Aspen Bridging director Jack Coombs explains how understanding some of the finer points managed to save a previously dead deal at the last minute.

The challenge

The borrower was originally acquiring a property with term finance which they planned to develop into a small house in multiple occupation (HMO).

However, this fell through at the eleventh hour when the lender discovered that the geographical area fell under Article 4 direction.

An Article 4 direction is made by the local planning authority.

It restricts the scope of permitted development rights either in relation to a particular area or site, or a particular type of development anywhere in the authority’s area.

Where an Article 4 direction is in effect, a planning application may be required for development that would otherwise have been permitted development.

Article 4 directions are used to control works that could threaten the character of an area of acknowledged importance, such as a conservation area.

In this instance the application showed that the property had established use as a single dwelling house, which comes under planning use class C3. The new owner wanted to use it as a small HMO which is planning use class C4, and that required planning consent with the local authority and property owners in the area.

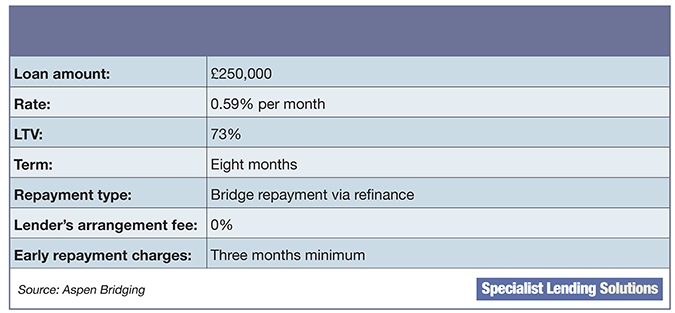

The deal

The solution

After the initial lender pulled out of the deal the broker contacted Aspen Bridging to try to find a solution.

Added to the legalities was a very tight timescale, with the borrower needing to complete in four days otherwise their deposit would be lost.

Aspen undertook research and could prove that the property had been operating as a small HMO for more than 10 years, thus falling outside Article 4 direction’s remit through time elapsed.

A £249,928.29 gross facility was agreed which represented a 73 per cent loan to value (LTV) semi-commercial deal, with purchase completed in under four days.

Exit was planned through a switch to term finance.