Accord, Skipton, Coventry and Bank of Ireland joined the flurry of lenders withdrawing fixed rate ranges, Moneyfacts confirmed, following a raft of lenders yesterday, including Halifax’s announcement it would remove all products with a fee.

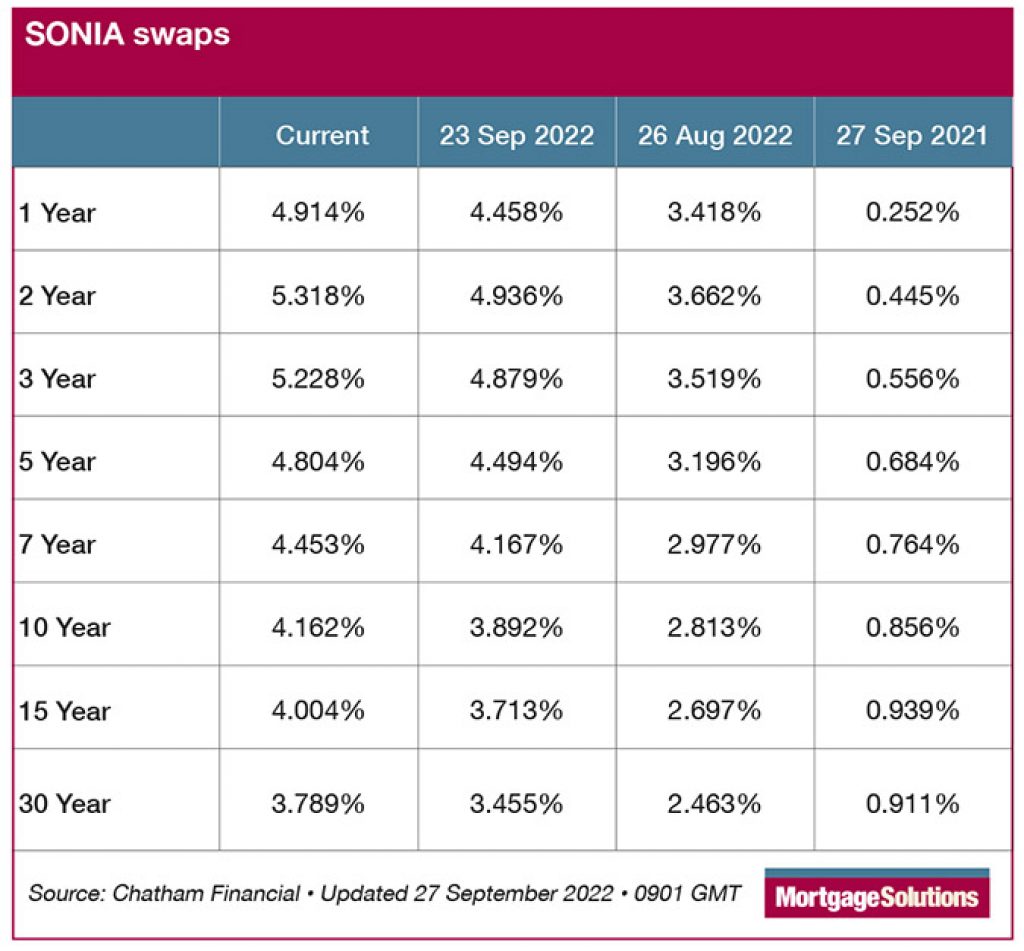

Sterling Overnight Indexed Average (Sonia) rates continue to skyrocket (see table below) forcing lenders to pull fixed rate products off shelves and into a dilemma over how to reprice any new fixed rate products.

In the last 48 hours, product changes have been in excess of 300 per cent higher than the same period in 2021, according to Twenty7Tec and Moneyfacts figures suggest mortgage products have tumbled from 5,318 in December last year to 3,596 this morning.

Sterling fell against the USD to a 50-year low of 1.0350 during Asian trading hours when markets opened on Monday and two-year UK government bond yields rose to 4.45 per cent, 115-basis points higher than on Thursday morning. Overnight index swaps signal that money markets are now expecting UK base rates to rise to more than six per cent by summer 2023.

‘The rates are changing every 20 minutes’

The swap markets continue to outpace lender ability to price responsibly and show no signs of settling. Accord Mortgages MD and director of mortgage distribution at Yorkshire Building Society Jeremy Duncombe said lenders are reacting with their own strategies but that the risk of offering unprofitable products or mispricing at an uncompetitive level was immobilising providers right now. Accord was forced to withdraw its fixed range at midday today,

Overall, lenders remain well-capitalised, with an appetite to lend but are simply struggling to find the price point. Many bigger lenders have a hedging strategy to protect against market volatility, but it can only last for so long, he added.

“Lenders have to lend both profitably and responsibly and we have to make decisions based around that,” he added.

“Swap rates will stabilise at some point and lenders will come back, but we don’t know how long this will last. Input from the government or the Bank of England is what’s needed and will lead to another market reaction, either positive or negative,” he said.

Another mid-sized lender told Mortgage Solutions: “We’re trying to hedge the markets and the rates are changing every 20 minutes. We are regulated for a reason and have a responsibility to make sure borrowers can afford the eventual mortgage. With fixed rates potentially being priced at over seven per cent this is a factor for lenders right now.

“The division between those who can afford to buy and those who can’t is growing. The government is going to have to step in and help.”

Lenders reviewing their pipelines

A specialist lender said residential borrowers with mortgage offers can rely on that in a regulated environment, but warned borrowers in the unregulated buy-to-let market or those who have just put their application in may have to start again as lenders review their pipelines of business.

“Depending on the size of lender, its funding arrangements and volume in that pipeline, there will be some lenders who simply won’t be able to offer loans at prices made available six weeks ago,” he said.

“Those lines will be haemorrhaging profit and it’s a real risk for customers and the brokers who will have to revisit those cases. It’s a horrible conversation, both for the lender to the broker and the broker to the customer, but it’ll be all about working partnerships under trying circumstances.”

Scanning the horizon

On the specialist buy-to-let mortgage market side, another lender told Mortgage Solutions that the market should expect specialist lenders to withdraw gradually from the high LTV product space, responding to the likely shrink in demand.

Some buy-to-let lenders will be considering offering high fees of around four per cent in exchange for lower interest rates to allow larger scale borrowers to fund their investments, alongside simpler, more streamlined product ranges, Mortgage Solutions understands.

Meanwhile, Lloyds-owned Halifax, which was one of the first big lenders to react yesterday, confirmed plans to make further product changes tomorrow on its fee-free range in response to swap market volatility.

Brokers calming clients

Brokers continue to reassure clients with reserved fixed rate mortgage deals that their mortgage is still available to them, and variable rates, which are being priced upwards across the market, continue to be on offer.

Adrian Anderson at Anderson Harris said: “The situation right now brings flashbacks of 2008. Banks temporarily withdrawing mortgage products because of turmoil in the financial markets is almost unheard of. It feels like, for a short period of time, there may not be any fixed rates available for new customers and my clients are the most anxious they have been since the financial crisis 14 years ago. We have had existing clients getting in touch asking us to second guess what their mortgage payments may be in the future.

“If the Bank of England does raise the base rate to five or six per cent as some analysts now predict, mortgage rates will quite simply be unaffordable for many borrowers. And those that can afford their mortgages at these very high interest rates will have very little disposable income, therefore households will not be spending and supporting the economy which was the intention of the mini-budget.”