However, two-thirds of people believe their property is worth more than their pension.

According to research from Retirement Advantage, 57% of people did not believe taking on debt in retirement was normal – this rose to 75% in over-55s.

Data from the Equity Release Council earlier this month revealed that equity release lending broke the £2bn barrier for the first time last year, indicating this attitude could be changing.

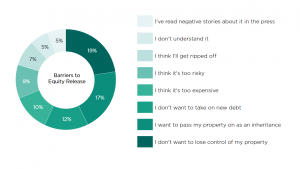

When asked about why they would not want to use equity release, the most popular reason was not losing control of their property (19%), followed by wanting to pass it on as inheritance (17%). (Click graph to enlarge.)

When asked about why they would not want to use equity release, the most popular reason was not losing control of their property (19%), followed by wanting to pass it on as inheritance (17%). (Click graph to enlarge.)

In its Home Truths report, the lender said this provided an opportunity for the industry to correct misconceptions and demonstrate that equity release could help people achieve their goals while remaining stable and in charge of their property.

This could be even more telling when 63% of those surveyed thought their property was worth more than their pension, compared to just 21% who thought the opposite.

Downsizing ambitions

Despite most of the 1,000 people surveyed wanting to remain in their current property for as long as they can as they get older, 26% planned to downsize when they retired.

However, as Later Life Academy managing partner Stuart Wilson noted earlier this month, that may not be as easy as they expect.

There was also a cautious note about retirees entering the buy-to-let market, as 51% said this would be unlikely for them.

The report found that people with a larger property were more aware of its value as an asset and more likely to use its value as such.

Those who own detached properties are twice as likely to agree it is normal to take on new debt in order to provide themselves with more money in retirement (41% compared to 20% of the average population).

Retirement Advantage Equity Release head of marketing Alice Watson said: “It’s clear that the type of property owned matters when considering options for retirement income, and advisers need to be aware of these differences when speaking to their clients.”