The alarming results show that lenders operating directly take more cases from remortgaging borrowers than they do new mortgages initially.

Indeed, the reversal of outcomes is so stark that the market share has been totally reversed by the time borrowers complete their remortgage.

With new property purchases severely limited under the present coronavirus restrictions, this means brokers will need to place a far greater emphasis on retaining their current customers and reverse this trend.

Mortgage Solutions analysed Financial Conduct Authority (FCA) data published in the occasional paper number 54, When discounted rates end: The cost of taking action in the mortgage market.

This was commissioned as part of the FCA’s compliance with the Competition and Markets Authority (CMA) investigation into the cost of mortgage loyalty.

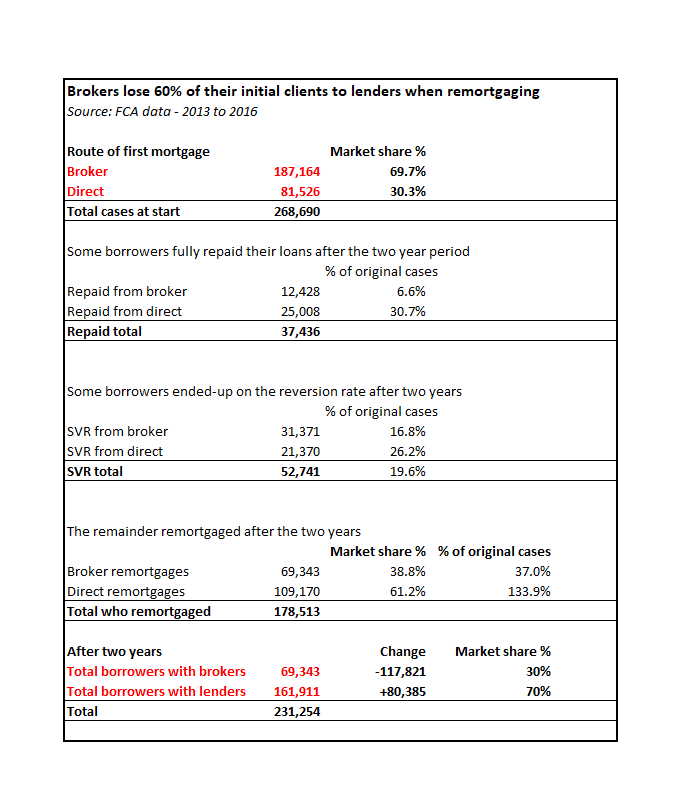

The FCA followed the progress of almost 270,000 new two-year fixed rate mortgages taken out between July 2013 and June 2014 for a house purchase.

It then tracked the outcomes of these mortgages between January 2015 and December 2016, providing a six-month extension at either end of the 24-month initial rate period.

The results were generally encouraging for brokers, showing they were far better at ensuring the borrowers they dealt with did not end up on the reversion rates and remortgaged either internally or externally.

Losing remortgage battle

However, the total number of customers they dealt with fell sharply at the end of the process, as the chart below shows.

Of the 268,690 new mortgages originally issued at the start of the time period, 187,164 were completed through a broker, giving intermediaries a 70 per cent market share.

Just 81,526 new house purchase mortgages were completed directly with lenders, giving them a 30 per cent market share.

However, the analysis shows that by the time it came to remortgaging, brokers only completed a deal on 69,343 of those original mortgages – more than 100,000 fewer than were done at first.

In contrast, 109,170 remortgages, including internal switches, were completed directly with lenders – over 25,000 more than were done two years earlier.

Stuck on SVR

Lenders also retain all those customers who fail to remortgage and instead slide on to the standard variable rate (SVR) at the end of the term.

And once borrowers who pay off the loan are factored in, lenders can claim 161,911 borrowers out of the original 268,690 cases which were completed – only 81,000 of which were done directly with them to start with.

This gives lenders a 70 per cent to 30 per cent market split – a complete reversal of the original position.

While the data reflects a market from four years ago and brokers have made improvements to retention strategies since, it serves as a strong reminder as to how much work there is for brokers to do if they wish to retain their market position.

‘Way to get through this’

TMA director of mortgage services David Copland said he was not surprised by the original results and that brokers needed to focus on this part of their business.

“Some brokers are working hard on existing clients but not I’m not sure all brokers have been working hard enough, meanwhile lenders have been really focusing hard on these borrowers,” he said.

“In the market where there’s not much face-to-face business going on brokers have got a great opportunity, but only when putting themselves out there.

“They need to lean on their existing client bank, use technology and do contact them regularly. That’s a way of getting through this situation,” he added.