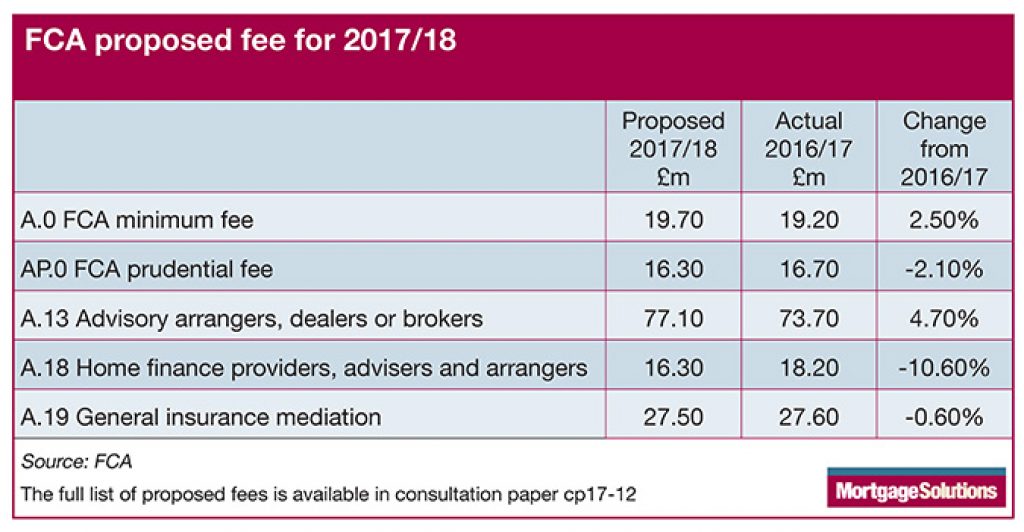

The regulator’s proposal means members of the A.18 Home finance providers, advisers and arrangers block would pay a combined £16.3m, down from £18.2m in 2016/17.

However, intermediaries falling in to the wider advice category (A.13 Advisory arrangers, dealers or brokers) face a 4.7% hike in their levy. (See table for full details.)

The regulator has also proposed increasing base fees charged by itself and the Prudential Regulation Authority by 1% to match inflation.

“We are proposing to increase 2017/18 minimum and flat fees by 1% to reflect the inflation increase in our ongoing regulatory activities (ORA),” it said.

“We are also proposing to link minimum fees and flat fees to future movements in our ORA. Such a link will mean that the level of minimum fees and flat fees will reflect increases in our costs over time rather than only variable fee-payers picking up these increased costs (or any decreases in our costs as applicable).”

Cost of Brexit

Overall, the FCA projected its budget for 2017/18 to be £526.9m.

This is an increase of £7.6m (1.5%) over the annual funding requirement (AFR) for 2016/17 and is driven by an inflation aligned £5.1m (1.0%) increase in ongoing regulatory activities and £2.5m for EU withdrawal costs.

The FCA said it expected to end 2016/17 with an approximate £10m underspend in our ORA budget, having made an additional contribution of £10m in support of our ongoing annual contribution to reducing the former-Financial Conduct Authority pension deficit.

It is proposing to retain this £10m as reserves to help mitigate future costs including moving to new offices at The International Quarter in Stratford next year and further EU withdrawal costs.

Brokers can respond to the consultation until 9 June.