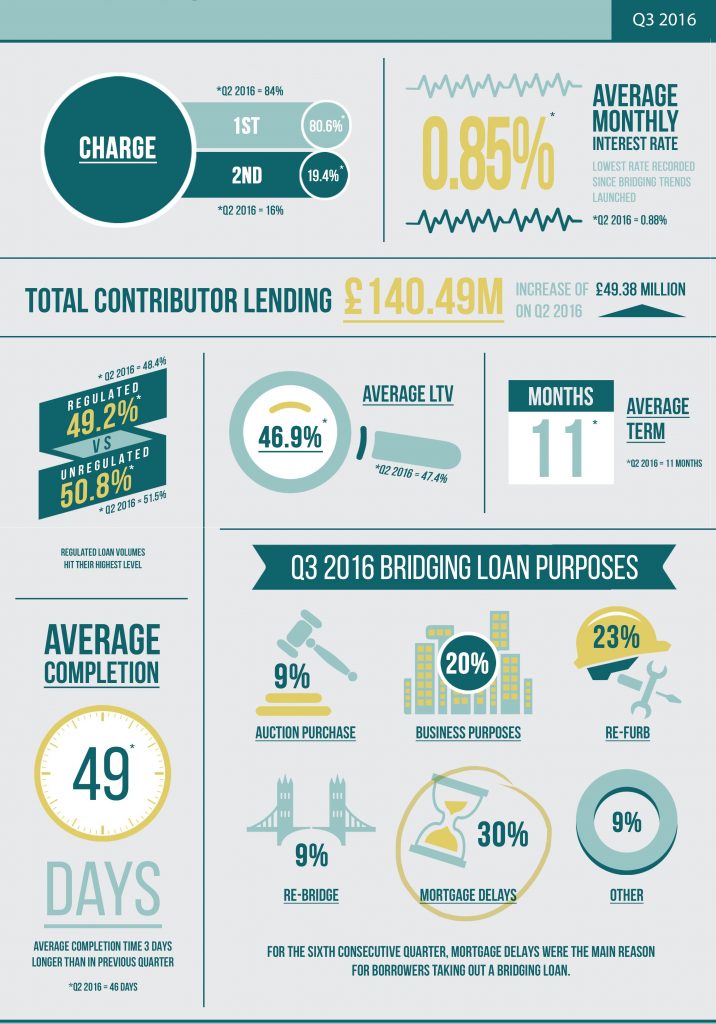

Third quarter volume was 54% higher, at £140.49m, than in the second quarter and up 6.6% on the third quarter last year, when volumes reached £131.7m. Contributors said there was strong demand for bridging finance as investors and developers looked for quick and accessible alternatives to traditional bank lending.

Second legal charge lending increased to 19.4% of all loans during Q3, from 16% in Q2, despite several lenders temporarily stopping second charge lending following the Brexit decision.

Bridging Trends is a quarterly survey combining data from bridging lender MT Finance and specialist finance brokers Brightstar Financial, Enness Private Clients, Positive Lending and SPF Short Term Finance.

Chris Borwick, associate director of Savills Private Finance, said the market “has actually turned out to be quite resilient”. “We have certainly seen an increase in most areas with enquiries coming in of all shapes and sizes. Market uncertainty has created opportunities for property investors, but also disruptions in normal residential transactions, so investors are looking to bridging finance in order to capitalise.”

Unregulated bridging loans continued to outstrip regulated bridging loans, though the gap is starting to close, with the number of regulated loans climbing to 49% of all lending. Average monthly interest rates in bridging fell to a low of 0.85% in the third quarter, dropping from 0.88% in the previous quarter and 0.92% in Q3 2015.

Joshua Elash, director of bridging finance for MTF, said the rise in regulated lending, attributed to the implementation of the Mortgage Credit Directive (MCD), was causing delays.

“This larger total percentage of regulated lending appears to have had an adverse impact on the average time a loan takes to complete, and more positively on the average weighted monthly interest rates being charged,” he said.

Kit Thompson, Brightstar’s director of bridging loans, said on average, it is taking three days longer to turn around a bridging loan compared to Q2 this year when the average completion time was 46 days.

“This is largely down to delays with valuations, down-valuations and legal delays, something which the sector (and wider industry as a whole) continues to struggle with. That said, new bridging enquiry levels remain high and there are plenty of funds out there to be deployed. It just takes longer to get these loans through than previously. This could indicate that lenders are becoming slightly more vigilant.”

Average loan-to-value (LTV) levels fell to 47% in Q3 from 47.4% in Q2, which the monitor said could be attributed to a number of specialist first charge lenders removing high LTV products from their ranges.

For the sixth consecutive quarter, mortgage delays were the most popular reason for borrowers to access a bridging loan, accounting for 30% of all bridging loans, in line with the previous quarter. Refurbishment was the second most popular reason for getting a bridging loan at 23%, following by business purposes at 20%.

However Chris Whitney, head of specialist lending at Enness Private Clients, said the term ‘mortgage delays’ was misleading. “Based on experience they aren’t delays as such but just a mismatch of timing between the speed at which the client’s preferred long-term lender can get funds in place and the timing of the desired transaction. The high street banks, and also challenger banks, are actively lending but the processes they have in place are just taking longer and longer in many cases several months.”

He added: “I think regulatory pressure and even more stringent liquidity rules will only see the larger banking institutions become even less user friendly.”