The August meeting was the last interest rate vote undertaken by Ian McCafferty, who retires from the committee at the end of this month and will be succeeded by Jonathan Haskel.

During the MPC meeting, the committee agreed to keep the stock of UK government bond purchases at £435m.

In June, the bank emphasised an “ongoing tightening of monetary policy”, yet the reasons for holding the rate at 0.5% then were linked to the slow growth of the UK economy in the first quarter, with GDP growth for the first three months of the year at a meagre 0.2%.

However, stronger economic data in Q2 was a big driver for the MPC to act on tightening monetary policy this month.

The MPC committee also revised upwards its forecasts for growth and inflation.

However, the Consumer Prices Index (CPI) forecasts from the August inflation report, despite being revised higher, remain only marginally above target, at +2.2% in 2019 and +2.1% in 2020.

The forecast expects inflation to finally come back below the 2% target mark in 2021.

Manufacturing bordering on recession

The short-term economic outlook for the UK continues to be uncertain.

On the one hand, the manufacturing sector is now bordering on a recession; on the other, construction and services were lifted by the heatwave in the three months up to June.

Meanwhile, the looming shadow of Brexit negotiations continues to cast uncertainty over the economy as a whole.

Mark Carney reiterated the “gradual pace” and “limited extent” of tightening. He also emphasised that the bank’s economic forecasts are conditional on a “relatively smooth transition” for Brexit.

Therefore, the market does not expect an aggressive pace of tightening in the near term, until there is more certainty around the Brexit negotiations.

Following the interest rate hike, UK markets are softer with the pound sterling hitting a one-year low of $1.27 against the dollar.

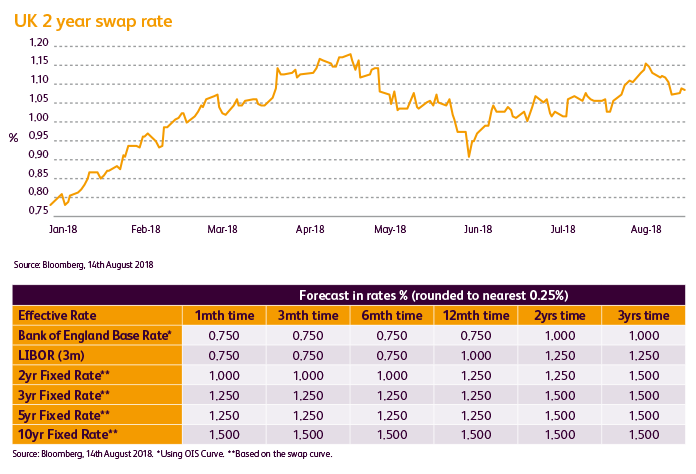

UK rates have also experienced a significant decrease across August; two-year swap rates peaked at 1.14 on the day of the rate’s hike and are currently trading within the 1.07-mark.

Three years to 1%

It is believed that UK markets failed to rally as a result of the continuing Brexit uncertainty and the neutral comments from Mark Carney after the announcement.

Due to the latest rate rise, the market does not expect any change in rates over the next 12 months. The borrowing base rate is expected to reach only 1.00% within three years.

In the swap markets, current market predictions expect the two-year rate to remain close to 1.00%, before rising to 1.25% in 12 months’ time and then 1.50% at the three-year mark.

Five-year swap rate predictions are at 1.25% for at least a year.

Similarly, market expectations have not changed for ten-year fixed swaps, which is predicted to stay at the 1.5% mark for at least two years.