Overall, buy-to-let (BTL) gross lending totalled £42.2bn in 2019, up 4.2 per cent on 2018.

Unlike the residential mortgage market, buy to let is far less concentrated in a handful of lenders, however despite this, the same big six banks still saw their BTL market share increase by 4.7 per cent and accounted for £20.63bn of new lending – almost half the market.

Top two

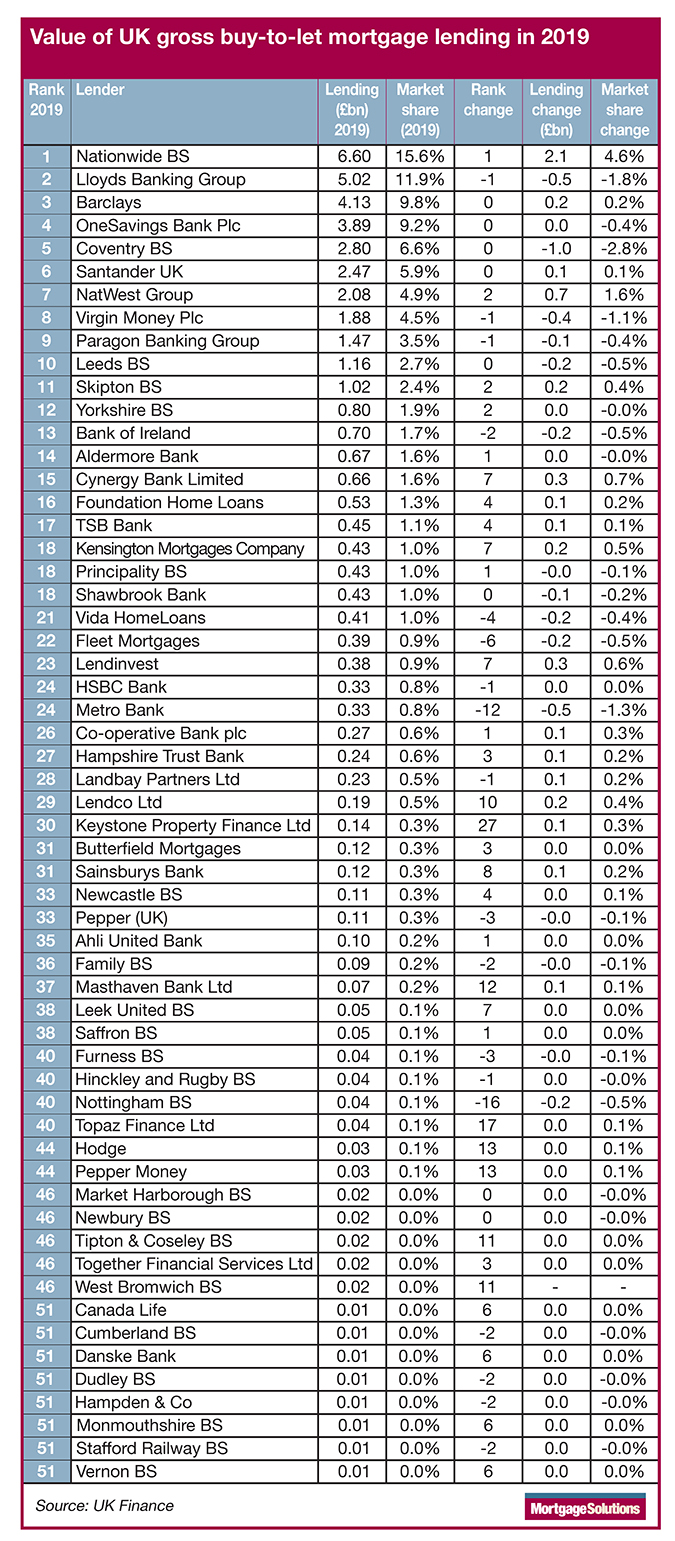

TMW grew its new BTL lending by £2.1bn to complete £6.6bn, taking a 15.6 per cent share of the market and leapfrogging BM Solutions for top spot. (See table below)

As the buy-to-let market has become more complex following tax and regulation changes TMW began rolling out a limited company proposition in 2018 to support landlords who are increasingly choosing this method of ownership.

In contrast, BM Solutions saw its new lending fall by around £500m as it completed just over £5bn in BTL business, with 12 per cent of the market.

The lender, which is part of Lloyds Banking Group, has chosen to focus on traditional mainstream landlords and has yet to introduce a limited company product, but has expanded its offer to include larger portfolios.

Major movers

Coventry Building Society, with its Godiva brand, Virgin Money and Metro Bank were among the big name lenders to see their market share fall.

Coventry BS remained the fifth largest buy-to-let lender, completing £2.8bn worth of loans, but this total was down £1bn on 2018.

Virgin Money completed 1.88bn of lending, down £400m from the previous year, while Metro Bank was hit with capital and regulation issues which saw it cut lending by more than half to around £330m.

Meanwhile NatWest grew its BTL business by £700m to complete £2.08bn of lending, becoming the seventh largest lender in the market – leapfrogging Virgin Money and Paragon.

And the completed One Savings Bank merger, which includes Precise Mortgages, Kent Reliance and Interbay Commercial, saw it combine to become the fourth largest lender with £3.89bn of completions.