is certainly competitive, with vacancies that clearly need to be filled”.

“This is a positive sign, indicating ongoing demand within the financial advice sector. It suggests that, despite recent market shifts, firms are actively looking to expand their advisory teams to meet client needs,” he said.

Sebastian Murphy, group director at JLM Mortgage Services, said the fall in adviser numbers was “worrying but sadly not surprising”.

He pointed to the hangover from a “turbulent 2023 market”, growing regulatory and compliance demands, such as recent FCA moves to make execution-only easier.

“It all risks undermining the value of advice and the number of advisers working, particularly when paired with such issues as the continued lack of progress on procuration fee parity for product transfers, which makes it harder for advisers to earn a sustainable living, even when carrying out the same level of work and taking on the same risk,” he noted.

| Average salary per year | Typical hours per week |

| £27,000 to £70,000 | 36 to 42 hours |

Source: National Careers Service

Murphy said that if these trends “continue unchecked”, adviser numbers could fall further with a “clear knock-on effect for consumers’ access to advice”.

“Fewer advisers inevitably means more people making mortgage decisions without expert, regulated input, which runs counter to what we are supposed to be seeing, namely an increase in positive consumer outcomes delivered via the Consumer Duty,” he said.

John Phillips, CEO of Just Mortgages and Spicerhaart, said the mortgage market is made up of a “core group of resilient advisers”, but there was “no question that the sector has been losing numbers”.

He noted that this was especially the case for new entrants, who may be struggling to find their feet in a changeable market, or more advisers looking to retire.

“Given that the average age of an adviser is on the high side, this is a fundamental issue that the sector will continue to face and requires urgent action if we want to ensure the majority of mortgages remain advised.

“Academy propositions are essential in creating a pathway into the sector, and a number of firms are already generating good results for those with a CeMAP qualification,” he noted.

Focus should on skills and aptitude rather than qualifications

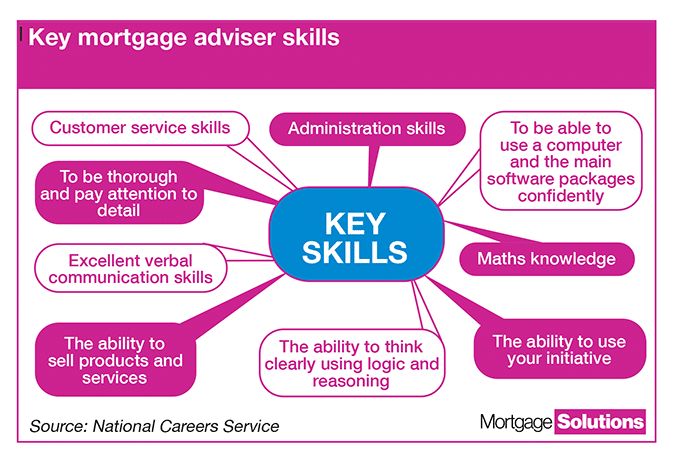

Phillips continued that to “backfill the talent pool”, the sector must support those who do not have qualifications but have the skills and aptitude for a career in advice.

He pointed to Just Learning, which is a comprehensive training course to help attendees achieve their CeMAP 1 qualification, with those successful securing a guaranteed interview with the business.

| College | Apprenticeship |

| Recommended courses:

· Business · Business and administration · T Levels in Finance

|

Recommended courses:

· Mortgage Adviser Level 3 Advanced Apprenticeship · Financial Adviser Level 4 Higher Apprenticeship. |

| Entry requirements:

4 or 5 GCSEs at grades 9 to 4 (A* to C), or equivalent, including English and maths for a T Level

|

Entry requirements:

5 GCSEs at grades 9 to 4 (A* to C), or equivalent, including English and maths, for an advanced apprenticeship

4 or 5 GCSEs at grades 9 to 4 (A* to C) and A levels, or equivalent, for a higher or degree apprenticeship |

Source: National Careers Service

“As a sector, we don’t always do a very good job of promoting the benefits and growth opportunities offered by a career in advice. As unemployment numbers climb, we have an opportunity to connect with talented and ambitious people who have been dealt a blow, provide a pivot and help them unlock a fulfilling career as an adviser.

“Once we have them, then the priority becomes ongoing mentoring, training and development to ensure they are supported and able to reach their full potential,” he noted.

Within JLM Mortgages, Murphy said it had invested heavily in recruitment support for AR firms, helping them “bring in and train new-to-market advisers, career switchers and graduates, with structured mentoring and supervision to accelerate competence”.

“Being an adviser is still a fantastic career with the ability to make a real difference to clients and a growing array of opportunities. But unless the industry – and regulators – recognise the importance of supporting advisers properly, we risk sleepwalking into an advice gap that will ultimately harm the very consumers regulation is designed to protect,” he said.

Amanda Wilson, commercial and strategy director at The Right Mortgage & Protection Network, said that “bringing in the new blood to replace those who have left can be a difficult process for firms, especially if they don’t have any support in this area”.

She said that there had been “significant interest” in its Retirement Plan, which is a “structured initiative” available to all advisers in the industry that “supports those transitioning out of the profession in an orderly way”.

This, in turn, has “helped create space for fresh talent to come through”, Wilson said.

“We’re heavily focused on bringing that new talent into the industry. From tailored recruitment support for member firms to training, mentoring and structured development for career changers and graduates, we’re investing in the next generation of advisers and helping them build sustainable, long-term careers. The profession remains hugely rewarding, and with the right support in place, we see this as an opportunity to reshape the adviser community for the future.”

Attracting new talent is ‘difficult’ but needs addressing

Thompson said that while the mortgage market was in “need of new talent”, there was “no obvious entity or body currently funding or investing in attracting new brokers effectively”.

He noted that decades ago, the financial services had done an “excellent job” but this “support has stopped, and that void remains unfilled”.

“While attracting new talent is very difficult, now is a good time to address this, as the market’s current trajectory highlights the urgent need for a robust pipeline of new advisers.

“Attracting a new generation to our industry hinges on improving its perception. We must actively challenge the outdated stereotypes of a commission-led, targets-driven, and long-hours culture. Instead, we need to highlight the rewarding aspects of a career that directly helps customers achieve their dreams of homeownership,” he said.

Toni Smith, director of Sesame, agreed, adding that the sector has a “duty to bring new people into the profession and give them the support they need to succeed”.

“The adviser population is ageing, and without action now, we risk creating a gap in future provision that could impact client outcomes for years to come. This is about more than numbers. It’s about ensuring firms are future-ready – diverse, resilient, and representative of the communities they serve.

“We’re proud to be supporting that, both through our recruitment efforts and the wider work of trade bodies like AMI and IMLA, who are pushing for long-term solutions to address the adviser gap,” she said.